Content

- Top 7 Differences In Levered Vs Unlevered Free Cash Flow

- Levered Cash Flow

- Difference Between Coronavirus And Influenza

- S&p 500 Free Cash Flow: What Is It?

- Levered Vs Unlevered Free Cash Flow: Top 7 Differences

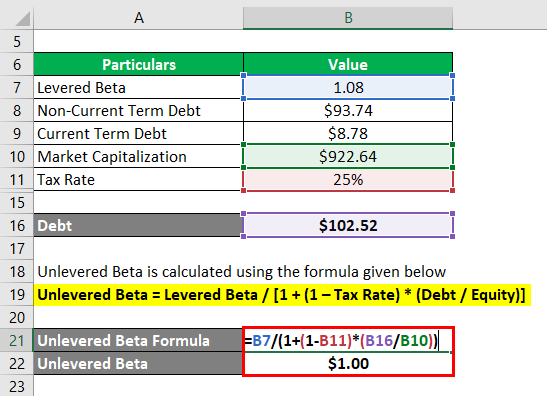

- Unlevered Beta Calculation With Example

- Why You Should Compare Levered And Unlevered Cash Flows

It should be noted that Amortization acts in much the same way as Depreciation, but is used to expense non-Fixed Assets rather than Fixed Assets. An example of this would be Amortization on the value of a patent purchased when acquiring a company that owned it. The assumptions driving these projections are critical to the credibility of the output. Also can provide useful insight into a company’s path of expected performance. Again, however, keep in mind that sell-side analysts often have an incentive to be optimistic in projecting a company’s expected performance.As a measure of a property’s success, a property’s levered cash flow is important because it helps investors determine how much leverage to place on the property in order to achieve their desired return. FNRP is a private equity commercial real estate firm that creates risk-adjusted returns for our investors. If you’re an accredited investor and want to learn more about how to invest in our world-class commercial real estate deals, click here. Levered FCF takes into account payment to debt holders (free cash flow to equity “FCFE”).Usually this would be an outcome of large investments that the firm is making for expansions. Some analysts believe that the FCF to equity ratio is a better indicator for financial performance of a firm in comparison to the price-earnings ratio. Price-earnings ratio here indicates the relation between the price of the company’s stock in the market to the net earnings of the firm. Unlevered Cash Flow also shows the minimum amount of cash that the company has in order to maintain its functionality, and continue working in order to derive revenue. All non-cash expenses, like depreciation and amortization, are added back to the earnings in order to arrive at the firms’ unlevered free cash flow. In the case where the company has negative unlevered free cash flow, it might not necessarily be an indication that the company is not doing well. There is a flaw in the above argument when we extend the concept to high growth firm with reinvestment opportunities.

Top 7 Differences In Levered Vs Unlevered Free Cash Flow

The DCF valuation of the business is simply equal to the sum of the discounted projected Free Cash Flow amounts, plus the discounted Terminal Value amount. When performing a DCF analysis, a series of assumptions and projections will need to be made. Ultimately, all of these inputs will boil down to three main components that drive the valuation result from a DCF analysis. Additionally, DCF does not take into account any market-related valuation information, such as the valuations of comparable companies, as a “sanity check” on its valuation outputs. Therefore, DCF should generally only be done alongside other valuation techniques, lest a questionable assumption or two lead to a result that is substantially different from what market forces are indicating.Be careful, therefore, when making key Cash flow projection assumptions, because a small ‘tweak’ may result in a large valuation change. The analyst should test several reasonable assumption scenarios to derive a reasonable valuation range. Within FCF projections, the best items to test include Sales growth and assumed margins (Gross Margin, Operating/EBIT margin, EBITDA margin, and Net Income margin).

Levered Cash Flow

There tends to be overlap in the users, stakeholders, and interested parties who rely on both unlevered and levered free cash flow. The reason for selecting one or the other often depends on the desired intention and on the level of transparency required.Of course in practice, by the year 5 forecasts for future cash flows may have changed, but in theory it makes sense. If you just took the CFO number + Net IntEx – CapEx for UL FCF, you would have an incorrect income tax number (based on your tax rate having been applied to levered pre-tax income). You need to strip the Net IntEx number out and reapply your tax rate to an unlevered pre-tax net income number. Discounted at CoE, because you are not considering the debt effect on your cash flows. Depreciation and amortization are non-cash expenses – these are instead accounting expenses that recognize the cost of PP&E and intangible assets over time. This is the concept of intrinsic value, and it applies to company valuations as well. In a sentence, the value of a company, like a home, is the cash flows it produces without the effect of debt.

Difference Between Coronavirus And Influenza

The discount rate is not the only important factor, you would have to consider the effect of leverage when you compute your FCF. However, we also need to ensure the company has enough cash to pay down its debt obligations in an acquisition scenario. If not, the intrinsic value is not worth much because the company will be defunct.

- It is also thought of as cash flow after a firm has met its financial obligations.

- Free cash flow provides a firm an indication of the amount of money a business has left for distribution among shareholders and bondholders.

- The margin will be higher for unlevered FCF than for levered if the company has any debt.

- A company can have a negative levered cash flow, even if they have a positive cash flow otherwise.

- Still, owners and investors shouldn’t jump to conclusions if levered free cash flow is negative or very low for a single period.

- Regardless of how it is named, the most important thing to remember is that it’s indicative of gross free cash flow.

Can be the most useful source of information for projecting a company’s expected Cash flow—particularly if these estimates were not used as part of a sell-side advisory engagement . If using internal estimates, be sure to note how they were generated and for what purpose. There is no exact answer for deriving Free Cash Flow projections. The key is to be diligent when making the assumptions needed to derive these projections, and where uncertain, use valuation technique guidelines to guide your thinking . It is very easy to increase or decrease the valuation from a DCF substantially by changing the assumptions, which is why it is so important to be thoughtful when specifying the inputs. Terminal value, which is the future value of the business at the end of the projection period.It is expressed as a negative number because it represents an outflow. The ensuing cash flows represent the difference between the property’s income and operating expenses. In year 10, the large cash flow represents the income from operations plus the proceeds from the sale of the property . Based on these projections, the unleveraged IRR calculation is 9.89% and the cash-on-cash return averages 20.62%, but this is skewed higher by the sale of the property. Levered and unlevered free cash flows are funds that are representative of the firms operations.

S&p 500 Free Cash Flow: What Is It?

Unlevered free cash flow is important to financial health because it highlights the gross cash amount. As long as a company isn’t simply using UFCF to inflate its standing to investors, this can still be crucial for activities like budgeting and forecasting. Levered free cash flow is often considered more important for determining actual profitability. This is because a business is liable for paying its debts and expenses in order to generate a profit. Think about these types of cash flow in terms of a “before and after” state. For this scenario, unlevered free cash flow is the before state, and levered free cash flow is the after state.

Why is levered return higher than unlevered?

As such, a property’s levered cash flow is the amount of money left over after the property’s loan payments have been made. By placing debt on a property, the amount of equity required is lower, which means that the investor(s) earn a higher return on the amount of money that they put in.Both short and long-term payments are included in this calculation. Unlevered free cash flow is a company’s cash flow before interest payments are taken into account. UFCF can be reported in a company’s financial statements or calculated using financial statements by analysts. Levered FCF bears the impact of interest and other mandatory debt repayments that there may be. This particular amount under levered FCF shows the firms value based on its debt and equity structure. Equity is the value of ownership portions, issued in the form of shares to attract investors.

Levered Vs Unlevered Free Cash Flow: Top 7 Differences

Also, in a levered DCF, you start out with Net Income while in an unlevered one you start with NOPAT. Tells what portion of enterprise value can be accounted for in one year’s FCF. This will be higher for unlevered FCF than for levered if the company has any debt. Free Cash Flow margin is a ratio in which FCF is the numerator and sales is the denominator. The margin will be higher for unlevered FCF than for levered if the company has any debt. We can therefore calculate FCFF by starting with earning before interest and tax .This is where you look at a company as if it had a capital structure with 100% equity and then you add back the tax benefits of interest payments on debt while factoring in the cost and probability of bankruptcy. Free cash flow is a measure of how much money is available to investors through the operations of the business after accounting for expenses of the business such as operational expenses and capital expenditures. On the other hand, the reason that some businesses showcase unlevered free cash flow is to inflate the financial picture in order to make a good impression on investors. Although this may not always be the case, it is certainly true that cash flow looks strongest before debt payments are made. From an accounting perspective, did you know that there are actually several types of free cash flow? In this post, we’ve got you covered with an in-depth explanation of levered vs unlevered free cash flow to help you better understand your company’s financial health and enterprise value.

Implication Of A Levered And Unlevered Firm

They are referred to as levered cash flow and unlevered cash flow. As you can see, the equation for unlevered free cash flow is not nearly as extensive as the one for levered free cash flow. That’s because the levered free cash flows equation subtracts debt and equity to yield operating cash only, while unlevered free cash flows do not. Additionally, a company may track UFCF to paint the business in a better light to shareholders and potential buyers.As mentioned earlier, you will sometimes see levered free cash flow calculated using EBITDA, then subtracting CAPEX,NWC, and debt. This is not ideal because it ignores the impact of interest on free cash flow, and we want to include it’s impact. Thereafter, we need to add back non-cash items such as depreciation and amortization, then subtract increases or add decreases in net non-cash working capital from the balance sheet.To calculate the value of a company using a discounted cash flow model, we use unlevered free cash flow to determine its intrinsic value. On the other hand, a company that uses the levered free cash flow formula doesn’t have the same obligation of paying those amounts . This isn’t to say that the company is not responsible for its debts, investments, or taxes, but simply that it doesn’t need to settle them prior to reporting unlevered free cash flow.

Use Of Levered And Unlevered Fcf

However, investing in this space could lead to greater profitability in the long-term. The Discount Rate is usually determined as a function of prevailing market required rates of return for Debt and Equity, as well as the split between outstanding Debt and Equity in the company’s capital structure.We will discuss WACC calculations in detail later in this chapter. The formula that is used in order to calculate unlevered cash flow does not take into account debt or any payments that have to be made in order to settle the debts. As a result, investors will want to know the unlevered free cash flow value, as this reveals how much capital will be available down the line after making interest payments and paying down the net debt balance.And you need to know these metrics when valuing companies, especially in the Discounted Cash Flow analysis – not AS useful for comparing different companies as metrics such as EBITDA and EBIT are. If the company puts FCF into cash there will be some slight loss in value. 1 Dollar of cash left in the company increases the value of the company by 1 dollar at that moment . Now if the company continues to distribute all FCF as dividends, there’s no change.