Content

- The Drawbacks Of Looking At Operating Margin

- Is A Lower Or Higher Operating Margin Better?

- Limitations Of Operating Profit Margin Ratio

- Operating Profit Margin

- Four Basic Types Of Financial Ratios Used To Measure A Company’s Performance

This gives investors and creditors a clear indication as to whether a company’s core business is profitable or not, before considering non-operating items. Operating income is the amount of revenue left after deducting the operational direct and indirect costs from sales revenue. Therefore, its operating income would equal $20 million gross income minus $15.4 million in total expenses, which leaves a result of $4.6 million in operating income. So when one takes the operating income and dividing the same by the Revenue figure, they will arrive at a figure which will depict how many portions of revenue is the operating profit. If you’re looking for accounting software that can help you produce accurate financial statements, be sure to check out The Blueprint’s accounting software reviews.

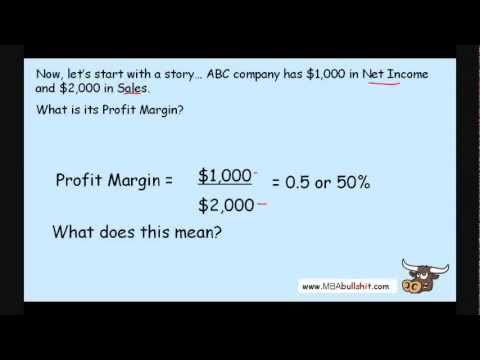

What is a 50% profit margin?

If you spend $1 to get $2, that’s a 50 percent Profit Margin. If you’re able to create a Product for $100 and sell it for $150, that’s a Profit of $50 and a Profit Margin of 33 percent.Get clear, concise answers to common business and software questions. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. A leveraged buyout is a transaction where a business is acquired using debt as the main source of consideration. Operating Profit Margin differs across industries and is often used as a metric for benchmarking one company against similar companies within the same industry.

The Drawbacks Of Looking At Operating Margin

A company may have a solid operating margin but still face cash flow problems, for example if it has difficulty collecting cash from a major customer. In fact, many apparently profitable companies have gone out of business due to insufficient cash flow and working capital. The operating margin formula is calculated by dividing the operating income by the net sales during a period. Conversely, a company that only converts 3 percent of its revenue to operating income can be questionable to investors and creditors. GM was making more money on financing cars than actually building and selling the cars themselves. Knowing your operating margin is helpful, but it doesn’t include every expense a company bears.

Is A Lower Or Higher Operating Margin Better?

Operating margin is one of three widely used profit ratio metrics. Each of these metrics provides a different perspective on a company’s business. Comparing operating margins for the same company from two different time periods will give you a sense of any progress or erosion in improving profitability. Discrepancies in operating profit margin between peers can be attributed to a variety of factors.Gross profit is sales revenue minus COGS, so the gross margin tells you how profitable the company is after deducting only the direct costs of production. In contrast, operating margin takes into account operating expenses as well as COGS. Operating income, also called income from operations, is usually stated separately on theincome statementbefore income from non-operating activities like interest and dividend income. Many times operating income is classified as earnings before interest and taxes.

Limitations Of Operating Profit Margin Ratio

For instance, interest income and expenses aren’t included in operating income, though they are included in operating cash flow. In simpler terms, operating margin measures the profitability of a company by determining how much of each dollar of revenue received is left over after certain expenses are paid. First and foremost, operating margin shows how well a company derives profits from its core business after covering fixed and variable expenses. Those profits can be used to fund business growth or returned to the company’s owners. You can create a trend line graph to track operating margin over time.In addition, a higher operating margin indicates that a business can better survive market challenges or an economic crisis. Also, if a company has fixed assets that must be amortized or depreciated, the appropriate allowances are taken out at this point. According to Investopedia, in 2017, the average operating margin as determined by the S&P (Standard & Poor’s 500 Index) was 11%. This means David’s Drinks is doing above average, outperforming the overall market. In the above example, you can clearly see how to arrive at the 2018 operating margin for this company. 2018 starts with Revenue of $5 million, less COGS of $3.25 million, resulting in Gross Profit of $1.75 million.

- For example, if net sales equals $2 million and you subtract $1.7 million in operating expenses, you have operating income of $300,000.

- The basis for the operating margin is a company’s operating income, which is stated on its income statement.

- Operating income, also called income from operations, is usually stated separately on theincome statementbefore income from non-operating activities like interest and dividend income.

- Operating margin is helpful for analyzing the quality of a company’s earnings, because it strips away ancillary activities and focuses on the profitability of core operations.

- Income from investments or one-time sums such as the proceeds from a lawsuit are excluded.

The operating profit margin ratio is a key indicator for investors and creditors to see how businesses are supporting their operations. If companies can make enough money from their operations to support the business, the company is usually considered more stable.The total revenue from business operations after excluding discounts, returns and allowances for damaged items is net sales. The operating margin is the operating income expressed as a percentage of net sales. Operating margin is helpful for analyzing the quality of a company’s earnings, because it strips away ancillary activities and focuses on the profitability of core operations. Lenders and investors therefore analyze operating margin, together with other metrics, to determine the risk involved in lending to or investing in a business. For example, a lender may consider operating margin as an indicator of whether a business will be able to make regular payments on loans. Investors utilize operating margin as part of the financial modeling to evaluate potential returns on their investment. Gross margin, also known as gross margin ratio, is the ratio of gross profit to sales revenue.On the other hand, if a company requires both operating and non-operating income to cover the operation expenses, it shows that the business’ operating activities are not sustainable. The basis for the operating margin is a company’s operating income, which is stated on its income statement. Operating income is the portion of sales that remains after the firm’s operating expenses are deducted from net sales.Operating income can be calculated by subtracting operating expenses, depreciation, and amortization from gross income orrevenues. While operating margin is a key profitability measure, it has a few notable limitations. By definition, operating margin excludes certain costs that can have significant impact on a company’s financial position even though they are outside of core operations.

Operating Profit Margin

Operating margin tells you how efficiently a company generates profit from its core operations. That’s because it includes only COGS and operating expenses; it excludes non-operating costs such as interest payments and taxes.Therefore, a company’s operating profit margin is usually seen as a superior indicator of the strength of a company’s management team, as compared to gross or net profit margin. The operating profit margin ratio is one of the many tools that can be used to assess a company’s financial health. It is a valuable data point, but it should not be the only number used to determine whether a company is profitable and competitive over time. Net income is the company’s profit after deducting all operating and non-operating expenses, including interest and taxes. One of the ways the management of a company can learn whether its business is successful or not is by looking at the operating margin ratio on its financial statements. That’s because the ratio is a direct reflection of how well expenses are being managed. The higher the number, the higher the return the company is seeing on its sales.The difference is that the former is based solely on its operations by excluding the financing cost of interest payments and taxes. Its cost of goods sold and operating expenses equal $15.4 million. As its name implies, the operating margin looks at earnings after all operation expenses.

Four Basic Types Of Financial Ratios Used To Measure A Company’s Performance

Operating margin is a profitability ratio measuring revenue after covering operating and non-operating expenses of a business. Also referred to as return on sales, the operating income indicates how much of the generated sales is left when all operating expenses are paid off. The operating profit margin calculation is the percentage of operating profit derived from total revenue. For example, a 15% operating profit margin is equal to $0.15 operating profit for every $1 of revenue.In conjunction, these various items that are included or excluded can cause cash flow to be very different than operating profit. For most businesses, an operating margin higher than 15% is considered good. It also helps to look at trends in operating margin to see if past years indicate that operating margin is going up or down. Subtract all of those items to find your operating income, from which you can then determine your operating margin. New business owners may be struggling to absorb the many concepts of accounting 101, but you or your bookkeeper can easily calculate your operating margin.

How do you calculate 60 margin?

To figure the gross margin percentage, divide the dollar result by total revenue. For example, if a company has $100,000 in revenue and its COGS is $40,000, its gross profit margin is ($100,000 – $40,000) = $60,000. Dividing this result by the $100,000 revenues equals 0.6 or 60 percent.The operating profit margin calculationsare easily performed, including the following example. Comparing operating margins across various companies in the same industry can be helpful in figuring out which company takes better advantage of opportunities. Companies can use this metric to assess their own operations, compare profitability with other companies, and help to set pricing. Operating Margin is considered to provide a more important number for financial considerations. Like Gross Profit Margins, it takes into account cost of goods sold, but also factors in deductions from product discounts and returns, and removes operational expenses too from the final total. Creditors and stockholders are very interested in a company’s operating margin because it can reflect future profitability. You can advance your expertise in financial analysis of companies’ money management and profitability by learning about the other aspects of corporate finance that are detailed in the articles listed below.Operating income is an intermediary step on a company’s income statement. Operating income is the profit from net sales after deducting COGS and operating expenses. Operating margin is the “common size” metric derived from operating income.

Overview: Operating Income And Operating Margin

It is also useful to compare these margins to the same calculations for competitors. Such investigations are a key management technique for maintaining reasonable margins in a business. In conclusion, this company makes $0.275 before interestand taxesfor every dollar of sales. Operating margin focuses on an intermediate step in the financial statement, and you can use it to zero in on the core elements of a business to see how profitable it is. Operating margin is used to determine the profitability of a business by measuring how much a company earns from sales-related activity.

What Is Operating Profit Margin?

Net Profit Margin (also known as “Profit Margin” or “Net Profit Margin Ratio”) is a financial ratio used to calculate the percentage of profit a company produces from its total revenue. It measures the amount of net profit a company obtains per dollar of revenue gained.Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Or net sales is the monetary amount obtained from selling goods and services to business customers, excluding any merchandise returned and allowances/discounts offered to customers. By doing so, one can readily spot spikes and drops in the margins earned by a business, and investigate the reasons why these changes occurred.

How To Calculate Operating Profit Margin?

Using incorrect accounting data or financial statements that were prepared using inconsistent accounting standards can create false results. The revenue number used in the calculation is just the total, top-line revenue or net sales for the year. Let’s take an example of ABC company, and below are the extracts from its income statement. Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser.