Content

- Business Checking Accounts

- Construction Accounting Basics

- Materials

- Job Costing Versus Process Costing

- Overview Of Managerial Accounting Practices

- Job Costing: Definition

- Advantages & Disadvantages Of Job Order Costing & Process Costing

- Job Costing Techniques

The production order takes the form of instructions issued to a foreman to proceed with the job. Thus, it serves as an authority to the foreman to indicate that the work should be started. Job costing is also known as job lot costing or lot costing. Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. When assets are reduced by liabilities the result is equity, the net asset value of your company. By watching the total equity balance trend, a CEO can quickly assess if a business is growing in value.Unless a business’s financial, time tracking and payroll systems are integrated, the business is likely to have time and expense leakage that will go undetected and unbilled. To understand the process of job costing, we first need to review a little Accounting 101. For a construction business, this would include materials such as lumber, wiring, screws and more. You may choose to add a margin to these materials to cover other related costs including wastage or delivery fees.

Business Checking Accounts

Profits cause equity to increase; losses cause equity to decrease. A balance sheet is a snapshot of your business’s financial position at a point in time. On the other hand, an income statement is a like a video – the cumulative picture of your company over a period of time. Management accounting is internal accounting which helps business owners put their numbers to work to make data-driven business decisions. The accounting discipline uses unit economics, breaking down a business to its most basic unit, to understand profitability and measure success.

- During the month, I received and fulfilled a special order for two toys that resemble the customers’ puppies.

- Upon completing a project, for example, accountants will draw up job cost sheets to compare actual costs with an initial estimate or bid to make sure they’re maintaining profitability.

- In this case, management accounting is accounting for the cost of your people.

- You might’ve used a hammer and blowtorch to make the wheelbarrow, but they’re not considered direct materials because they aren’t attached to the final product.

- Calculate how much it costs your business to employ all staff members who will work on the project per day.

Job costing is commonly used in the construction industry, where costs vary widely from job to job. But it’s also used by manufacturers, creative agencies, law firms and more. Predetermined overhead rate is estimated overhead divided by estimated activity.A bobby pin manufacturer doesn’t use job costing, since one bobby pin is indistinguishable from another. For identical units production, use process costing, where you apply direct costs to batches of products instead of individual products. DebitCreditc.Work In Process Inventory20,000Factory Payroll20,000Record direct labor used ($4,000+ 16,000)Overhead2,000Factory Payroll2,000Record indirect labor usedd.

Construction Accounting Basics

By working out the specific costs for each job, you’ll have far more confidence in the final estimate. Identify where you’ll need subcontractors, then confirm their availability – you don’t want to be waiting on them. Have the contractors estimate the job but be aware they may not be as precise as you. It pays to do your own calculations based on their hourly rate. You might want to build in some contingency to cover the tricky tasks that always seem to come up.

What is job costing explain?

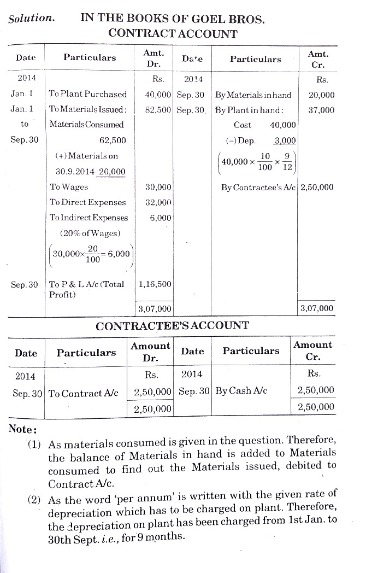

Job costing is defined as a method of recording the costs of a manufacturing job, rather than process. With job costing systems, a project manager or accountant can keep track of the cost of each job, maintaining data which is often more relevant to the operations of the business.You look at the job in detail and break down the specific labour and materials requirements. After calculating these costs, you add a charge to cover your overheads.Materials required for the job are issued from the stores on the basis of a BOM or a materials requisition form. The responsibility of preparing the BOM lies with the production planning department. The foreman receives a copy of the BOM along with the production order.

Materials

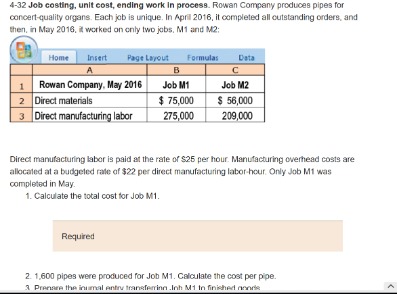

The company estimates that it will have $1,250,000 in overhead costs in 2015. The company believes that employees will work 200,000 hours and that 150,000 machine hours will be used during 2015. Calculate the predetermined overhead rate assuming that the company uses direct labor hours to allocate overhead to jobs. A job profitability report is like an overall profit & loss statement for the firm, but is specific to each job number. In a job costing environment, labor may be charged directly to individual jobs if the labor is directly traceable to those jobs.Job costing, generally, means a specific accounting methodology used to track the expense of creating a unique product. Job costing forms have spaces to include direct labor, direct materials, and overhead. Applied overhead is overhead added to a job by taking the predetermined overhead rate multiplied by theactual activity. Applied overhead is added to direct materials and direct labor to calculate total job cost. The company can choose any activity it believes will most accurately apply the overhead costs.

Job Costing Versus Process Costing

We can’t wait that long if we want to determine if we are making profit on our jobs. We have previously discussed cost objects and assigning costs to cost objects. The unit of costing, under any job costing system, is a job or specific work order. By the time the missed expenses are discovered, it’s too late to bill the client an additional fee. To understand the profitability of their businesses, many CEOs will only look at the income statement at the end of each month. Because the income statement tells them what they want to see – their topline revenue and bottom line profit. But those lines on an income statement don’t show the whole picture of a business’s profitability.

Overview Of Managerial Accounting Practices

This review will help you understand what the software does and whether it’s right for you. If certain special tools are required for the job, a separate list known as the tool listis also prepared. When an order for a job is received and accepted by the manufacturer, the order, as well as the job, is given a specific number.

Job Costing: Definition

Process costing is used when the products are more homogeneous in nature. Conversely, job costing systems assign costs to distinct production jobs that are significantly different. An average cost per unit of product is then calculated for each job. The total cost of your firm’s billable labor hours is $20,000 and you will bill $2,500 in material costs. Your firm has determined your applied overhead cost for the job is $8,500.

Calculate Labor Costs

By using a job costing software, bookkeepers can run the system quite smoothly. Job costing is defined as a method of recording the costs of a manufacturing job, rather than process. With job costing systems, a project manager or accountant can keep track of the cost of each job, maintaining data which is often more relevant to the operations of the business. Continuing the consulting business example, say one project required 300 direct labor hours. The overhead allocation is $600 ($2 overhead rate 300 direct labor hours). Here at GrowthForce, we go beyond just bookkeeping and accounting.

Advantages & Disadvantages Of Job Order Costing & Process Costing

Most companies use direct labor hours or machine hours to allocate overhead costs. Whenever we use an estimate instead of actual numbers, it should be expected that an adjustment is needed. We will discuss the difference between actual and applied overhead and how we handle the differences in the next sections. You want to use job costing in your construction business, and you’re looking to calculate your predetermined overhead rate to use for job costing. You estimate that in 2020, you’ll have $500,000.00 in overhead costs. You also estimate that your employees will work 10,000 hours in 2020. Job costing can help you accurately price your products and services.An alternative use is to see if any excess costs incurred can be billed to a customer. This is best for businesses that do highly custom work, such as construction contractors and consultants.When a job is completed, it is then shifted into a finished goods inventory account. Then, once the goods are sold, the cost of the asset is removed from the inventory account and shifted into the cost of goods sold, while the company also records a sale transaction. The average direct labor rate is $18.00 per hour and the company uses the predetermined overhead rate calculated in Example #1. If spoilage or scrap is created, then normal amounts are charged to an overhead cost pool for later allocation, while abnormal amounts are charged directly to the cost of goods sold. Once work is completed on a job, the cost of the entire job is shifted from work-in-process inventory to finished goods inventory. Let’s say a consulting business uses direct labor hours as an activity driver, and it incurred $100,000 in overhead costs last month.According to my accounting software, I incurred these expenses over the last month. You can use either the traditional or activity-based costing methods to allocate overhead. Because ABC might have you crying SOS because of its complexity. You’ll need to charge an overhead to account for depreciation of equipment, and for other business expenses like office rental and administration. These costs don’t directly relate to the job so this step is an approximation rather than a calculation. Many builders work out the overhead by adding 10 percentto each job – but each business is different. It’s best to have an accountant help you find out how you should treat overheads.Because all units are identical or very similar, average costs for each unit of product are calculated by dividing the process costs by the number of units produced. Job costing results in discrete “buckets” of information about each job that the cost accountant can review to see if it really should be assigned to that job. If there are many jobs currently in progress, there is a strong chance that costs will be incorrectly assigned, but the very nature of the job costing system makes it highly auditable.