Content

- How To Complete Irs Payment Trace Form 3911

- Want To Get A Refund Of Excess Sdi?

- The Right To Quality Service

- What Happens If You Can’t Pay Your Taxes?

- Use Refund Towards Your Estimated Payments

- Unclaimed Income Tax Refunds By Taxpayers

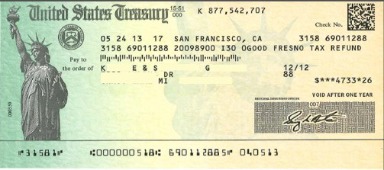

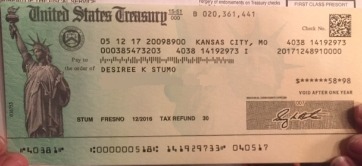

For 2021 Returns, taxpayers who claimed an inaccurate amount of the first and second stimulus payments would have seen their refund adjusted to the correct amount. If you’ve e-filed and opted to receive your refund via direct deposit, it generally takes the IRS no more than three weeks to send your refund. How long it takes to show in your account will vary by bank. Once the IRS sends your refund electronically, it typically takes between one and five business days for your deposit to show up. If you opted for a paper check, your return could take six to eight weeks to arrive. If you owe 2018 Taxes, file your tax return as soon as possible to reduce late filing fees and late tax payment penalties. If you owe 2019 Taxes, file your tax return as soon as possible to reduce late filing fees and late tax payment penalties.

Can I cash an expired check?

Banks don’t have to accept checks that are more than 6 months (180 days) old. That’s according to the Uniform Commercial Code (UCC), a set of laws governing commercial exchanges, including checks. However, banks can still choose to accept your check.A replacement check will be issued within days. In most cases, the US Postal Service does not forward refund checks.If you request cash back when making a purchase in a store, you may be charged a fee by the merchant processing the transaction. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale. Vanilla Reload is provided by ITC Financial Licenses, Inc.

How To Complete Irs Payment Trace Form 3911

You can check on the status of your refund at the IRS’s Where’s My Refund? Lea has worked with hundreds of federal individual and expat tax clients.

- Starting price for state returns will vary by state filed and complexity.

- In 2020, the IRS changed the rules to allow for electronic filing of amended returns, though it only applies to 2019 and 2020 returns.

- You can still track the refund’s status through the IRS website if you file an amended return.

- The IRS can’t compel a bank to redirect refunds that were deposited to the wrong bank account.

- This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund.

- Before you start a payment trace, check with the IRS about the status of your payment.

CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. What happens if you find out about a credit or deduction that would have resulted in a refund — after you filed? Or maybe you learned of an error on your return that would have meant a lower balance due or more money back. If it’s been three years or fewer since the due date of your return, you can amend your return and still receive your unclaimed tax refund. If your original refund check was cashed, you’ll receive a claim package within six weeks to complete and return to the Bureau of the Fiscal Service to process your claim. One way to make sure your paycheck is never lost or stolen again is to enroll in direct deposit.

Want To Get A Refund Of Excess Sdi?

When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. In addition to the seven reasons listed above, one of the significant reasons for slower processing times during 2020 has been the impact of the COVID-19 pandemic. In particular, if a taxpayer filed a paper return, the processing time may be slower due to limited staffing as a result of the pandemic. Once you have completed the form, mail it to the IRS address where you would file paper tax returns. Finally, if you’re searching for your stimulus payment, you can check Get My Payment. If the IRS agrees with your claim, it will credit your tax account for your stimulus payments. However, you will need to claim the 2020 Recovery Rebate Credit on your 2020 tax return to retrieve your funds.

The Right To Quality Service

State e-file not available in NH. E-file fees do not apply to NY state returns. If the check hasn’t been cashed, you’ll get a replacement refund check in about six weeks. Once the IRS finishes tracing your refund, the IRS’s next steps depend on whether you requested your refund come to you as a direct deposit or paper check. City of New York checks are valid for 180 days from the check date. OPA will not replace a check that is valid.Starting price for state returns will vary by state filed and complexity. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. See Peace of Mind® Terms for details. Enrolled Agents do not provide legal representation; signed Power of Attorney required.

What Happens If You Can’t Pay Your Taxes?

You won’t have to worry about a paper check getting lost in the mail, stolen, or misplaced once you have it in hand. But keep in mind that the IRS doesn’t allow more than three direct deposits into the same bank account per tax year. If this is the case, you can ask the IRS to do a refund trace.

Use Refund Towards Your Estimated Payments

You can still track the refund’s status through the IRS website if you file an amended return. The IRS issued more than 111 million tax refunds in 2019, with the average being $2,869. Overall, more than 150 million individual tax returns were processed.The IRS assumes no responsibility for errors by you or your preparer. You should also check with your financial institution to make sure the mistake hasn’t been at their end. However, please note that due to varying circumstances such as address changes, some returns take longer to process than others. If it has been more than 10 weeks since you filed your tax return, you may call our Taxpayer Services Division and speak with a taxpayer service representative.

You Are Leaving H&r Block® And Going To Another Website

Take the check and a copy of the death certificate to your bank and try to cash or deposit it. If you paid more than the maximum State Disability Insurance or Voluntary Plan Disability Insurance tax, you may be eligible to claim a credit for excess SDI. If you owe money to a government agency, they may partner with us to collect it.Applies to individual tax returns only. All tax situations are different. Fees apply if you have us file a corrected or amended return.