Content

- See For Yourself How Easy Our Accounting Software Is To Use!

- Always Register For A Sales Tax Permit Before You Begin Collecting Sales Tax

- Lesson 11 In The Basic Accounting Series

- What Is The Journal Entry For Sales Tax?

- Make Sure Youre Collecting Correctly

- Accounting For Sales Tax: What Is Sales Tax And How To Account For It

- Is Sales Tax Payable A Current Liability?

- Accounting Services

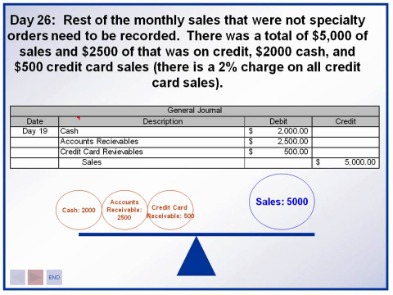

And, credit your Sales Tax Payable account the amount of the sales tax collected. Record both your sales revenue of $5,000 and your sales tax liability of $250 in your accounting books. DateAccountNotesDebitCreditX/XX/XXXXCashCollected sales taxXSales RevenueXSales Tax PayableXWhen you remit the sales tax to the government, you can reverse your initial journal entry. To do this, debit your Sales Tax Payable account and credit your Cash account.

Does tax count as an expense?

The tax expense is what an entity has determined is owed in taxes based on standard business accounting rules. … The tax payable is the actual amount owed in taxes based on the rules of the tax code. The payable amount is recognized on the balance sheet as a liability until the company settles the tax bill.Economy, technology vendors often provide IT services and products through a remote connection and therefore do not maintain sellers’ permits in many taxing jurisdictions. Tax practitioners should review software contracts, licenses, and method of delivery to determine taxability. Electronically downloaded software and software as a service are taxable in some states but not in others. Some goods, like raw materials, are not subject to sales tax. If you sell raw materials to another business that then sells them to customers, you generally won’t collect sales tax from the business. The percentage you collect from customers varies based on what state, county, or city your business has a physical presence in.For sales under $300 for the month, remit sales taxes quarterly. Depending on your jurisdiction, you may pay sales tax electronically by creating an online ID for your business. It is quite common to have a separate sales tax liability account for each state. If a company operates in multiple states, having a separate account for the sales taxes collected for each one makes it much easier to make remittances.

See For Yourself How Easy Our Accounting Software Is To Use!

Depending on your location, there may be additional rules that govern when to use a cash or accrual basis. Talk to your accountant about which method is most appropriate for your company. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Be sure to open any correspondence from state taxing authorities promptly, as it could be a notice that your filing frequency has changed. Check them out if you want to automate all things sales tax. Requisition process where controls may be separate from general purchasing.If the company leases machinery or equipment, examine leasing agreements. Cost centers and general ledger accounts can be used to identify the use or nature of a purchase. Decrease your Cash account and increase the corresponding expense (e.g., Supplies) account. Because expenses are increased through debits, debit an expense account and credit your Cash account. We are the American Institute of CPAs, the world’s largest member association representing the accounting profession.The sales amount without the sales taxes was entered in the Sales Revenue account. The sales taxes were credited in their own Sales Taxes Payable account. This Sales Taxes Payable account represent Retailer’s obligation to transmit collected sales taxes to the tax authority during the next payment to the authority.

Always Register For A Sales Tax Permit Before You Begin Collecting Sales Tax

Is regressive – as sales taxes affect everyone at the same tax rate, regardless of the individual’s income level. This article will refresh those basic accounting concepts and give you examples of small business sales tax accountingjournal entries.Do not pay sales tax or use tax when you purchase prewritten computer software to resell to clients. Instead, give your supplier a completed Form ST3, Certificate of Exemption. Since states make their own sales tax rules, they can also set their sales tax due dates. Nexus is just a fancy way of saying that your business is connected to a state, and is therefore required to collect sales tax from buyers there. The rules differ from state to state and are fraught with exceptions. But most of the confusion simply stems from figuring out if your business is required to pay sales tax and how much you need to collect.Check with the state’s Department of Revenue to learn more about sales tax return filing frequency. Generally, the higher your sales volume in a state, the more frequently you are required to file a sales tax return in that state.

Lesson 11 In The Basic Accounting Series

The majority of states impose sales tax, but there are some exceptions. Alaska, Delaware, Montana, New Hampshire, and Oregon do not have a sales tax. However, there might be local taxes imposed in these states. When you buy goods that are subject to sales tax, the seller collects the tax from you. With cash basis, you owe two sales tax payments, $24 for August and $36 for September, because you received payments in both August and September.

What Is The Journal Entry For Sales Tax?

Because states are sticklers about “checking in” on registered sellers, even if your business wasn’t active during the financial year. Failing to file a zero return can result in anything from a $50 penalty to having your sales tax license revoked. In fact, three states enacted and then swiftly repealed sales taxes on services, in part because of the complexity in administering the taxes. Three states already tax professional services and do not exempt accounting services. The states areHawaii- 4%,New Mexico- 5%, andSouth Dakota– 4%.

Make Sure Youre Collecting Correctly

When a company bills its customers for sales taxes, those sales taxes are not an expense to the company; they are an expense to the customers. From the company’s perspective, these sales tax billings are liabilities to the local government until remitted. When you purchase goods and pay sales tax on those goods, you must create a journal entry. Generally, your total expense for the purchase includes both the price of the item and the sales tax. Because sales tax is lumped into the total amount your customers pay, you will include the sales tax as part of the total sales revenue in your accounting books, too. The amount of sales tax depends on the state, city and country your business has a physical presence in.

- With cash basis, you owe two sales tax payments, $24 for August and $36 for September, because you received payments in both August and September.

- Nor should they be represented as an expense when you remit those collected sales taxes.

- If the company leases machinery or equipment, examine leasing agreements.

- When we see legislative developments affecting the accounting profession, we speak up with a collective voice and advocate on your behalf.

- Instead, the merchant is merely an agent of the state and will record the sales taxes collected as a current liability.

- Purchases are recorded net of sales tax because any input tax paid on the purchases will be recovered from tax authorities and hence, does not form part of the expense.

As states’ economies shift from manufacturing to services , state legislators are likely to consider again this yearsales taxeson professional services. John Kasich recently proposed a sales tax on services that includes accounting services — theMNCPAandOSCPAhave already mobilized to oppose it. Gross salesare recorded using asset accounts such as Cash orAccounts Receivable. Net sales is recorded using revenue accounts such as Sales Revenue. The sales taxes collected is recorded using a current liability account such as Sales Tax Payable. What if the customer does not pay the sales tax portion of the invoice?We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Here’s what you’ll want to review to make sure your business is compliant with all applicable sales tax laws. Interestingly, New York has one of the highest state tax rates (4%) and average local rates (4.52%), but it’s not one of the top states for combined state and local rates. Let’s say you sell $5,000 worth of goods to a customer, which is subject to a 5% sales tax.

Accounting For Sales Tax: What Is Sales Tax And How To Account For It

Below are examples of journal entries that reflect that concept. Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Is Sales Tax Payable A Current Liability?

Testing the sales tax process will ensure the company puts its procedures in practice. Review sales tax payable accounts to make certain all tax collected by the company is remitted timely. Sales tax is a fiduciary tax, and businesses may be liable for fraud penalties if they hold unremitted state and local sales taxes. The business now has to pay the collected sales taxes to the relevant taxing authorities. When the business receives the sales taxes, a credit is made to the sales taxes payable account and debits the cash account. After the funds from sales taxes are submitted to the taxing authorities, the sales tax liability is removed.Keep a running balance of sales tax collected during the period. Your company’s income statement should not reflect sales tax as part of the company’s revenues. Practitioners should review how the company applies sales tax rates.

Accounting Services

Most states require sellers to file either monthly, quarterly or annually. Some states have semi-annual filing, and others will start you out filing monthly no matter your sales volume. If you have business tax nexus in a state, you need to collect retail sales tax from all of your customers in that state, on all of your sales channels. The sales taxes were calculated by considering that the $107 includes the sales revenue (100%) and the sales taxes (7%). The risk posed by state and local sales and use taxes should be viewed in the same manner as other business risks, e.g., product liability, theft, and casualty. Management acts prudently by purchasing insurance to cover these risks to prevent catastrophic damage to operations. A policy and procedures review, properly designed and executed, similarly provides “insurance” against a sales or use tax disaster.But it’s also possible for your business to have nexus in additional states, so it’s something you need to keep an eye on. This transaction reduces the Sales Taxes Payable account because Retailer settled its obligation to the tax authority. Be the first to know when the JofA publishes breaking news about tax, financial reporting, auditing, or other topics. Select to receive all alerts or just ones for the topic that interest you most. Use tax, interest, and penalties can drain cash, force unanticipated borrowing, impair debt covenants, and, ultimately, may cause companies to close their doors. A policy and procedures review can help prevent big problems.The funds collected from sales taxes are not a part of revenues and will not show up on theincome statement.Those funds will instead show up on thebalance sheetas a current liability. Nor should they be represented as an expense when you remit those collected sales taxes.In this section of sales tax accounting, we will use a fictitious company to provide examples of journal entries to record sales, collected sales taxes, and remitted sales tax collection. All accounting software includes a billing feature that allows you to include the sales tax at the bottom of each invoice, after the subtotal of line items billed. When you charge customers the sales tax, you eventually collect it and then remit it to the state government, which in turn pays it out to the various local governments. Sales taxes collected from customers and not yet remitted to the tax authorities are usually recorded in Sales Taxes Payable account. There are two ways to approach recording sales taxes on a company’s books. Under the first method, sales taxes are reflected in their own account directly. Under the second method, sales taxes are recorded as part of the sales account and then are moved to their own account .