Content

- Operating Earnings

- Operating Expenses

- Operating Income Ebit

- Operating Income Vs Revenue, Gross Profit, And Net Income

- Accounting Topics

- Why Is Ebit Important?

- Understanding Earnings Before Interest And Taxes

- Operating Income Vs Operating Profit

- Operating Income Formulas

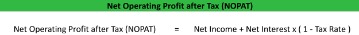

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Operating income is calculated before, or located slightly above, net income. This person might well take your customer base figures more to heart than your bottom line. As long as you’re on track to profitability and meet your targets, you can still attract the capital you need to get off the ground.The simple definition is that operating income shows your business’s ability to generate earnings from its operational activities. It measures the amount of money a company makes from its core business activities, not including other income that does not relate directly to everyday activities of the business. Some businesses include non-operating expenses and other income that the company generates in EBIT. However, while calculating operating income, only the income from operations is taken into account. Always begin with total revenue or total sales and subtract operating expenses, including the cost of goods sold. You may take out one-time or extraordinary items, such as the revenue from the sale of an asset or the cost of a lawsuit, as these do not relate to the business’s core operations.EBIT removes the interest expense and thus inflates a company’s earnings potential, particularly if the company has substantial debt. Not including debt in the analysis can be problematic if the company increases its debt due to a lack of cash flow or poor sales performance. The operating margin measures the profit a company makes on a dollar of sales after accounting for the direct costs involved in earning those revenues. Operating income is total revenue minus direct costs minus indirect costs. This formula is used when direct cost and indirect cost is available for the company. In corporate finance, the debt-service coverage ratio is a measurement of the cash flow available to pay current debt obligations.Operating income and operating profit are sometimes used as a synonym for EBIT when a firm does not have non-operating income and non-operating expenses. One of the overall advantages of using operating income over other financial ratios is in the simplicity and standardization of calculation. Though interest and taxes play an important role in the financial health of a company they do not, generally, make or break the model for success.

Operating Earnings

For instance, assume you paid $250,000 in cost of goods sold, $12,000 in rent, $50,000 in wages, $3,000 in utilities, $2,500 in interest and $25,000 in income taxes. Your total operating expenses are $315,000, which excludes the interest and income taxes. Operating income is the amount of profit left after considering all operating expenses and subtracting those expenses from the company’s revenue. This type of income is listed on the income statement, which includes a summary of a business’s revenue and expenses for a specified period.Operating income excludes items such as investments in other firms (non-operating income), taxes, and interest expenses. In addition, nonrecurring items, such as cash paid for a lawsuit settlement, are not included. Operating income is required to calculate theoperating margin, which describes a company’s operating efficiency. On an income statement, which shows a company’s revenue and expenses for a specific period of time, the operating income is entered after the total revenue and total operating expenses amounts. The operating income amount is calculated by subtracting total operating expenses from total revenue. Operating income, often referred to as EBIT or earnings before interest and taxes, is a profitability formula that calculates a company’s profits derived from operations. In other words, it measures the amount of money a company makes from its core business activities not including other income expenses not directly related to the core activities of the business.Operating income is an accounting figure that measures the amount of profit realized from a business’s operations, after deducting operating expenses such as wages, depreciation, and cost of goods sold . Operating income tells about the financial condition of a company higher the operating income more profitable company will be and will able to pay the debt of the company on time.

- However, it does not take into consideration taxes, interest or financing charges, or depreciation and amortization.

- Both EBIT and EBITDA strip out the cost of debt financing and taxes, while EBITDA takes it another step by putting depreciation and amortization expenses back into the profit of a company.

- SheetsA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time.

- Operating income takes a company’s gross income, which is equivalent to total revenue minus cost of goods sold , and subtracts all operating expenses.

- Income from operations is a company’s earnings before factoring of interest, taxes and the sales or purchases or any assets.

- Now, you know your operating income which is an important factor of valuing a company.

It does not include other income expenses not directly related to the core business operations. Operating expenses are those directly related to acquiring and selling your products and services.

Operating Expenses

Aside from getting an idea of profitability from operations, EBIT is used in several financial ratios used in fundamental analysis. For instance, the interest coverage ratio divides EBIT by interest expense and the EBIT/EV multiple compares a firm’s earnings to its enterprise value. EBIT is a company’s operating profit without interest expense and taxes. However, EBITDA or takes EBIT and strips outdepreciation, andamortizationexpenses when calculating profitability.

Operating Income Ebit

The one big difference between operating income and EBIT is that EBIT includes any non-operating income the company generates. This is an important concept because it gives investors and creditors an idea of how well the core business activities are doing. It separates the operating and non-operating revenues and expenses to give external users a clear picture of how the company makes money. Operating Income is gross income less depreciation less operating expense less amortization.

Operating Income Vs Revenue, Gross Profit, And Net Income

A company is having total revenue of $15,000, and a direct cost to the company is $2,000 and indirect cost to the company is $3000. Numbers 1-6 of her expenses are operating expenses because they have to do with the everyday function of her business. Note that she didn’t include the $7,000 in damages from line seven because it was an extraordinary loss.

Accounting Topics

Anyone struggling with determining this value may want to consider reaching out to one of the best online accounting firms. Full BioAmy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals.Earnings Before Interest and Tax is the business’s net income from the operations without taking into account the tax and capital structure of the business. It is often considered synonymous with operating income, although there are exceptions. The income statement ends with net income, also termed profits or the “bottom-line.” It is the amount of money left after subtractingallexpenses. Gross profit can also be calculated by taking the revenue and subtracting the cost of goods sold , also called the cost of revenue or cost of sales. Often, companies include interest income in EBIT, but some may exclude it depending on its source.

Why Is Ebit Important?

In fact, many investors consider operating income to be a more reliable measure of profits than net income (bottom-line profits). Operating income is also called income from operations or operating profit.

Understanding Earnings Before Interest And Taxes

The allowances are sub-divided broadly into two categories- direct labor involved in the manufacturing process and indirect labor pertaining to all other processes. Types Of Financial StatementsThere are three types of financial statements, i.e., Balance Sheet, Income Statement and Cash Flow Statements. These written records facilitate the analysis and comparison of an organization’s financial position and performance. It refers to the direct costs attributable to the production of the goods sold in a company including direct labor costs used to produce the product, allocated overhead and the cost of materials used. You can find the income statements of all publicly traded companies for free online, both on the SEC website and the companies’ investor relations pages. Famously, Warren Buffett recognizes the importance of operating income very well.EBIT is a company’s net income before income tax expense and interest expenses are deducted. Investors, vendors, and other stakeholders need this information to get a clear picture of your operational health. Net Sales refers to sales of products and services – not income from the sale of investments and assets. Also, be sure to subtract discounts and allowances from this figure.Like EBIT, EBITDA also excludes taxes and interest expenses on debt. EBIT is also helpful to investors who are comparing multiple companies with different tax situations. For example, let’s say an investor is thinking of buying stock in a company, EBIT can help to identify the operating profit of the company without taxes being factored into the analysis. If the company recently received a tax break or there was a cut in corporate taxes in the United States, the company’s net income or profit would increase.To get a business loan, you’ll need to provide operating profit numbers. Your lender will compare your Operating Profit Margin to the size of your business to determine your stability. Depreciation and amortization are often included in this list and always used in the operating income equation. Keep in mind that just because a business shows a profit on the bottom line for the year doesn’t mean the business is healthy. As a result, they are liquidating their equipment and realizing huge gains. The core activities are losing money, but equipment sales are making money. Now, you know your operating income which is an important factor of valuing a company.Business leaders use the phrase net income when referring to a company’s total profits – after they’ve taken all expenses into account. These expenses may include the production costs of products/services, taxes, fees, operational costs, etc. Operating income and revenue differ as they represent different aspects of a business’s finances. Revenue is the amount made from sales and services, usually in the form of payments from clients or customers. Operating income is the amount from the revenue after the operating expenses are considered. Operating expenses include the costs of running the core business activities. Some examples of operating costs are utilities, rent, wages, commissions, insurance, supplies expenses etc.Investor monitor operating income as it gives the idea of the future scalability of the company. But some company’s management misuse this and do fraud by changing the value of revenue and delaying expenses which is against GAAP principle of accounting. For company’s with a significant amount of fixed assets, depreciation expense can impact net income or the bottom line.Using the numbers from the previous example, your net operating income is $85,000, or $400,000 minus $315,000. This means your small business earned $85,000 in profit before paying interest, taxes and other nonoperating items.