Content

- Diverse Pay Or Deduction Scales

- A Spouse Is On An Income

- When It Makes Sense To File As ‘married Filing Separately’

- Best Tax Software 2021

- Taxes: Single Vs Married

- Small Business

Filing separate returns in such a situation may be beneficial if it allows you to claim more of your available medical deductions by applying the threshold to only one of your incomes. The capital loss deduction limit is $1,500 each when filing separately, instead of $3,000 on a joint return.

- Many or all of the products featured here are from our partners who compensate us.

- Fees apply if you have us file a corrected or amended return.

- All income from paid employment, including tips, bonuses, and the like.

- But if the couple filed separately, the cost would easily exceed the teacher’s threshold for medical deductions, which would be $3,375 ($45,000 x 7.5%), based only on the teacher’s AGI.

- Your Saver’s Credit will be limited to half the amount that it would be on a joint return.

All income from paid employment, including tips, bonuses, and the like. This calculator assumes no exclusions to wages and salary income such as contributions to 401 retirement plans. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX.If an election is made, married filing jointly is your Connecticut income tax filing status. For example, the standard deduction for the 2020 tax year is $12,400 for single filers. The deduction for taxpayers who are married and file jointly is $24,800. In this case, the deduction is doubled for joint filers. That isn’t always the case though. As another example, single filers can deduct up to $3,000 of capital gains losses from income.The IRS considers you unmarried if you’re not legally married. The cost of keeping up a home includes the property taxes, mortgage interest or rent, utilities, repairs and maintenance, property insurance, food and other household expenses. Tax deductions and credits you can claim, so you can select the right one when you file your taxes.

Diverse Pay Or Deduction Scales

Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For forms and publications, visit the Forms and Publications search tool. This Google™ translation feature, provided on the Franchise Tax Board website, is for general information only.The right filing status for you will depend on your expenses and income. There are many factors involved in determining whether it is better for married couples to file separately or jointly. When a couple is unsure of which filing status to choose, it makes sense to compute the tax return both ways to determine which will give the biggest refund or lowest tax bill. First comes love, then comes marriage, then comes—filing with the Internal Revenue Service .CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return .

A Spouse Is On An Income

For example, if one spouse decides to itemize deductions, the other spouse must do so as well, even if their itemized deductions are less than the standard deduction. If one spouse has itemized deductions of $20,000 and the other has only $2,500, the second spouse must claim that $2,500 rather than the larger standard deduction. This means that filing separately is a good idea from a tax-savings standpoint only when one spouse’s deductions are large enough to make up for the second spouse’s lost deduction amount. When filing jointly, “each spouse is responsible for the entire tax due,” adds Guglielmetti. “So, even if your other finances are separate, if you file jointly and your spouse doesn’t pay , you’re responsible. Filing separately keeps those responsibilities separate, and you’re only responsible for your own.” For example, if you and your spouse file jointly and earn a combined AGI of $100,000, you would have to rack up more than $7,500 in doctors bills before you could begin deducting any of these expenses. Conversely, if you chose to file separately with an AGI of $40,000, your medical bill total would only have to exceed $3,000, which is 7.5% of $40,000.The income threshold for the highest tax rate comes much sooner for MFS than for MFJ and single filers. For 2020, once taxable income reaches $311,025 for MFS, the 37% tax rate kicks in, compared to $622,051 for MFJ and $518,401 for single filers. Once you file your taxes, you may learn that you have a big tax refund coming your way.

When It Makes Sense To File As ‘married Filing Separately’

Enter the total amount of expenses, not just the deductible portion. Professional services businesses are those in which the principal asset is the reputation or skill of its employees (e.g. doctors, lawyers, or accountants). Your Alternative Minimum Tax exemption amount will be half of what you would get on a joint return.

Best Tax Software 2021

Remember, though, that itemizing deductions will disable either spouse from claiming their separate standard deduction of $12,400 . One big change that comes with marriage is how you report withholding. Normally, you fill out your W-4to reflect how many total exemptions you can take. After marriage, you and your spouse need to distribute your exemptions across both your W-4 forms.

What is the benefit of a married couple filing separately?

By using the Married Filing Separately filing status, you will keep your own tax liability separate from your spouse’s tax liability. When you file a joint return, you will each be responsible for your combined tax bill (if either of you owes taxes).State e-file available for $19.95. The American Opportunity and Lifetime Learning Education Tax Credits, which reduces the amount of taxes owed by those who are attending college, or have a spouse or child with college or graduate school tuition costs.

Taxes: Single Vs Married

Small Business Small business tax prep File yourself or with a small business certified tax professional. Emerald Card The best in digital banking, with a prepaid debit card.

Get The Latest On Monthly Child Tax Credit Payments Here

In the vast majority of cases, it’s best for married couples to file jointly, but there may be a few instances when it’s better to submit separate returns. If you are both part-year residents of Connecticut and have the same period of residency , you may choose married filing jointly or married filing separately as your Connecticut income tax filing status. If you get married on or before the last day of the tax year (Dec. 31), your filing status for that year is married. However, you still need to decide between the statuses of married filing jointly and married filing separately. Filing jointly will result in one tax return. That makes filing simpler but it won’t allow all couples to maximize tax benefits.COVID-19 updates for California taxpayers affected by the pandemic. If one spouse chooses to itemize their deductions, the other must too. Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. Planning your family’s finances goes beyond just taxes.Find a local financial advisor today. You cannot exclude any interest income from U.S. savings bonds that you used for education expenses.

Small Business

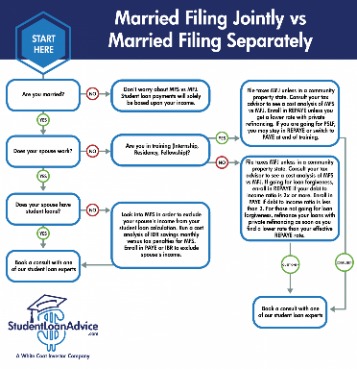

As a general rule, a resident and a nonresident cannot file a joint or combined Virginia return. This is particularly important for members of the military to consider when choosing a filing status. Please review the filing status information carefully. Filing separately would allow both spouses to begin deducting qualified medical expenses after they exceed 7.5% of their own AGI.