Content

- How To Calculate Retained Earnings

- Retained Earnings To Total Assets

- How Are Dividends Related To Retained Earnings?

- What Does The Return On Assets Ratio Tell Us?

- Is A Corporation Required To Have Retained Earnings?

- Retained Earnings Accounting

If a cash dividend is declared and distributed, then the net assets of the corporation decrease. The investors may not prefer this because most of the proportion of the profit will be used to cover the interest payments and fewer profits will be remained for dividends and for retained earnings. Interest payments can become burdensome and can create cash flow problems. It illustrates how much profits over all the years since inception were generated from $1 of total assets.Now that you know what counts as retained earnings, how do you calculate them? You’ll need to know your previous retained earnings, your net income and the dividends you’ve paid. You should be able to find your previous retained earnings on your balance sheet or statement of retained earnings. Instead, the corporation likely used the cash to acquire additional assets in order to generate additional earnings for its stockholders. In some cases, the corporation will use the cash from the retained earnings to reduce its liabilities. As a result, it is difficult to identify exactly where the retained earnings are presently. Dividends are usually distributed to shareholders in either cash or stock.It means that the value of the assets of the company must rise above its liabilities before the stockholders hold positive equity value in the company. At the end of that period, the net income at that point is transferred from the Profit and Loss Account to the retained earnings account. If the balance of the retained earnings account is negative it may be called accumulated losses, retained losses or accumulated deficit, or similar terminology. The higher your retained earnings to assets ratio the less reliant your company is on other common types of debt and equity financing. Generating income for reinvestment has significant advantages over debt and equity financing. When you finance your company through new debt, you have to pay back the debt holders with principal and interest over time.

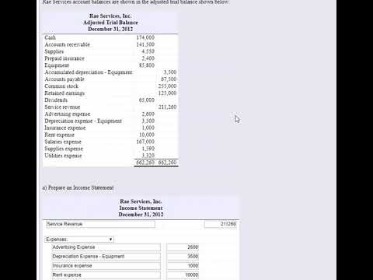

How To Calculate Retained Earnings

These retained earnings that are restricted are appropriately called restricted retained earnings (also referred to as appropriated retained earnings… no pun intended). For one, there is a limit to the number of stocks a corporation can issue . Following is the illustration is given to differentiate between the retained earnings of unalike industries.Retained earnings refer to the profits a company has earned after dividends to shareholders have been paid. Along with the three main financial statements , a statement of retained earnings (or statement of shareholder’s equity) will be required for all audited financial statements. For this reason, a company’s “working capital”is known as the “current ratio”which divides current assets by current liabilities. Generally, you will record them on your balance sheet under the equity section. But, you can also record retained earnings on a separate financial statement known as the statement of retained earnings.

How do you reconcile retained earnings?

The retained earnings calculation or formula is quite simple. Beginning retained earnings corrected for adjustments, plus net income, minus dividends, equals ending retained earnings. Just like the statement of shareholder’s equity, the statement of retained is a basic reconciliation.And by calculating retained earnings over time, you can get a sense of your business’s profitability. One can get a sense of how the retained earnings have been used by studying the corporation’s balance sheet and its statement of cash flows. The amount of retained earnings is reported in the stockholders’ equity section of the corporation’s balance sheet. It can increase when the company has a profit, when income is greater than expenses. The profits go into the company for use to pay down debt and to increase owner’s equity. Companies that chose to reinvest more of their retained earnings into the business may have a competitive advantage in the marketplace against other companies that are strapped for cash.

Retained Earnings To Total Assets

Similar to cash equivalents, these are investments in securities that will provide a cash return within a single year. US Treasury bills, for example, are a cash equivalent, as are money market funds. Cash equivalents are any type of liquid securities that are not in the form of cash currently, but that will be in the form of cash within a year. Retained earnings is the cumulative measurement of net income left over, subtracting net dividends.

How Are Dividends Related To Retained Earnings?

A list of the current assets a company owns will be available on the balance sheet. Typically these will be broadly categorized by type, such as short-term investments, inventory, and cash and cash equivalents.With equity financing, you must issue new stock and sell fractions of the company to raise funds. In general, a higher than industry average ratio and a ratio that rises provide good signs for the company. Portion of stockholders’ equity typically results from accumulated earnings, reduced by net losses and dividends.

What Does The Return On Assets Ratio Tell Us?

However, most companies making losses at the starting point of their business and there is not retained earnings but accumulated losses. Non-current assets are assets that have a useful life of longer than one year. Notes receivable are also considered current assets if their lifespan is less than one year. Revenue, also known as gross sales, is calculated as the total income earned from sales in a given period of time.

- Stockholders’ equity is the amount of capital given to a business by its shareholders, plus donated capital and earnings generated by the operations of the business, minus any dividends issued.

- While both retained earnings and revenue both provide us insights into a company’s financial performance, they are not the same thing.

- Those closing entries can be debited from their respective accounts and credited to Retained Earnings.

- This simple example will show you how to find retained earnings on any balance sheet.

- Retained earnings are an essential part of the picture when it comes to valuing a company, but they aren’t the whole picture.

- Like the retained earnings formula, the statement of retained earnings lists beginning retained earnings, net income or loss, dividends paid, and the final retained earnings.

This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. All investments involve risk, including the possible loss of capital.This refers to the total money earned when goods or services are sold. It doesn’t take into account the cost of producing the goods or services, or any debts or financial obligations a company might have to fulfill before it is profitable. Retained earnings are recorded under the shareholder’s equity section of a corporate balance sheet.

Is A Corporation Required To Have Retained Earnings?

Prepaid expenses are funds that have been spent preemptively on goods or services to be received in the future. Cash and cash equivalents are the most liquid of assets, meaning that they can be converted into hard currency most easily. Knowing the amount of retained earnings your business has can help with making decisions and obtaining financing. Learn what retained earnings are, how to calculate them, and how to record it.Non-cash items such as write-downs or impairments and stock-based compensation also affect the account. They are not technically liquid because they don’t earn a company money; however, they are listed among a company’s current assets because they free up capital to be used later. Likewise, the balance sheet will also draw a distinction between current liabilities, which are short-term debts that must be paid within a year, and long-term liabilities. So, no, retained earnings are not considered an asset on a balance sheet. They’re reported as a line item on the shareholder’s equity section of the balance sheet rather than the asset section. While you can reinvest retained earnings as assets, they are not assets on their own. In other words, money in the retained earnings account serves as a business cash reserve or working capital.

What Is Business Cash Flow?

Like paid-in capital, retained earnings is a source of assets received by a corporation. Paid-in capital is the actual investment by the stockholders; retained earnings is the investment by the stockholders through earnings not yet withdrawn. Under the shareholder’s equity section at the end of each accounting period. To calculate RE, the beginning RE balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted. A summary report called a statement of retained earnings is also maintained, outlining the changes in RE for a specific period. Retained earnings are business profits that can be used for investing or paying down business debts. They are cumulative earnings that represent what is leftover after you have paid expenses and dividends to your business’s shareholders or owners.In most cases in most jurisdictions no tax is payable on the accumulated earnings retained by a company. However, this creates a potential for tax avoidance, because the corporate tax rate is usually lower than the higher marginal rates for some individual taxpayers. Higher income taxpayers could “park” income inside a private company instead of being paid out as a dividend and then taxed at the individual rates. To remove this tax benefit, some jurisdictions impose an “undistributed profits tax” on retained earnings of private companies, usually at the highest individual marginal tax rate.Revenue refers to the sales made by a business and is the first line item you’ll see in an income statement. In the event of liquidation or bankruptcy, the whole amount of retained earnings would be used to settle the financial obligations of the corporation . When a corporation has already established itself where it matures and its growth slows down, then it would have less need for its retained earnings. Another purpose of retained earnings is to use them as a shield against future losses. There’s also the option to use retained earnings for paying off its debt obligations. By having retained earnings, the corporation has another source of funding for its growth. For example, if a corporation that has a $15/share value declares a 6% stock dividend, the value of each share would go down to $14.15.Usually, retained earnings consists of a corporation’s earnings since the corporation was formed minus the amount that was distributed to the stockholders as dividends. In other words, retained earnings is the amount of earnings that the stockholders are leaving in the corporation to be reinvested. Owners of limited liability companies also have capital accounts and owner’s equity. The owners take money out of the business as a draw from their capital accounts. Retained earnings are corporate income or profit that is not paid out as dividends. That is, it’s money that’s retained or kept in the company’s accounts. Refers to the total income earned after a company has deducted all costs incurred during the period — which could include debt payments, tax payments, and the hard cost of goods or services.In short, corporations have “retained earnings”, sole-proprietorships have “owner’s equity”, partnerships have “partners’ equity”, and LLCs have “members’ equity”. A sole-proprietorship does not maintain a retained earnings account but rather all of its retained earnings go to its owner’s equity.

Retained Earnings Accounting

This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action.This ratio also gives the company an idea of how much it relies on debt for the funding of its total assets. Depending on the industry of the company in question, a current asset could be anything from crude oil to foreign currency. For example, an auto manufacturer may count auto parts as a current asset. On the other hand, a mutual fund may count short term investments or bonds. Current assets reflect the ability of a company to pay its short term outstanding liabilities and fund day-to-day operations. A company can also choose to prepay rent it owes on buildings or real estate; however, only one year’s worth of that prepaid rent counts towards current assets. Payments to insurance companies or contractors are common prepaid expenses that count towards current assets.Stockholders’ equity is the amount of capital given to a business by its shareholders, plus donated capital and earnings generated by the operations of the business, minus any dividends issued. These profits trickle down to shareholders partly in the form of dividends.Retained earnings are a line item in the equity section and help you figure out your total equity. Costs of production of the goods sold in a company and includes the cost of the materials used in creating the good along with direct labor and production costs.