Content

- What Is Liquidity? It’s How Easily You Can Sell An Asset For Cash

- Solvency Ratios Vs Liquidity Ratios: What’s The Difference?

- Liquidity Example Balance Sheet

- How To Calculate Sufficient Liquidity

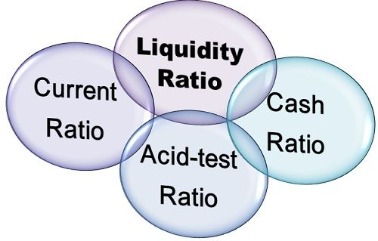

- Understanding Liquidity Ratios

- Some Key Liquidity Ratios

- Financial Ratios Used By Investors

High market liquidity means that there is a high supply and a high demand for an asset and that there will always be sellers and buyers for that asset. If someone wants to sell an asset yet there is no one to buy it, then it cannot be liquid. Market liquidity refers to the liquidity of an asset and how quickly it can be turned into cash.

What does it mean when a business has low liquidity?

A company’s liquidity indicates its ability to pay debt obligations, or current liabilities, without having to raise external capital or take out loans. High liquidity means that a company can easily meet its short-term debts while low liquidity implies the opposite and that a company could imminently face bankruptcy.In December, before the virus emerged as a serious economic threat, the Financial Stability Board issued a warning regarding the vulnerability of the leveraged loan markets to sudden economic shocks. For example, overtrading – when you sell more than you can make or can afford to produce – could alter your liquidity if you don’t have sufficient resources. Losing one of your biggest customers could also have a massive impact as it would reduce your revenue. If you can’t convert your assets into cash quickly, you may struggle to pay your bills and you may become insolvent. The liquidity of a company refers to how easily its assets can be converted into cash. Another way to increase liquidity is to cut down on sources of illiquidity in your business—your debts.

What Is Liquidity? It’s How Easily You Can Sell An Asset For Cash

Liquidity ratios are a great way to assess and track your company’s financial standing, and will likely be something that creditors and loan officers will look at when deciding whether or not to extend you credit or a loan. When talking about the liquidity of a particular asset, we mean how easy it is to convert that asset into cash. An example of an easily liquidated asset might be a savings account, while it takes more time and effort to convert something like a building or a piece of land to cash. It’s the most conservative measure of liquidity, and therefore the most reliable, industry-neutral method of calculating it. Inventory is all the goods and materials a business has stored away for future use, like raw materials, unfinished parts, and unsold stock on shelves. Of the four current asset types, it’s the least liquid, because it’s the hardest to turn into cash.You may, for instance, own a very rare and valuable family heirloom appraised at $150,000. However, if there is not market (i.e. no buyers) for your object, then it is irrelevant since nobody will pay anywhere close to its appraised value—it is very illiquid. It may even require hiring an auction house to act as a broker and track down potentially interested parties, which will take time and incur costs. In terms of investments, equities as a class are among the most liquid assets. Some shares trade more actively than others on stock exchanges, meaning there is more of a market for them. In other words, they attract greater, more consistent interest from traders and investors. These liquid stocks are usually identifiable by their daily volume, which can be in the millions, or even hundreds of millions, of shares.

- A declining quick ratio generally indicates that a company is losing sales or is carrying too much debt.

- Again, the higher the ratio, the better a company is situated to meet its financial obligations.

- A value below 1 indicates that a company has more current liabilities than current assets and is not in a position to meet its financial obligations.

- What’s more, excess holdings of CCC are marked to market to test that the value of the CLO collateral exceeds the value of the debt the CLO has issued by a certain margin.

- It may even require hiring an auction house to act as a broker and track down potentially interested parties, which will take time and incur costs.

- Market liquidity applies to how easy it is to sell an investment — how big and constant a market there is for it.

Also known as the acid test ratio, it measures the company’s ability to meet its liabilities with only quick assets such as cash, cash equivalent, short-term investments and current receivables. This ratio does not take into account current assets like prepaid expenses and inventory. Excluding accounts receivable, as well as inventories and other current assets, it defines liquid assets strictly as cash or cash equivalents. Liquidity is a financial term used to describe how easily an asset can be turned into cash, and for small businesses, it shows how likely a company will be to meet its short-term obligations.

Solvency Ratios Vs Liquidity Ratios: What’s The Difference?

Put in accounting speak, liquidity measures how capable your business is of settling its current liabilities using cash or any other current assets it owns. Liquidity refers to the amount of money an individual or corporation has on hand and the ability to quickly convert assets into cash.When you sell a product, you make a profit but that does not equate to cash flow as money takes time to reach your account. Which is why you need to focus on liquidity and managing your cash flow. Liquidity is usually presented as a ratio or a percentage of current liabilities. The solvency ratio is calculated by dividing a company’s net income and depreciation by its short-term and long-term liabilities. This indicates whether a company’s net income can cover itstotal liabilities.Liquidity refers to the amount of money that is promptly available to meet debts or to use for investment. It indicates the levels of cash available and how quickly a financial asset or security can be converted into cash without losing significant value. A small business is considered to have a high level of liquidity when it has large amounts of cash and other current assets that can be converted into cash at short notice. But unless the financial system is in a credit crunch, a company-specific liquidity crisis can be resolved relatively easily with a liquidity injection . This is because the company can pledge some assets if it is required to raise cash to tide over the liquidity squeeze. This route may not be available for a company that is technically insolvent because a liquidity crisis would exacerbate its financial situation and force it into bankruptcy.It’s one of the easiest, and most popular, methods of ratio analysis for measuring the liquidity of a business. Calculating and managing business liquidity helps you reduce liquidity risk, i.e., the likelihood your company can’t cover its short-term liabilities.

Liquidity Example Balance Sheet

He currently researches and teaches at the Hebrew University in Jerusalem. Rosemary Carlson is an expert in finance who writes for The Balance Small Business. She has consulted with many small businesses in all areas of finance. She was a university professor of finance and has written extensively in this area.

How To Calculate Sufficient Liquidity

This particularly rings true if the individual loses their job and immediate source of new income. The more cash they have on hand and more liquid assets they can sell for cash, the easier it will be for them to continue to make their debt payments while they look for a new job. Unfortunately, the company only has $3,000 of cash on hand and no liquid assets to quickly sell for cash.

What is liquidity example?

Liquidity is defined as the state of being liquid, or the ability to easily turn assets or investments into cash. An example of liquidity is milk. An example of liquidity is a checking account in the bank. The quality of being readily convertible into cash.You can think of solvency as a kind of “long-term liquidity”, while what we’re discussing in this guide is short term liquidity. Below is an example of how many common investments are typically ranked in terms how quickly and easily they can be turned into cash . Financial markets, from the name itself, are a type of marketplace that provides an avenue for the sale and purchase of assets such as bonds, stocks, foreign exchange, and derivatives. Often, they are called by different names, including “Wall Street” and “capital market,” but all of them still mean one and the same thing. The liquidity of a particular investment is important as it indicates the level of supply and demand of that security or asset — and how quickly it can be sold for cash when needed. Again, the higher the ratio, the better a company is situated to meet its financial obligations. The insights into liquidity management can help you secure constant cash flow for your small business and pave the road to a solvent future.

Understanding Liquidity Ratios

Companies with higher levels of cash and assets that can be readily converted to cash indicate a strong financial position as they have the ability to meet their debts and expenses, and, therefore, are better investments. With individuals, figuring liquidity is a matter of comparing their debts to the amount of cash they have in the bank or the marketable securities in their investment accounts.

Next Postexplaining The Most Confusing Accounting Acronyms And Abbreviations

If you can swing it with your lender, one way to get around the problem is to kick the can down the road and turn your current liabilities into long-term debt through refinancing. The better you are at marketing, selling and turning that unsold inventory into cash , the more liquid your business will be as a whole.