Content

- Software Features

- Accounting For Intangible Assets

- What Are Intangible Goods?

- List Of Intangible Assets

- Straight Line Amortization Vs Testing For Impairment

- Reversal Of Impairment Loss

- Overview: What Are Intangible Assets?

- Types Of Intangible Assets

Provided, it does not meet the intangible assets definition and recognition criteria. Furthermore, the possibility of future economic returns flowing from such intangible assets must depend on valid assumptions. These assumptions must be with regard to circumstances existing over the life of the asset. When one company acquires another company by paying extra amount as premium for customer loyalty, brand value, and other non-quantifiable assets, that premium amount is called Goodwill. Intangibles for corporations are amortized over a 15-year period, equivalent to 180 months. Finally, after you have calculated the value of the company’s tangible and intangible assets, you can find the true market value of the company.Because intangible assets with infinite value continue to generate revenue, they cannot be amortised. Instead, they should be evaluated for impairment once a year, as well as any time you suspect that the asset may be impaired. It therefore isn’t always possible to calculate the initial cost of an intangible asset, meaning many intangible assets cannot be reported on a balance sheet. In most cases, intangible assets are considered long-term assets because they provide long-term value to a company and cannot be quickly converted to cash. Basic accounting principles tell us that assets are anything of value that you own.For example, a contractual agreement for the use of another company’s patent for two years is a definite intangible asset because it loses its value when the contract expires. What this essentially means is the difference represents how much the buyer is willing to pay for the business as a whole, over and above the value of its individual assets alone. For example, if XYZ Company paid $50 million to acquire a sporting goods business and $10 million was the value of its assets net of liabilities, then $40 million would be goodwill. Companies can only have goodwill on their balance sheets if they have acquired another business. FreshBooks makes it easy to generate balance sheets via their cloud accounting software.

Software Features

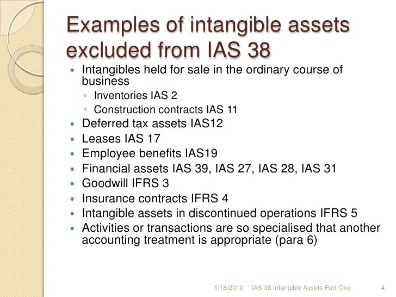

In accounting, intangible assets are defined as non-monetary assets that cannot be seen, touched or physically measured. As discussed above, intangible assets are classified on the basis of their useful life. These include intangible assets with a finite life and ones with an indefinite life. As per International Accounting Standard 38, you can recognize only the acquired intangible assets. In other words, intangible assets represented on your balance sheet are either acquired as a part of the Business Combination. However, say you incur an expense on this project post the Business Combination. Then, as per Intangible Assets Accounting, you need to charge such an expenditure as an expense.

Accounting For Intangible Assets

However, you need to charge the Development Cost as an intangible Asset. Provided you can determine its technical and commercial feasibility for sale or use. There are certain cases where an asset contains both tangible and intangible elements. You need to make use of sound judgment to understand whether to treat such an asset as intangible or not. In addition to this, you must review the period of amortization at least annually. Also, the amortization amount is shown in your Profit and Loss Statement. Provided IFRS does not require that such a charge must be included in the cost of any other asset.

Is app development an asset?

A software development is a significant asset.Intangible assets are initially recorded on financial statements at their purchase price, or the cost of acquiring the asset. If an intangible asset is internally generated, its cost is immediately expensed. Healthy Cupcakes and Snacks is a business that has built a large base of loyal followers and has a significant amount of brand recognition in the health foods industry. Fresh Food Markets makes a deal to purchase Healthy Cupcakes and Snacks for $2 million.

What Are Intangible Goods?

The International Accounting Standards Board offers some guidance as to how intangible assets should be accounted for in financial statements. In general, legal intangibles that are developed internally are not recognized and legal intangibles that are purchased from third parties are recognized. Anything your company develops that holds value, such as a specific design that your company created or a software program that was developed, are also considered intangible assets. All intangible assets are recorded on your company’s balance sheet. The costs of intangible assets with identifiable useful lives are amortized over their economic/legal life. These are the types of intangible assets that generate economic benefits for your business for a limited period of time.The purchase price was $20,000 more than the value of the competitor’s net assets. So the web developer now has $20,000 worth of goodwill as an asset. Usually, you can find the value of tangible assets as a definite number.When an intangible asset has a finite useful life, it should be amortised. Amortisation is the process of charging the cost of an intangible asset as an expense.This document/information does not constitute, and should not be considered a substitute for, legal or financial advice. Each financial situation is different, the advice provided is intended to be general. Please contact your financial or legal advisors for information specific to your situation.A local news website picks up the story and posts it on their website. Now plenty of past and potential customers have a negative view of the restaurant.

List Of Intangible Assets

Assume Company A wants to acquire Company B. Company B is having assets of USD 5 Million and liabilities of USD$ 1 Million. Company A paid USD 6 Million which is USD 2 Million is more the net value of USD 4 Million .

- Not being careful enough with one’s intangible assets can also diminish or destroy their value.

- As intangible assets lose value, they will eventually stop being useful.

- Limited-life intangibles are amortized throughout the useful life of the intangible asset using either the units of activity or the straight-line method.

- In the below example, patents, an intangible asset, are included on the balance sheet as they need to be amortized .

- You can consent to processing for these purposes configuring your preferences below.

- Find out what you need to look for in an applicant tracking system.

- However, not all intangible assets are recognized on the financial statements of a company.

Therefore, they believe the balance sheets of these companies do not reflect the value of their intangible assets. An intangible asset is a non-physical asset having a useful life greater than one year. These assets are generally recognized as part of an acquisition, where the acquirer is allowed to assign some portion of the purchase price to acquired intangible assets. Few internally-generated intangible assets can be recognized on an entity’s balance sheet. U.S. GAAP has very specific rules regarding the recognition of intangible assets on financial statements.Intangible assets with indefinite useful lives are assessed each year for impairment. Impairment losses are determined by subtracting the asset’s market value from the asset’s book/carrying value. If an impairment loss is found it is recognized on the income statement and the intangible asset value is reduced. Goodwill is an example of an intangible asset that has an indefinite useful life, and is therefore tested for impairment on an annual basis as opposed to being amortized on a straight line basis. A company cannot purchase goodwill by itself; it must buy an entire business or a part of a business to obtain the accompanying intangible asset. Under current US GAAP, firms are required to compare the fair value of reporting units to the respective reporting unit’s book value, which is calculated as assets plus goodwill less liabilities. If the fair value of the reporting unit is less than its carrying value, goodwill has been impaired.

Straight Line Amortization Vs Testing For Impairment

Once you have this list, add all the values together to determine the total value of the company’s tangible assets. In accounting, goodwill represents the difference between the purchase price of a business and the fair value of its assets, net of liabilities. Referring to the identifiable intangible asset definition mentioned earlier, goodwill does not meet the IFRS definition, as it is not identifiable/not separable.Intangible assets are non-monetary assets that cannot be seen, touched or physically measured. Intangible assets are created through time and effort, and are identifiable as separate assets.Only intangible assets with an indefinite life are reassessed each year for impairment. Intangible assets have a useful life that is either identifiable or indefinite. Intangible assets with identifiable useful lives are amortized on a straight-line basis over their economic or legal life, whichever is shorter. The finite useful life of an intangible asset is considered to be the length of time it is expected to contribute to the cash flows of the reporting entity. Pertinent factors that should be considered in estimating the useful lives of intangible assets include legal, regulatory, or contractual provisions that may limit the useful life. Intangible assets with identifiable useful lives are amortized on a straight-line basis over their economic or legal life, which ever is shorter.Unlike tangible assets such as a building, inventory, or equipment, intangible assets do not include anything that you can touch. Intangible assets can also increase the value of tangible assets.

Research And Development

However, the assets with an indefinite useful life are not amortized. Depreciation too spreads out the cost of the asset over its useful life. Whereas, Amortization is used to expense the Intangible Assets of your business over their useful life. Amortization is nothing but a charge against an intangible asset.

Overview: What Are Intangible Assets?

These things add value that you cannot separate from the company itself. The best way to track and manage intangible assets is by using accounting software. If you’re in the market for an application that can easily track assets and record amortization, be sure to check out our accounting software reviews. Therefore, intangible assets are resources that do not have a physical existence. Furthermore, the different types of intangible assets too generate economic benefit for your business in the future. When a company acquires another company, anything which is paid beyond the net value of the company due to its brand reputation is called Goodwill and would be recorded in the acquirer’s balance sheet.

Types Of Intangible Assets

Intangible assets are not in physical form but have more value than physical assets. The consumer is willing to pay extra than the product’s worth to receive the value of the brand due to high brand equity. That is the reason brand equity would have economic value and considered as Intangible asset.