Content

- Irs Adds New Guidance But Form 1040 Cryptocurrency Question Is Still Causing Confusion

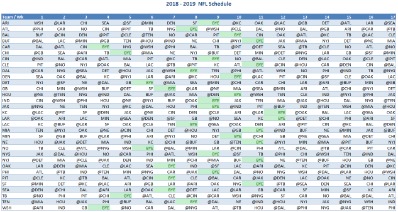

- Schedules & Worksheets

- Get The Latest On Monthly Child Tax Credit Payments Here

- Reporting Other Income

- Forms

- Irs Free File & How To Get Free Tax Preparation Or Free Tax Help In 2021

Still, it’s a good idea to familiarize yourself with the forms you need so you know what to look for when you review your tax return before filing. This is not to say that the IRS is uninterested in people who are merely holding cryptocurrency. They have made it clear that they are quite interested but they have other ways of obtaining that information and, at least for the largest holders, they are using them.

Irs Adds New Guidance But Form 1040 Cryptocurrency Question Is Still Causing Confusion

Your selected PDF file will load into the DocuClix PDF-Editor. Recovery of a deduction which you claimed in an earlier year.Payment of taxes owed can be delayed to the same date without penalty. Barter income (the fair market value of goods or services exchanged by two parties is taxable; both parties should report the full value received from the transaction as other income). The purpose of the Schedule K-1 is to report each partner’s share of the partnership’s earnings, losses, deductions, and credits.Airdrops—Airdrops are perhaps best compared to the legal concept of treasure trove. Drops of cryptocurrency that simply show up in your account or wallet are taxable events. If you receive an airdrop answering yes to the cryptocurrency question is a given. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

- Lea has worked with hundreds of federal individual and expat tax clients.

- Here is a list of our partners and here’s how we make money.

- While not filed with an individual partner’s tax return, the Schedule K-1 is necessary for a partner to accurately determine how much income to report for the year.

- This is not to say that the IRS is uninterested in people who are merely holding cryptocurrency.

Investopedia does not include all offers available in the marketplace. Schedule K-1 is an Internal Revenue Service tax form issued annually for an investment in a partnership. The Schedule K-1 is also used by shareholders of S corporations, companies with under 100 stockholders that are taxed as partnerships. Trusts and estates that have distributed income to beneficiaries also file Schedule K-1s. Most name-brand tax software providers sell versions that can prepare Schedule A. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

Schedules & Worksheets

We believe everyone should be able to make financial decisions with confidence. In the absence of your current tax return, you may submit a statement from your employer instead. This statement should verify your annual earnings and be stamped or signed by an official of the employer. Please have this statement translated into English, if necessary. You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above. A tax schedule is a rate sheet used by individual taxpayers to determine their estimated taxes due.

What is a schedule 1 on tax return?

Generally, taxpayers file a Schedule 1 to report income or adjustments to income that can’t be entered directly on Form 1040. This question is used to help determine if you may be eligible to skip certain questions in the FAFSA form. The answer to this question may be prefilled with “Transferred from the IRS.”The state form isn’t a substitute for the federal Form K-1. Instead, it relates to Idaho law and identifies Idaho adjustments, allocation and apportionment amounts, credits, and recapture amounts. Full instructions are included with the form on this website.If you do your own taxes, keep a hard or electronic copy with your other tax documents (W2s, etc.). These are valuable deductions for many taxpayers for two reasons. First, these deductions directly reduce your adjusted gross income, opening up the possibility of taking other deductions and tax credits that have adjusted gross income limits. Payment for Services—When taxpayers receive cryptocurrency as payment for providing services it is often going to be considered self-employment income .

Get The Latest On Monthly Child Tax Credit Payments Here

When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

Reporting Other Income

Other Income is generally taxable income that is often considered uncommon; this type of income is reported on Line 8 of Schedule 1 as well as Form 1040. When you prepare and e-file your tax return on eFile.com, we will automatically report your Other Income on the correct form and calculate any taxes owed on it. Let us do the hard work for you – Dare to Compare TurboTax® or H&R Block®. Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation. However, you contributed $3,000 to your health savings account, $8,000 to a SEP IRA, and paid student loan interest adding up to $1,000. With a total of $12,000 in above-the-line deductions, your adjusted gross income is $79,000, meaning you’re likely eligible for the full American Opportunity Tax Credit.Alternative Trade Adjustment Assistance or Reemployment Trade Adjustment Assistance payments (generally reported on a 1099-G). Read below for the definition and meaning of Other Income. Do you have income from nonemployment that may be considered Other Income? Let the eFile Tax App work for you; report your income and we will determine if it is taxed as Other Income and report it on your IRS Forms. It looks like we’re having some trouble accessing your Credit Karma account. We’re working hard at getting everything back up and running, so check back soon to access your free credit scores, full credit report and more. If you are expecting a refund, electronic filing is the quickest way to receive the refund.

Forms

Jury duty pay (reported on a 1099-MISC if it totals $600 or more, but any amount is taxable; you can deduct jury duty pay if you have to pay it to your employer). Cash for Keys program income from a financial institution that was offered to you to expedite the process of foreclosure (generally reported on 1099-MISC).

The Purpose Of Irs Form 1065

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The financial information posted to each partner’s Schedule K-1 is sent to the IRS along with Form 1065. S Corporations also file K-1s, accompanying them with Form 1120S. If you need a different year from the current filing year, select the applicable YEAR from the drop down. Casualty and theft losses of certain income-producing property. Each of the seven sections has subsections so that you can add up various types of expenses that qualify for the deduction.If you’re thinking about itemizing your taxes, get ready to attach an IRS Schedule A to your Form 1040. Here’s a simple explainer of what IRS Schedule A is, who has to file one and some tips and tricks that could save money and time. Taxable distributions from a health savings account or an Archer MSA. These are generally reported on a 1099-SA; you can deduct qualified contributions to an Archer MSA.