Content

- Writing An Invoice As A Sole Trader

- What Should I Include In My Invoice?

- What Should Be Included On An Invoice For A Sole Trader

- Creating A Proper Invoice

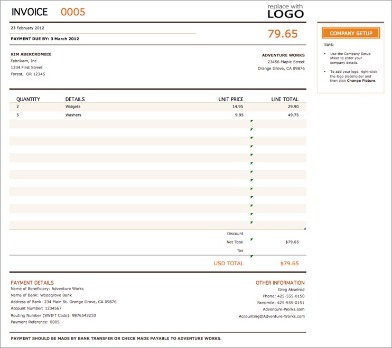

- Invoice Template For Sole Traders

- Want More Helpful Articles About Running A Business?

- For Business

To make things easier, we have listed some of the best free invoice software. Also with this invoicing solution, I can easily upload the business image to invoicing and statements at no cost.

Writing An Invoice As A Sole Trader

This is something you will have determined in the ‘pre-invoice’ step. It’s also a good idea to include the client’s address in this step, as well as any necessary information that the client uses to track invoices . Invoicera has all the latest invoicing features built-in specifically for traders in its online version. You can even customize an invoicing software as per your business requirements. After trying multiple accounting apps for 10 years, ZipBooks was finally the solution. My clients can pay online & accept quotes through a simple, interactive process. As a self-employed business, you will have to work long hours on projects for your clients.Include all the essential products and service offerings along with the charges you’re providing to the customers. It is wise to include a breakdown of charges made to your client’s account with clear instructions on how to pay the balance. Including all of this information allows your client to make payments without any confusion. Square Invoices lets you create and send digital invoices—and schedule when you want to send them.

What Should I Include In My Invoice?

In a nutshell, freelancers who offer products or services to a company can invoice them. Now, there are several things to consider before you do so. Note any services you provided to your clients and a detailed description of each. Then, add the cost for each service in the appropriate field. When you supply multiple goods or services, it can eat up way too much time creating a new invoice for each order. Make it easy on yourself with this easy to reuse, fully customizable invoice template.Automate late fee and payment reminders to get paid quicker. Automation ensures better resource utilization and cost-cutting. After you submit your invoice, you should receive your payment by the date you specified. If you do not receive your payment by this time, check in with the client or company to confirm that your sole trader invoice was received.

Can an individual make an invoice?

Even as a private individual, creating an invoice is no problem. If you were to sell your car, or charge for a non-professional service, the person making a purchase from you may require a personal invoice. Many companies also require invoices when purchasing a product or service from a private individual.The requirement list doesn’t remain the same for every customer, and therefore their choices vary. Satisfying the demands of the clients is the essential part of business operation for a sole trader. An invoice reflects your professionalism towards your work, and therefore, you must prepare a professional invoice to hold up your reputation among your clients.

What Should Be Included On An Invoice For A Sole Trader

You need to mention the price and service details and need to clarify the payment terms as well. Invoice is a vital financial tool that requests customers to settle down the payment. You must ensure that the invoice is filled with all the necessary details. ReliaBills offer unlimited invoices along with the tools to generate recurring invoices without any added costs. You can even use it to send automated reminders via email to your clients. It is basically a client management platform that streamlines the invoice generation and payment collection process.

- Your customers all have different needs and requirements – and that’s part of the joy of operating your sole trader business.

- Not too many settings or functions required, invoicing done efficiently at no cost.

- Just be sure to check the sales tax laws for the countries you’re invoicing to and from.

- We make money from our other services, like bookkeeping.

- After you submit your invoice, you should receive your payment by the date you specified.

- If you’re a freelancer who takes pride in their services, then pleasing customers is your top priority.

You’ll never lose track of payments with this organized, professional template. Add lines to describe all the details so you get the payment you deserve.

Creating A Proper Invoice

Individuals offering professional services can provide a description of the materials used and the price of each item. Additionally, service charges should be reported with the total hours of labor and the service rate ($/hr).

Do sole traders need VAT on invoices?

If you are wondering how claiming VAT back works, you do need to be a VAT-registered sole trader to do so. If you don’t charge VAT to your customers, you cannot claim back any VAT on goods or services purchased for business use either.Since the types of clients you serve vary, it is wise to have some different invoice styles up your sleeve. As a sole proprietor, getting paid is important to you. You carry the weight of your business on your back and you deserve to get paid for your hard work. Put simply, the invoices you send directly reflect the quality of your work and your working style. Working on multiple projects may lead to overlooking key metrics of your business.

Invoice Template For Sole Traders

Here’s an opportunity to reflect your individualism and creativity through a medium that is traditionally quite dull. The main challenge here is to emphasise your brand while maintaining that air of professionalism. Do keep in mind though, aside from the crucial criteria listed above, this step is purely optional.