Content

- What Is The Best Accounting App For Tax Businesses?

- This Tax Season Find Your Strength In Numbers With Freshbooks

- Dont Have Freshbooks?

- How Do I Add Taxes On My Invoices?

- Record Of Tax Payments

- Payments Collected Report

Payments Collected Report – This lists all payments you’ve received , pulled from the Payments sub-tab of your FreshBooks account. However, if you are granted an extension you can’t put off paying the taxes you owe.

What Is The Best Accounting App For Tax Businesses?

If you send invoices through FreshBooks, you’ve already got a head start on knowing your invoice income. They’re all kept in one place and you can easily view a history of the invoices you sent last year. In the US, small businesses are given the choice between the two methods, with the majority of non-inventory based businesses opting to use the cash method.

This Tax Season Find Your Strength In Numbers With Freshbooks

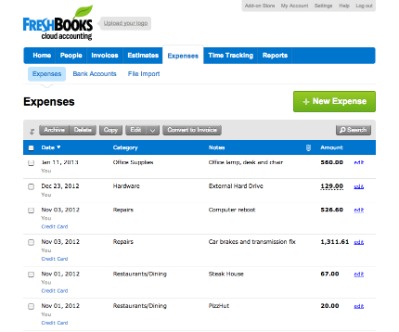

If those have been recorded within FreshBooks, they will have been listed as an Expense. Check your Expense Report to see how much you’ve already paid. That way, if you end up owing taxes, you will only have to pay the difference between what you owe and what you have already paid.Here are a few things to know to make your life a bit easier during tax season. The adjustments to income, also known as line deductions, help you lower your tax burden by reducing your total income.If you use Gusto, you can also find a summary of all employee and contractor payments and taxes. But we’re all human and odds are there have been a few oddball expenses that didn’t get tracked.FreshBooks will automatically add the expense to your account. Use our timer to accurately record hours spent per project. You’ll never be scrambling again to remember how many hours you worked for what client. Add team members so you can see overall billable hours per client and track productivity and project progress. Track your time using our web platform, mobile app or Chrome extension for a specific client, add notes and then bill for your logged hours whenever you’re ready. When you’re a first-time small business owner, there’s a lot to know and understand, especially when it comes to filing your taxes for the first time. But knowledge is power, and with these tips in your back pocket from the beginning, you can save yourself headaches down the road.Your clients trust you to provide accurate information about their tax situation, exemptions and more. Shouldn’t you manage your business accounting at the same level of accuracy? With FreshBooks, you don’t have to have an accounting background to know that your business numbers add up. A good certified public accountant or enrolled agent can help guide you through the tax preparation and strategy process. If you need the support of a CPA, consider working with Taxfyle, a service that connects you with licensed CPAs and helps you file your business taxes. Now that you’re self-employed, you’ll be on the hook for the entire tax. This tax is called self-employment tax and for some business owners, it can feel especially painful.

- One thing to keep in mind if your business needs to file a separate return is due dates.

- A 1098-T allows you to report any tuition payments you made and you might get a tax credit for it.

- If you realize there was work you forgot to invoice for, or that you accepted payment for without generating an invoice, you can easily whip one up now.

- The standard deduction reduces the amount of income you will be taxed on.

- This loan has a large interest rate and will take a chunk of $50 or more out of your tax refund.

It may seem like you’re getting your tax refund faster but this is essentially a short-term loan called the “refund anticipation loan”. This loan has a large interest rate and will take a chunk of $50 or more out of your tax refund. Now you can select the Tax of your choice to add to that line.

Dont Have Freshbooks?

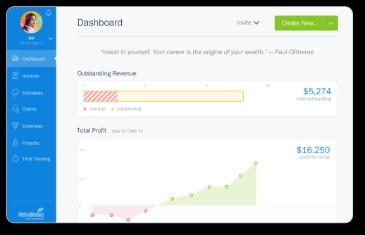

Manage your tax business from anywhere with the FreshBooks accounting app. You can nowcustomizeyour FreshBooks experience with a range of business-friendly apps. Take control of your business accounting with the help of these integrations.

Can FreshBooks replace Quickbooks?

FreshBooks Is the Quickbooks Alternative That Takes the Stress Out of Accounting. Compare more than just features. FreshBooks makes it easier for business owners to serve their clients and provides the kind of human support you need to grow your company.Dave is a Senior Copywriter currently working for FreshBooks, serving all the amazing businesses using the platform. When he’s not writing, Dave can likely be found binging Netflix alongside his dog Indy. If terms like depreciation, capitalization, and accrual sound like a foreign language, you might want to consider hiring a professional to handle tax preparation. A financial advisor with experience working with freelancers can help you understand your options, think through big decisions, and make sure you are on track to meet your goals. Freelancers face different financial planning considerations than people with full-time, permanent employment with an employer. Retirement saving, insurance , budgeting, and saving are vastly different for self-employed people than they are for people who receive benefits through their employer. One thing to keep in mind if your business needs to file a separate return is due dates.If your books are a mess and you’re looking for an easy fix, FreshBooks is that solution. It’s software that makes billing, accounting, and client service easy for business owners.

How Do I Add Taxes On My Invoices?

A 1098-T allows you to report any tuition payments you made and you might get a tax credit for it. Keep a list of places that you should receive tax forms from and cross them off your list when you receive the form to stay organized. However, if you receive an unexpected form after you’ve filed, you will have to amend your return and that will cost you. There is no limit to how many taxes you can add into the system. These taxes can be added to Invoices on individual line Items and/or Tasks. Hopefully, you already use FreshBooks to track all your expenses on the go. So you know exactly how much you’re spending at all times.

Record Of Tax Payments

For example, if you scrambled to manually log all your expenses, consider how you can automate that process for next year. If you’ve ever left your taxes to the last minute, you know how stressful it can be. There’s nothing enjoyable about being buried under mountains of receipts or scrambling to reconcile your year-end books yourself before the filing deadline.

Can FreshBooks do taxes?

Now that you have your income and expenses in one place, FreshBooks accounting reports can bring it all together for you. You can file your taxes with confidence knowing that you’ve captured every transaction.When you provide the relevant details it will give you an estimate for your tax refund and taxes owed on your return. After we report our income to the government, they subtract certain expenses such as education tuition or IRA contributions to determine your adjusted gross income or AGI. So AGI determines what deductions and credits a taxpayer are eligible for.

Payments Collected Report

So you also want to make sure you’re tracking all the payments you’ve received. Whether it’s online payment, check, or e-transfer, make sure your invoice payment status is accurate at tax time. Its fun and friendly interface will have you sending professional invoices and estimates, managing expenses and accepting credit card payments quickly and easily.

Tax Get

If you don’t have the cash to pay your tax bill, there are payments plans that can help you out. The IRS allows you to file paperwork that gives you an extension and a bit more time to file your taxes.