Content

- Net Cash Flow

- What Is Net Cash?

- Difference Between Net Cash Flow And Net Income

- What Is Cash Flow?

- Budgeting For Capital Expenditures

- Components Of The Operating Cash Flow Formula

- How Can You Calculate Free Cash Flow In Excel?

- Why Is Net Cash Flow Important?

However, while analyzing net cash flows, we don’t just need to see whether it is positive or negative, but we must also see the time frame and the reason behind it. For example, an organization may have invested a huge sum in purchasing an equipment to manufacture a new product line. The cash flow might turn negative in the short-run because of this move. However, in the long-run this new product could result in increased cash generation for the organization which will make the cash flows positive. Similarly, Net cash flows can be negative if the organization has repaid a big portion of debt, but this may not impact its viability in the long-term.

Net Cash Flow

Finally, the interest rate is calculated from the revenue and compared with the owner’s value and the decision will be made based on the outcome. For a successful outcome, it must always be kept in mind that this phase requires a strong vision and a competent estimator and economic specialists. Operating expense , which refers to the direct expense during operations, such as the cost of the workover or other activities, has a direct impact on the production. The indirect expenses include management salaries, computers, desks, and other usable equipment during project implementation. It’s important to note that an exceedingly high FCF might be an indication that a company is not investing in its business properly, such as updating its plant and equipment. Conversely, negative FCF might not necessarily mean a company is in financial trouble, but rather, investing heavily in expanding its market share, which would likely lead to future growth.Profit excluding investment is referred to as operating cash flow and is shown in Eq. If the two assets have different owners , the argument above is unhelpful in setting out payments from the net cash flows in compensation for the use of their assets over the lifetime of the project. Since valuing the resource in a consistent manner is the aim of green accounting, correct green accounting must allocate the project value to the assets invested in the project.

What Is Net Cash?

Hence, the analysis has to be multidimensional when it comes to net cash flow. Stock-based compensation must be recorded as an expense on the income statement, but there is no actual outflow of cash. Since the company pays the CEO, CFO, and other employees with stock, the company issues shares instead of giving them cash.Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business. If you run out of cash flow, you run the risk of not being able to keep the lights on, both literally and figuratively speaking. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. Learn more about how you can improve payment processing at your business today. Dividends – This will be base dividend that the company intends to distribute to its share holders. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regard to your individual circumstances.

- Rate of return on investment and compare this with the previously assumed interest rate or other company standard.

- The net cash figure is commonly used when evaluating a company’s cash flows.

- In contrast, a concept that has progressed to first-in-human studies and represents an attractive business opportunity might command a high price.

- Capital generated through debt agreements or cash that’s been issued to pay off debts or pay out dividends.

- Rising cash flow is often seen as an indicator that future growth is likely.

- Rate-of-return criterion should be applied using compound interest methods.

However, it is pretty simple to determine how you’ll market on YouTube. You will want to use a few guidelines so the videos will be viewed and compelling to your target audience.

Difference Between Net Cash Flow And Net Income

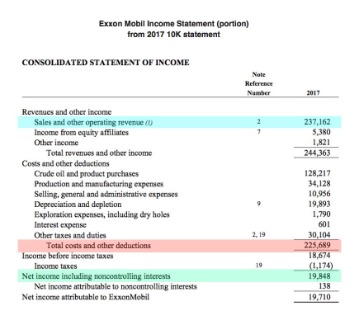

For example, while investing in new machinery or real estate may leave you in the red, you can expect to make your money back relatively quickly. Free cash flow can be calculated in various ways, depending on audience and available data. A common measure is to take the earnings before interest and taxes, add depreciation and amortization, and then subtract taxes, changes in working capital and capital expenditure.

Does FCF include Capex?

Free cash flow (FCF) is the cash a company generates after taking into consideration cash outflows that support its operations and maintain its capital assets. In other words, free cash flow is the cash left over after a company pays for its operating expenses and capital expenditures (CapEx).In contrast, a concept that has progressed to first-in-human studies and represents an attractive business opportunity might command a high price. The value of your idea increases the further you take it down the development path; however, moving along that path requires the innovator’s time and efforts as well as the investor’s money.

What Is Cash Flow?

Accordingly, let it be assumed that, at each time during the life of the project, such an allocation of the current net cash flow can be and is made to the manufactured capital and the resource. An allocation is a long-run provision, determined when the investments are made. Free cash flow-to-sales is a performance ratio that measures operating cash flows after the deduction of capital expenditures relative to sales. Unlevered free cash flow (i.e., cash flows before interest payments) is defined as EBITDA – CAPEX – changes in net working capital – taxes. If there are mandatory repayments of debt, then some analysts utilize levered free cash flow, which is the same formula above, but less interest and mandatory principal repayments. The unlevered cash flow is usually used as the industry norm, because it allows for easier comparison of different companies’ cash flows.In particular, even though the resource may have been provided by nature as a ‘free gift,’ it has an opportunity cost. One opportunity cost in the case of a nonrenewable resource is the choice of when it is developed and exploited. Deploying the resource in a way that allows for the realization of its economic value constitutes a decision concerning the use of the resource by its owner. It is comparable to the extinguishing of the materials, labor, and other factors in creating the capital value. Given a projection of the net cash flows, the remaining value of the project at any time after the investment is made, up to the closing date, is the firm’s discounted net cash flow from that time on. When it is desired to make a comparison between different options, then the revenue and oil price will be the same for all the alternatives.3.Exact economic recovery of the investments in each stock over the life of the project. The present value of the allocation to each asset is the initial value of the asset. In the United States, the federal government has set up programs to fund start-ups and/or small companies through the Small Business Innovation Research program. The advantage of this funding is that the government does not want to own part of the company or even to gain a monetary return on its investment.

Budgeting For Capital Expenditures

A negative cash flow does not mean a company is unable to pay all of its obligations; it just means that the amount of cash received for that period was insufficient to cover its obligations for that same time period. If you need to raise capital via business loan or investors, net cash flow is one of the relevant metrics. Lenders and potential investors will look at net cash flow to determine whether they can expect repayment of the loan or return on their investment. Put simply, if your business is consistently able to generate a positive net cash flow, it may have a real chance of succeeding.This is the net cash generated from sales and purchase of equipment and assets and any other capital expenditure for core operations. It also includes the movement of cash due to investments made outside the company like investing in other businesses, stock market, bonds etc. The project is a combination of the remaining reserve and the capital invested in wells and equipment. The depreciation formula for the project involves the total net cash flow. Again, unlike in a Hotelling analysis, marginal cost and the net price of the resource (the ‘Hotelling rent’) do not appear. The method can be generalized to production involving more complicated conditions.Rate-of-return criterion should be applied using compound interest methods. Despite the nonuniqueness, the net cash flow at any time is the sum of the returns to and the depreciation of the remaining balances of the payment schedules of the two assets. Therefore, depreciation of the resource at any time is the net cash flow minus two terms. One term is the provision for depreciation of the nonresource capital.Bryn Mawr Trust, and its affiliates, subsidiaries and vendors do not provide legal, tax or accounting advice. Please consult your legal, tax or accounting advisors to determine how this information may apply to your own situation. Using a simple cash flow calculator can not only show where you are spending your money, but it can help you understand how much cash is available for those vital day-to-day obligations. An overview on the benefits and drawbacks of using an LLC with your income properties, along with the cost, ownership structure, asset protection, and financing implications.The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in. This represents the amount of cash generated after reinvestment was made back into the business. An increase in current assets causes a reduction in cash, while an increase in current liabilities cases an increase in cash. The resulting $8,807.37 represents the indirect cost to the Contractor for the Project suspension in year 1. Note that this figure cannot be calculated if the delay is analyzed using a pure accounting approach that does not consider the time value of money.As a function of the revenue, which is the outcome from the wells every year based on the oil price in that year. It can take a long time for an offshore reservoir to decline and finally reach the threshold of being an uneconomic well. This limit is determined as occurring when the operating expense begins to be higher than the income of the well. It might seem odd to add back depreciation/amortization since it accounts for capital spending. The reasoning behind the adjustment is that free cash flow is meant to measure money being spent right now, not transactions that happened in the past.

Components Of The Operating Cash Flow Formula

However, a surprising number of buyers rely on the seller’s pro forma statement when deciding whether or not to invest. This appears at first to be the most direct method of deriving net cash flow, but the accounting transaction recording system does not aggregate or report information in this manner. This is cash received through a debt agreement, or cash issued to pay off a debt, repurchase company shares, or pay out a dividend. We can calculate the net cash flow from the statement of cash flows with the help of following equation.

How Can You Calculate Free Cash Flow In Excel?

Payroll Pay employees and independent contractors, and handle taxes easily. This means that Company A’s net cash flow over the given period is $80,000, indicating that the business is relatively strong, and should have enough capital to invest in new products or reduce debts. Capital generated and used by your business’s basic operations, including expenditures for administrative expenses and receipts from customers. Learning how to find net cash flow can be a great way to gain insight into the financial health of your business. Free cash flow may be different from net income, as free cash flow takes into account the purchase of capital goods and changes in working capital. Some of the views and opinions expressed in this article are solely those of the original contributors. These publications are for informational purposes only and should not be construed as a recommendation for any specific product or service.Therefore, the formulas for present value and depreciation define a unique depreciation schedule from initiation to termination. As in traditional accounting, the sum of the undiscounted depreciation over the life of the project is equal to the original value of the project. The initial value of the resource can be obtained only as a residual, namely, the total discounted net cash flow less the initial value of the invested capital.CFO includes net profits adjusted with non-cash expenses and incomes, and changes in working capital. Non-cash expenses are added back to profits and non-cash revenues are deducted.Net cash flow is normally calculated for uniform time intervals – quarterly or half-yearly. The net cash flow table is a productive technique that represents the improvement of benefits and income over the advancement stage and specialized lifetime of an undertaking. Return on Capital Employed is a financial ratio that measures a company’s profitability and the efficiency with which its capital is employed. Return on gross invested capital is a measure of how much money a company earns based on its gross invested capital.When a company has negative sales growth, it’s likely to lower its capital spending. Receivables, provided they are being timely collected, will also ratchet down. All this “deceleration” will show up as additions to free cash flow. However, over the long term, decelerating sales trends will eventually catch up. That’s a big mistake, because the seller wants to get the highest possible price for their property and may exaggerate the net cash flow by overstating income or understating expenses. Instead, a buyer should create their own cash flow analysis by accurately determining the property’s rental income and monthly expenses. It is the difference between cash balance from balance sheet over two consecutive periods.