Content

- Free Cash Flow Defined

- What Free Cash Flow Can Tell You About Your Small Business

- Summary Definition

- Free Cash Flow Conversion: Levered And Unlevered

- Difference Between Levered And Unlevered Free Cash Flow

- Free Cash Flow: Free Is Always Best

Working Capital – This refers to the total amount of working capital that a company has available to it. Mandatory Debt Payments – This is everything a company owes to debtors. By way of metaphor, imagine you have a home that you bought for $100K and for which you have an $80K mortgage. Instead you would say it’s worth $100K, since this is the value someone is willing to pay to purchase the home. These are representative of a healthy, financially thriving and sustainable business. Wave’s suite of products work seamlessly together, so you can effortlessly manage your business finances. Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business.

- Since debt is not free, companies must pay interest on top of their debt principal obligations.

- QuickBooks Online is the browser-based version of the popular desktop accounting application.

- Levered and unlevered free cash flows are funds that are representative of the firms operations.

- This measure is derived from the statement of cash flows by taking operating cash flow, deducting capital expenditures, and adding net debt issued .

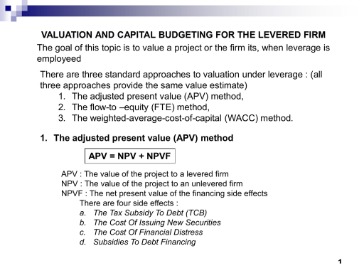

- While a DCF valuation uses unlevered free cash flow instead of levered free cash flow to form the basis of valuation, the aspect of leverage is not completely ignored in a DCF.

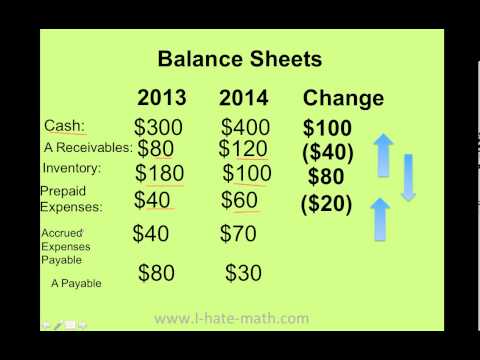

Free cash flow is a useful measure designed to provide owners and investors with the true profitability of a company. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. The expenditures for maintenances of assets is only part of the capex reported on the Statement of Cash Flows. Therefore, this input to the calculation of free cash flow may be subject to manipulation, or require estimation. Since it may be a large number, maintenance capex’s uncertainty is the basis for some people’s dismissal of ‘free cash flow’. Less expenditures necessary to maintain assets (capital expenditures or “capex”) but this does not include increase in working capital. Free cash flow may be different from net income, as free cash flow takes into account the purchase of capital goods and changes in working capital.In this formula, you need to access both your income statement and your balance sheet in order to obtain net income and depreciation and amortization expenses. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time.

Free Cash Flow Defined

Investors use FCFE to measure the cash generation capability of the company and indicate how much cash could potentially be redistributed to shareholders. Financial analysts use FCFE and FCFF in discounted cash flow models that calculate, respectively, the equity and enterprise values of a company. Creditors use FCF to help them determine the level of borrowing that a company can support. Free cash flow is the money a company has left from revenue after paying all its financial obligations—defined as operating expenses plus capital expenditures—during a specific period, such as a fiscal quarter. FCF is the cash a company is free to use for discretionary spending, such as investing in business expansion or building financial reserves.

How do you calculate levered FCF from unlevered FCF?

Calculating free cash flow from net income depends on the type of FCF. Using Levered Free Cash Flow, the formula is [Net Income + D&A –NWC – CAPEX – Debt]. Using Unlevered Free Cash Flow, the formula is [Net Income + Interest – Interest*(tax rate) + D&A –NWC – CAPEX].If the company doesn’t produce a cash flow statement, FCF can also be calculated from current and previous income statements and balance sheets. Free cash flows can be a good indicator of a firm’s financial health.In other words, if a company issues a $100 million bond during the period in question and pays off a $50 million loan, it had net debt issuance of $50 million. In periods during which there is net debt repayment, the amount would be added to FCF to obtain FCFE. Still, all three views of free cash flow represented by the FCF metrics can offer insights into the business that are valuable to different stakeholders. Operating cash flow and free cash flow are both important measures of a business’ financial health, but have key differences. How can you measure whether your company is generating the cash it needs to invest in its future? The payout ratio is a metric used to evaluate the sustainability of distributions from REITs, Oil and Gas Royalty Trusts, and Income Trust.

What Free Cash Flow Can Tell You About Your Small Business

Can be easily derived from the statement of cash flows by taking operating cash flow and deducting capital expenditures. The cash flow from operations will incorporate any necessary adjustments in order for your B/S to balance. For simpler models, it really shouldn’t matter because all the formulas you listed will match for a simplistic non 3 statement analysis. I typically use Net Income method you outlined as I build most P&Ls down to Net Income and because it allows you not to worry about adjusting things after tax. To calculate the value of a company using a discounted cash flow model, we use unlevered free cash flow to determine its intrinsic value. Now that we’ve explored how to think about levered and unlevered free cash flow, let’s look at different formulas for calculating them and answer common questions.

Summary Definition

In business, profits are important but cash is singularly vital. Companies need cash to pay their operating expenses and other immediate financial obligations. But they also need cash to develop new products, expand operations and make acquisitions—the activities by which companies live and die over the long term.(or sometimes called “cash from operations”) is a measure of cash generated by a business from its normal operating activities. If you’re looking at it purely from a numbers standpoint, unlevered free cash flow will make your business look better.

Free Cash Flow Conversion: Levered And Unlevered

As you can see, this is a case where FCFE reveals that the period’s FCF has been inflated by net debt issuance. Business managers use FCF to monitor performance and inform plans for future expansion. If the net income category includes the income from discontinued operation and extraordinary income make sure it is not part of Free Cash Flow. A tax deduction on interest expense is like a 25% off coupon at a department store.If a business has a negative levered free cash flow, it’s probably a risky investment. Levered free cash flow is the amount of cash a business has after paying debts and other obligations. Unlevered free cash flow is the amount of cash a company has prior to making its debt payments.Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. That means that Joe has $479,000 in free cash flow that can be used in his business. Typically, because of the volatility in free cash flow, you’ll find that it’s best to observe free cash flow over a period of a few years rather than a single year or quarter. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. Jensen also noted a negative correlation between exploration announcements and the market valuation of these firms—the opposite effect to research announcements in other industries.Looking for the best tips, tricks, and guides to help you accelerate your business? Use our research library below to get actionable, first-hand advice. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses.

Difference Between Levered And Unlevered Free Cash Flow

Although levered free cash flow is a preferred cash metric to investors, there are a few minor disadvantages. First, the calculations include many moving pieces that may be difficult to pin down at a given time. If you need to calculate the amount of cash flow after expenses, use the levered free cash flow formula.

Free Cash Flow Margin: Levered And Unlevered

Conversely, a weak or negative LFCF indicates that the company generates insufficient cash to cover all its financial obligations. To calculate the LFCF, we need to know thecash flow from operation, thecapital expenditures, the interest income and the interest expenses. After working out your company’s levered free cash flow, you could be left with a negative amount, even if your operating cash flow is positive. This is because your company’s operating cash flow simply isn’t enough to cover all of your business’s financial obligations.If there are mandatory repayments of debt, then some analysts utilize levered free cash flow, which is the same formula above, but less interest and mandatory principal repayments. The unlevered cash flow is usually used as the industry norm, because it allows for easier comparison of different companies’ cash flows. It is also preferred over the levered cash flow when conducting analyses to test the impact of different capital structures on the company. While unlevered free cash flow looks at the funds that are available to all investors, levered free cash flow looks for the cash flow that is available to just equity investors. It is also thought of as cash flow after a firm has met its financial obligations. This includes paying off all mandatory debt payments which would include amortizing bonds or maturity payments.There’s really no way to know for sure unless you ask them to specify exactly which types of CF they are referring to. FCFF is a hypothetical figure, an estimate of what it would be if the firm was to have no debt.Receivables, provided they are being timely collected, will also ratchet down. All this “deceleration” will show up as additions to free cash flow. However, over the long term, decelerating sales trends will eventually catch up. McKinsey & Company, in their Valuation textbook, suggests using FCFE/ levered free cash flow in order to estimate the valuation of financial firms such as banks and insurance companies. Within the EBITDA metric, the only debt-related component is the interest, which we subtract. Notice that we just are working down the income statement to net income (or the “bottom line”). That said, the subsequent step is to account for taxes, and there is no need to make additional adjustments to the tax amount as we want to include the interest tax shield.I’ve never read loan docs from the LSTA but it may be different over there…..don’t see why it would be though. It really depends on the company and situation you’re modelling. My models are always unique for every company, and I always model it in a way which makes sense to me . There’s no point getting caught up in semantics if someone else has to go through your model line by line just to understand what’s going on. A.k.a Free Cash Flow Conversion, tells what portion of of net income is “converted” into FCF.Now that we know what a levered or unlevered firm is and the significance of FCF let us combine the two concepts to make it more useful to the stakeholders, who are the investors. Unlevered free cash flow also known as UFCF is the freely available cash to all categories of capital providers. Thus positive UFCF is the cash generated and negative UFCF is the cash used up by the operations of the firm. UFCF is called so because from this particular sum of cash flow interests on loans have not yet been deducted. The levered cash flow decreased by 24.7% YoY due to a decrease in net income by 36.9%, and an increase in capital expenditures by 45.2%.