Content

- What Is Accounts Payable On A Balance Sheet?

- How To Print Secure Business Checks With Checkrun

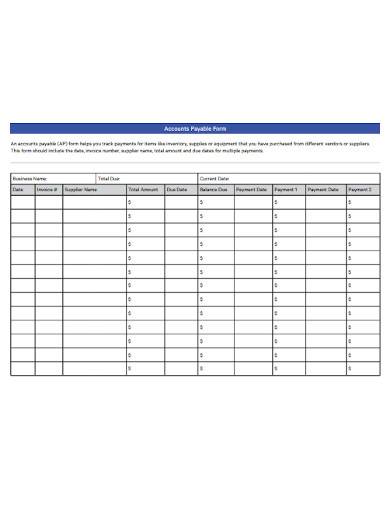

- Accounts Payable:

- Accounts Payable

- Simplify Your Accounts Payable With Checkrun

- Streamline The Approval Workflow Process

- What Is A Check Run?

- Is Accounts Payable A Debit Or Credit?

A reconciliation of the petty cash fund must be done on a regular basis. Complete the Petty Cash/Change Fund Reconciliation Form to insure the receipts plus cash on hand is equal to the amount of the authorized petty cash fund. Makes the purchase, paying for the item with personal monies or with the petty cash advance and obtains an itemized receipt or cash register sales slip. Purchases which are required to be reported in a specific manner such as, but not limited to, personnel services, travel expenses, payroll advances, and business meals. Disbursements from petty cash funds must be properly documented and for a valid University business purpose.

- Accounts payable are the amount of money that your organization owes to the supplier, whereas accounts receivable is the amount of the money your customers owe to your organization.

- I want to show that I have indeed given the check as payment to the other party, but that the cash in my bank checking account has not been drawn yet.

- Product Reviews Unbiased, expert reviews on the best software and banking products for your business.

- Modern tools can simplify and improve accounts payable check run procedures, saving you time and money.

- The US Treasury estimated that implementing e-invoicing across the entire federal government would reduce cost by 50% and save $450 million annually.

- In brief, an asset is something that can generate cash flow reduce expenses, or make sales.

It has extensive reporting functions, multi-user plans and an intuitive interface. Sage Business Cloud Accounting allows you to manage vendor details from a central location. The vendor setup screen in Sage 50cloud Accounting lets you manage all vendor details. If you remember from bookkeeping basics, accounts payable is a permanent account, so your closing entries will not affect this account. Get clear, concise answers to common business and software questions. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Store pre-printed checks in a secure location.Any unused pre-printed checks need to be stored in a locked location.

What Is Accounts Payable On A Balance Sheet?

Petty cash funds must be kept separate from change funds, cash drawers, personal funds, and any other collected revenue. Departments requiring a stop payment on an operating/accounts payable (non-payroll) check should contact the Manager of Auxiliary Funds and Banking Operationsimmediately upon realizing a check is lost or stolen. If a stop payment is required on a payroll check, Payroll Services must be contacted. Certain items can be purchased without a university purchase order. Accounts Payable distributes the fellowship checks to the departments.Benefit from the power of accounts payable automation and increase efficiency, reduce costs and greatly improve cash flow management with Checkrun. Details entered on the cheque, vendor bank account details, payment vouchers, the original bill and purchase order need to be scrutinized. A managerial authorization might be required at this point too. Accrual accounting is the most common method used by businesses. Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts. This lesson will introduce you to accounting for receivables. The journal entries regarding booking sales, customer payments and taking credit losses will be illustrated with examples.The University may reimburse allowable house-hunting and moving expenses to new, regular, full-time faculty and staff with a maximum amount of up to one month’s salary. Current employees who are assigned to a remote work area on behalf of the University may also be reimbursed for allowable moving expenses up to $6,000. When the duties are separated, it will require more than one dishonest person to steal from the company. Hence, small companies without sufficient staff to separate employees’ responsibilities will have a greater risk of theft. One of the most used features on QuickBooks Online is the invoice tool. We’ll show you how to create an invoice, make recurring invoices, send reminders, and more. QuickBooks Online is the browser-based version of the popular desktop accounting application.

Can accounts payable be a debit?

In finance and accounting, accounts payable can serve as either a credit or a debit. Because accounts payable is a liability account, it should have a credit balance. The credit balance indicates the amount that a company owes to its vendors.This method allows you to view incoming bills and help to ensure accuracy while avoiding payment errors. Creating a chart of accounts that works with your business is one of the most important things you’ll need to do before you begin to process accounts payable. Your chart of accounts is where all of your accounting transactions reside, and accounts payable is no exception. If you’re used to managing your own personal bills, you should have no problem transitioning to the accounts payable process. However, there are a few things you need to do in order to prepare and process accounts payable properly.

How To Print Secure Business Checks With Checkrun

AR is the amount of money that is owed by the organization’s customers, while AP are the amount of money your organization owes to your vendors and suppliers. Accounts payable are the amount of money that your organization owes to the supplier, whereas accounts receivable is the amount of the money your customers owe to your organization. In short, AP is something others claim on you, and account receivable you something you claim on others. These both look similar but mixing up could cause a lack of balance in your accounting. Another way we can say AP is a liability on the balance sheet, and accounts receivable are an asset on the left side of the balance sheet. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. No one wants to be audited, but if you ever are, you’ll have a solid audit trail using accounting software, from initial approval to the final bill payment process.Doube-entry accounting ensures that the total amount of debits equals the total amount of credits. Learn the basics of how this accounting system is reflected in journals and ledgers through examples, and understand the concept of normal balances. Liabilities in accounting are the financial obligations of an individual or organization. Explore the definition, examples, and the basic equation used for liability in accounting in this lesson. Records housed at different sources are rarely perfectly aligned.Another payment term commonly used, particularly among suppliers, is 2/10 Net 30. Using the same invoice date , this term means if you pay your invoice by December 24, you can take a 2% discount off of the total amount due. If you don’t pay by December 24, the full amount of the invoice is due by January 14 at the latest.

Accounts Payable:

Certain circumstances may require North Carolina withholding a percentage from payments. In order to ensure timely payment, please allow 5 to 10 business days for adequate processing time. Departments or vendors may request the cancellation of a check or a stop payment of a check . You may also request that a check be reissued at the time of the original stop payment or cancellation request. Roanoke College has implemented an Accounts Payable Direct Deposit Program called E-Checks. The program allows automatic deposit of employee reimbursement requests and travel advances directly into the bank account of your choice. Recurring audit findings may result in the petty cash fund being revoked.

Accounts Payable

Electronic Invoicing can be a very useful tool for the AP department. Electronic invoicing allows vendors to submit invoices over the internet and have those invoices automatically routed and processed. Because invoice arrival and presentation is almost immediate invoices are paid sooner; therefore, the amount of time and money it takes to process these invoices is greatly reduced.

Is accounts payable an accountant?

To record accounts payable, the accountant credits accounts payable when the bill or invoice is received. … When the bill is paid, the accountant debits accounts payable to decrease the liability balance. The offsetting credit is made to the cash account, which also decreases the cash balance.Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team. Accounting software will flag payments that are due soon, ensuring you see them with plenty of time to pay them.

Simplify Your Accounts Payable With Checkrun

Accounts payable is money owed by a business to its suppliers shown as a liability on a company’s balance sheet. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents. Processing an invoice includes recording important data from the invoice and inputting it into the company’s financial, or bookkeeping, system.

Streamline The Approval Workflow Process

After this is accomplished, the invoices must go through the company’s respective business process in order to be paid. Accounts payable is the amount of money you owe to another company or supplier for any purchase you made or any service they provided to you. On your balance sheet, it appears as a liability, which means you owe it.Historical cost accounting is the process of recording the original value of an item and is the most common method used due to it being easily understood. Discover how to account for the original, or historical cost of an item and the advantages of using the method for businesses. There are certain terms which are important to understand in relation to invoices and payments. Learn about the importance of the due date when payments are required, possible discounts for timely payments, and end of month invoices that must be paid by the 30th or 31st of the given month.

Safety Procedures: Reduce Accounts Payable Fraud

Also, pay by ACH, RTP, Direct deposit, and eChecks without any transaction fees. Vendors often send statements to their customers to indicate the amounts that remain unpaid. When a vendor statement is received the details on the statement should be compared to the company’s records. Managing your accounts payable is part of properly running your business. By implementing a good accounts payable system from the start, you can eliminate costly late fees, build valuable business relationships, and ensure that your expenses are accurately accounted for. Again, if you only have a few vendors to pay, this may not be an issue, but even if you have to pay just five vendors monthly, your life will be much easier if you use accounting software. If you pay your vendors using a check, you should probably include a copy of the invoice in the envelope along with the check.You will also want to make sure that the invoice number is on any type of remittance in order to ensure your payment is posted properly. Accounts payable is a liability account, so if you’re using double-entry accounting, any increase to this account would be posted as a credit, with a corresponding debit made to an expense account. If you’re unsure about the correct accounts payable process and what it entails, be sure to read on for an in-depth explanation to help your accounting process. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities.Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Accounts Payable is responsible for accurate and timely payment of all invoices for the University. This includes all payments on purchase orders, blanket purchase orders, check requests, travel advances and travel expense reports, petty cash, freight bills, and fellowship payments. Many companies are involved in work to streamline or automate the business process of their accounts payable departments. This process is straightforward but can become very cumbersome, especially if the company has a very large number of invoices. This problem is compounded when invoices that require processing are on paper. This can lead to lost invoices, human error during data entry, and invoice duplicates.Authorized approvers, customized workflows and added security such as positive pay willhelp reduce the risk of payment fraud. Cash-basis and accrual-basis accounting are different methods of recording revenue and expenses in business transactions. Accounts receivable is the money a business is owed for the goods and services it has rendered on credit. Learn about the definition and process of accounts receivable, and check out some real-life applications and examples. When a petty cash fund is no longer needed, the fund custodian should replenish the fund to the authorized amount. This amount must then be returned to the Cashiers’ Office, crediting the original index with an account code of A001, indicating the fund is being closed.