Content

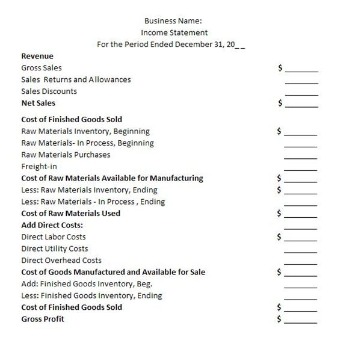

- Add Operating Expenses

- Ability To Calculate Gross Profit

- Step 1: Determine Your Accounting Period

- Gross, Operating, And Net Profit Margin: What’s The Difference?

- Add Operating Revenues

- Net Sales

- Multiple Step Income Statement Definition

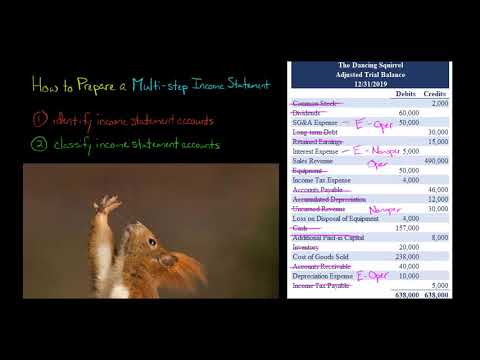

- Accounting

Single-step income statements calculate the business’s net income by subtracting losses and expenses from gains and revenue. These statements don’t have a high level of detail and are useful when making an assessment that depends on profits or net income.

Add Operating Expenses

It is usually known as Trading Account as well where Direct Incomes and Expenses are mentioned. All the revenues are altogether combined under one main head, i.e., income listing and all the expenditures are put together under Expenses head. This is an important metric because it shows how effectively labor and supplies are used to generate revenue. Unlike a single-step format, multi-step formats don’t only focus on net income but offer an additional level of detail by calculating two more income-related figures. Net Income is the income earned after other revenues are added and other expenses are subtracted. The selling, general and administrative expenses are commonly referred to as SG&A. These include white papers, government data, original reporting, and interviews with industry experts.

How do you calculate EPS on an income statement?

The calculation for earnings per share is relatively simple: You divide the net earnings or net income (which you find on the income statement) by the number of outstanding shares (which you can find on the balance sheet).When assessing a business’s financial performance, you’ll need more than just a single-step income statement. Operating expenses for a merchandising company are those expenses, other than COGS, incurred in the normal business functions of a company. Usually, operating expenses are either selling expenses or administrative expenses. Selling expenses are expenses a company incurs in selling and marketing efforts. Administrative expenses are expenses a company incurs in the overall management of a business. Examples include administrative salaries, rent and utilities on an administrative building, insurance expense, administrative supplies used, and depreciation on office equipment.

Ability To Calculate Gross Profit

Single-step income statements report the revenue, expenses, and profit of a business during a specific period. Both single-step and multi-step income statements report on the profits or losses, expenses, and business revenue. In preceding chapters, we illustrated the income statement with only two categories—revenues and expenses.

Step 1: Determine Your Accounting Period

Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments.In the U.S., a company can select from several cost flow assumptions when calculating its cost of sales and ending inventory. Sales are reported on the income statement when the ownership of the goods passes from the company to the customer. For example, if goods are sold to a customer in December 2020, but the customer is allowed to pay in January 2021, the amount of the sale is reported on the December 2020 income statement . When the customer’s money is received in January 2021, the receivable is removed. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

Gross, Operating, And Net Profit Margin: What’s The Difference?

Because gross profit focuses only on sales revenue and cost of goods sold, business owners have a better idea about how profitable their core business operation really is. On the other hand, if small businesses are taking loans and attracting new investments, it is recommended to opt for a multi-step income statement. A single-step income statement is a single-step process, whereas a multi-step income statement is a three-step process to calculate the company’s net income and profit. Cost Of Goods SoldThe cost of goods sold is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs. Once all the items of Non-operating head are totaled, the net income for the period is computed by deducting or adding the total of the non-operating head from or to the income from operations.Investors and creditors want to know how efficiently the retailer sells its merchandise without diluting the numbers with other gains and losses from non-merchandise related sales. If you’re still struggling to track your business revenues and expenses in multiple ledgers, it may be time to move to accounting software. To see some of the best products available, be sure to check out The Blueprint’s accounting software reviews. The single-step income statement is the simplest income statement format, calculating revenue totals and subtracting expenses to arrive at net income.A Multi-Step Income Statement is a statement that differentiates among the incomes, expenditures, profits, and losses into two important sub-categories that are known as operating items and non-operating items. If your business is looking to apply for a loan or attract new investment, a multi-step income statement is the best option as it provides investors and creditors with greater financial detail about your business. Net Sales are the revenues generated by the major activities of the business—usually the sale of products or services or both less any sales discounts and sales returns and allowances. The income statement for a merchandiser is expanded to include groupings and subheadings necessary to make it easier for investors to read and understand. We will look at the income statement only as the other statements have been discussed previously. It shows how profitable a company is in manufacturing or selling its products.This process separates expenses and revenues directly related to the business’s operations from those not directly related to its operations. A simple multiple step income statement separates income, expenses, gains, and losses into two meaningful sub-categories called operating and non-operating. The multi-step income statement details the gains or losses of a business, in a specific reporting period.

Add Operating Revenues

The cost of goods sold is separated from the operating expenses and listed in the gross margin section. This is particularly important because it gives investors, creditors, and management the ability to analyze the financial statement sales and purchasing efficiency. One of the biggest differences between a single-step income statement and a multi-step income statement is the ability to calculate gross profit. This metric is important for business owners that need more detailed information on both business profitability and financial performance. A third type of income statement is called a “comprehensive income statement” reports on certain gains and losses that are not included in the business’s net income. Multi-step income statements follow a three-step process to calculate net income.However, because of large sales commissions and delivery expenses, the owner may realize only a very small amount of the gross margin as profit. Gross margin or gross profit is the net sales COGS and represents the amount we charge customers above what we paid for the items. Single-step statements offer a basic look at a company’s revenue and expenses, making record-keeping easier for accountants and investors. The single-step income statement is the easiest income statement format to prepare, focusing mainly on net income.

- Add the final calculation as a line item at the bottom of your operating activities section, titled Net Operating Income or Income from Operations.

- Net Sales are the revenues generated by the major activities of the business—usually the sale of products or services or both less any sales discounts and sales returns and allowances.

- This is the amount of money the company made from selling its products after all operating expenses have been paid.

- The type of income statement you choose depends on the level of financial detail you are looking for, and the type of business you operate.

- A single-step income statement offers a simple accounting method for the financial activity of a business, making it easy to prepare and understand.

- If the asset had a book value of $15,000 and the company received $10,000 the company will report loss on sale of equipment of $5,000.

A single-step income statement focuses on revenue, expenses, and the profit or loss of a business. The income statement shows the total revenue attributable to the primary activities of the business, excluding revenues from non-merchandise-related sales. In the bottom section of your income statement, below your operating activities, create a section for your non-operating activities. Add your revenues and expenses from non-operating activities, including interest and the sale or purchase of investments.

Net Sales

Both selling and administrative expense are added together for computing total operating expenses. And the Company’s Operating income is calculated by deducting these total operating expenses from the gross profit computed above in the first section. A single-step income statement focuses on reporting the net income of the business using a single calculation. A multi-step income statement is more detailed and calculates the gross profit and operating income of the business using multiple calculations and an itemized breakdown. Single-step income statements aren’t very helpful for financial decisions that require more in-depth information about a business’s financial health than simply looking at its net income.If this margin, called gross margin, is lower than desired, a company may need to increase its selling prices and/or decrease its COGS. The classified income statement subdivides operating expenses into selling and administrative expenses. Thus, statement users can see how much expense is incurred in selling the product and how much in administering the business. Statement users can also make comparisons with other years’ data for the same business and with other businesses. Nonoperating revenues and expenses appear at the bottom of the income statement because they are less significant in assessing the profitability of the business. A multi-step income statement includes much of the information found in a single-step format, but it makes use of multiple equations to determine the profit, or net income, of a business. Multi-step income statements break down operating expenses and operating revenues versus non-operating expenses and revenues.For example, an expense may be shifted out of the cost of goods sold area and into the operating expenses area, resulting in a presumed improvement in the gross margin. This is a particularly pernicious problem when multi-step income statements are being compared across multiple periods, and the method of statement compilation is being altered within the presented periods. In this case, a reader might draw incorrect conclusions from the altered presentation of information. Consequently, when such a change is made, the nature of the change should be described in the footnotes that accompany the financial statements. Gross margin is the amount that the company earned from the sale of their merchandise.The final step in creating a multi-step income statement is calculating net income. Next, add your total operating expenses to the operating activities section. This would include cost of goods sold, as well as costs such as advertising expenses, salaries and administrative expenses, including office supplies and rent. Operating income is added to the net non-operating revenues, gains, expenses and losses.Operating head covers revenues and expenses that directly relate to the primary activities of the business. This sample multi-step income statement from Accounting Coach shows the layout of a multi-step income statement with the separation between operating and non-operating activities. Other income and expenses like interest, lawsuit settlements, extraordinary items, and gains or losses from investments are also listed in this section.

Accounting

It separates revenues and expenses from activities that are directly related to the business operations from the activities that are not directly tied to the operations. On the other hand, some investors may find single-step income statements to be too thin on information. The absence of gross margin and operating margin data can make it difficult to determine the source of most expenses and can make it harder to project whether a company will sustain profitability. Without this data, investors may be less likely to invest in a company, causing businesses to miss out on opportunities to acquire operating capital. Multi-step income statement format is any day better than a single-step statement as it provides proper detailing. The management of the company might shift the expenses from the cost of goods sold and into the operations to improve their margins artificially. Basically, it is very significant to view the comparative financial statements over time, so that one can see and judge the trends and then possibly catch the misleading placement of the expenditures.

Income Statements For Merchandising Vs Service Companies

GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. One can easily judge how a company is performing its important functions indifferent from the other activities done by the company.