Content

- The Historical Perspectives Of Financial And Managerial Accounting

- Software Features

- Managerial Accounting Vs Financial Accounting: The Top 10 Differences

- Expand Your Accounting Career With An Online Macc

- Video Explaining The Differences

- Accounting Standards

- What Is Managerial Accounting?

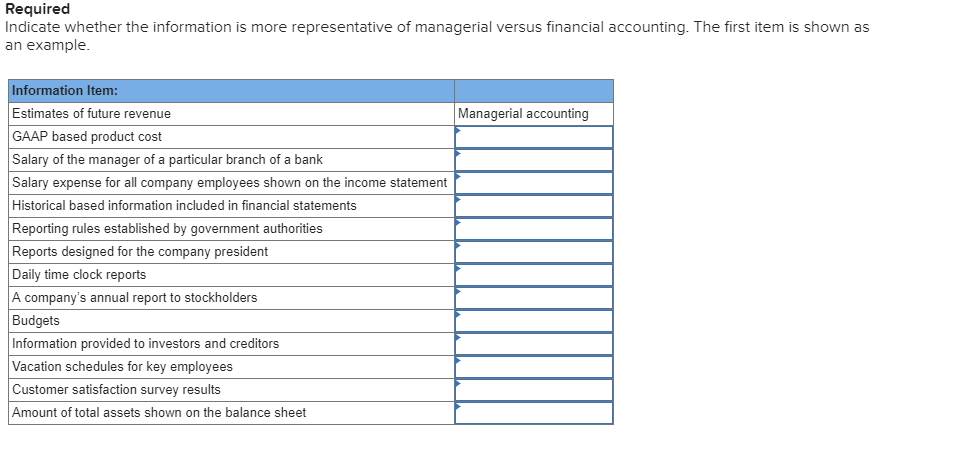

An example would be an internet company that uses cloud computing services for its employees. Conforming to these rules allows lenders and investors to directly compare companies based on their financial statements. Though some accounting software applications do offer budgeting capability, many businesses use a spreadsheet application such as Microsoft Excel to create budgets and estimates. The information contained in financial statements must be accurate and is derived from the various financial transactions entered throughout the specified accounting period.One of the main functions of managerial accounting is to estimate future costs, such as production, marketing, inventory, shipping, and R&D. It helps you get a handle on what might occur in a few days, weeks, months, and years. Both operational budgeting and capital budgeting (calculating whether your business’s long-term investments are worth the expense) fall into this category. Because it is manager oriented, any study of managerial accounting must be preceded by some understanding of what managers do, the information managers need, and the general business environment. Management accounting is a field of accounting that analyzes and provides cost information to the internal management for the purposes of planning, controlling and decision making.If you want to know whether an asset (e.g., an assembly machine) is productive , you make use of managerial accounting to analyze the situation. Managerial accounting processes economic information to be used by management in making decisions. Complete two years of continuous experience in either managerial accounting or financial management. In the United States, average salaries for management and financial accountants are similar. For the most up-to-date salary information from Indeed, click on the salary link. The social work education programs provided by the University of Nevada, Reno School of Social Work are accredited at the baccalaureate and master’s levels by the Council on Social Work Education . This indicates to the public and to potential employers that graduates meet the high professional standards established by CSWE in its Educational Policy and Accreditation Standards .

The Historical Perspectives Of Financial And Managerial Accounting

When compiling information and creating reports, managerial accounting doesn’t have to comply with any local, state, or federal standards. This is because the information is typically kept in-house and is not meant for public consumption.Once again, the company that has the most accurate “crystal ball” on future market activity has the advantage, underscoring the importance of effective managerial accounting, as well as its potential weaknesses. A company that closely ties itself to inaccurate managerial accounting projections may experience challenges adapting to actual market conditions. The primary difference between financial and managerial accounting is one of audience. There’s not only a distinction between financial and managerial accounting, supervisors and managers at different levels or in different departments may be concerned with even smaller subsets of the overall financial picture.

Software Features

The biggest practical difference between financial accounting and managerial accounting relates to their legal status. This means there is no centralized system regulating reports, and it can often take much longer to find what you need. Although financial accounting reports may be useful for future use such as forecasting, the forward view is more definitive of managerial accounting.

- There is also a difference in the accounting certifications typically found in each of these areas.

- Financial accounting does have internal value, but mostly needed by stakeholders outside an organization since it seeks to disclose the financial health of the company and its performance.

- Although financial accounting reports may be useful for future use such as forecasting, the forward view is more definitive of managerial accounting.

- In general, financial accounting refers to the aggregation of accounting information into financial statements, while managerial accounting refers to the internal processes used to account for business transactions.

Managerial accounting focuses on operational reporting and looks to the future by using forecasting. These reports are shared internally within the company, typically with managers and senior employees. Managerial accounting reports are issued more frequently and follow no specific period. Managerial accounting often involves reporting on more detailed aspects of the organization.

Managerial Accounting Vs Financial Accounting: The Top 10 Differences

A company’s financial health is best evaluated using standard accounting practices, and in some cases required, such as with a publicly traded company. These are, ideally, a reliable, accurate and comparable way to evaluate a business, whether for investing or financing. While reports generated by standard financial accounting practices contain valuable information for the management of a company, typical periods may be monthly, quarterly or annually. Managerial Accounting is used mainly at a departmental or geographical level, while Financial Accounting tends to have more of a companywide focus. Take for example monthly financial statements including the income & expense statement, the balance sheet and the cash flow statement.There have been arguments as to which between financial accounting and managerial accounting is more important, but is somewhat pointless. In this article, we will differentiate managerial and financial accounting in terms of users, compliance with standards, purpose, time orientation, frequency, and more. Management accounting refers to accounting information developed for managers within an organization. This is the phase of accounting concerned with providing information to managers for use in planning and controlling operations and in decision making. Managerial accountants typically command higher salaries than financial accountants. The median annual salary for financial accountants is about $55,500, according to July 2020 data from PayScale. The median annual salary for managerial accountants is about $72,100, according to August 2020 data from PayScale.

What are the major differences between managerial accounting and financial accounting quizlet?

What is the Key difference between managerial and financial accounting? Managerial Provides information and analysis to managers inside the organization (Company) to help with decision making. While Financial Accounting is the financial information and analyses for (Employees) people outside the Organization (company).When you read a financial accounting report, you’re seeing what happened yesterday, last week, or last year . Managerial accounting and financial accounting are two of the most prominent branches of accounting.

Expand Your Accounting Career With An Online Macc

This could involve analyzing individual product lines, assessing operations and even evaluating how physical facilities are managed. Financial accounting must follow certain standards in accordance with GAAP, which is a requirement for businesses based in the U.S. to maintain their publicly traded statuses. Managerial accounting is not intended for external users and can be modified according to the company’s processes. In the U.S., the financial accounting reports of a company are governed by the Generally Accepted Accounting Principles as adopted by the U.S.

What is an example of managerial accounting?

Answer: Managerial accounting often focuses on making future projections for segments of a company. … For example, Sportswear Company might measure the percentage of defective products produced or the percentage of on-time deliveries to customers.She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting.

Video Explaining The Differences

Managerial and financial accountants both sift through and organize financial data, but for very different audiences and purposes. Individuals looking to break into the accounting field should understand the similarities and differences between these job titles to ensure they’re on a career path that aligns with their talents, goals and interests.

Accounting Standards

While financial accounting can help organizations improve their internal processes, it’s mainly intended to keep parties outside the company informed about historical financial data and trends. One of the major differences between corporate finance and managerial accounting is that managerial accounting analyzes companies at the department or product level, rather than as a whole. Senior managers need a way to measure their performance and demonstrate that their management efforts result in financial gains for the firm. Financial benchmarks or standards such as budgets help managerial accountants guide managers in their daily decisions within organizations. Moreover, managerial accounting interprets, measures and communicates information from analyses produced by finance professionals. While finance professionals base their findings and analysis on financial data, managerial accountants consider external factors including employee morale, environmental and market changes and media coverage. Reacting quickly to financial data generated to meet generally accepted accounting principles may not be possible.

What Is Managerial Accounting?

Managerial accounting uses this data to help develop processes around internal decision-making, financial planning and budgeting. Combined, these two functions give organizations a complete view of how costs affect their business, and what actions they need to take to improve productivity.Financial accountancy data, information and analyses reports are historical in nature. Managerial accounting information is confidential and used largely by managers only inside the company. Financial accounting takes a wider view and examines the financial status of the entire business. Data analytics manager, who reviews and develops plans in response to internal data.Anyone working as a financial accountant must be familiar with relevant compliance guidelines and routine accounting tasks, such as creating invoices and monitoring accounts receivable balances. One of the biggest differences between financial and managerial accounting is their legal status. As the reports created with managerial consulting are purely for internal use, there is no specific set of accounting standards they need to adhere to. Each company is free to use its own system and rules when creating managerial reports. Most accounting tasks can be divided into financial accounting and managerial accounting. It is useful to describe the differences between these two aspects of accounting, since each one describes a distinctly different career path.

As To Source Of Data

Reports produced by financial accounting (e.g., financial statements and investor reports) are largely distributed externally to people outside your organization. As part of their roles, managerial accounts must analyze a variety of events and operational data to discover how their companies can improve performance. Once this financial data is aggregated, they translate complex correlations into digestible information that can be leveraged by internal stakeholders.