Content

- What Are Revenue And Gross Profit?

- Questions About Your Credit? Experian Is Here To Help

- Net Sales Or Revenue Vs Net Income

- Operating Margin

- How To Calculate Gross Profit: An Example

- Preparing Sales Revenue Sections Of Income Statements

- How To Report Product Sales Revenue & Service Revenue On An Income Statement

- Do You Understand All Your Profits?

Interest expense, interest income, and other non-operational revenue sources are not considered in computing for operating income. Net income is the result of all costs, including interest expense for outstanding debt, taxes, and any one-off items, such as the sale of an asset or division. Net income is important because it shows a company’s profit for the period when taking into account all aspects of the business. Investors may often hear or read net income described as earnings, which are synonymous with each other.Operating income is just a subset used in calculating the net income. Business leaders use the phrase net income when referring to a company’s total profits – after they’ve taken all expenses into account. These expenses may include the production costs of products/services, taxes, fees, operational costs, etc. Net income is the total amount of money your business earned in a period of time, minus all of its business expenses, taxes, and interest.Similarly, current liabilities include balances that must be paid within a year, including accounts payable and the current portion of long-term debt. If a business converted all current assets into cash, and used the cash to pay all current liabilities, any cash remaining equals working capital. Investors and lenders sometimes prefer to look at operating net income rather than net income. This gives them a better idea of how profitable the company’s core business activities are. Your operating profit tells you the amount that your company is making from its business operations. Operating profit does not take into consideration interest and taxes. When you are analyzing your company’s gross profit vs net profit, the critical issue that you have to remember is that gross profit takes only the cost of goods sold into account.

What Are Revenue And Gross Profit?

Such securities include stock options issued to employees and convertible bonds. Expert entrepreneurs keep close track of their companies’ sales. They know their revenue figures on a daily, weekly, and monthly basis. Most business owners would know the exact amount they have in their bank account on any given day. Direct costs are expenses incurred and attributed to creating or purchasing a product or in offering services. Often regarded as the cost of goods sold or cost of sales, the expenses are specifically related to the cost of producing goods or services. The costs can be fixed or variable but are dependent on the quantity being produced and sold.Net income, also called net profit, reflects the amount of revenue that remains after accounting for all expenses and income in a period. Net income is the last line and sits at the bottom of the income statement. As a result, it’s often referred to as a company’s “bottom line” number. Financially healthy firms have a positive working capital balance, meaning that current assets are greater than current liabilities. Free cash flow assumes that working capital must be set aside for business operations, which is why the balance is subtracted from the cash flow total.The difference between net revenue and operating income shows how much expenses take out of your revenue stream. If net sales are high but operating income is low, it may be time to trim the budget. Your company’s income statement is the place you report both net revenue and operating income. It represents the income that the business generated during the reporting period covered by the statement. In 2021, Seaside had a $300,000, 6% loan outstanding, and paid interest expense on the loan. NOPAT removes non-operating income and expenses from earnings before tax.That way anyone reading the income statement can see how much income your business activities earn and whether your business is profitable. That information is important not only to you but also to lenders and investors. Lumping money from investments in with operating income would muddy the image. A company adopts strategies to reduce costs or raise income to improve its bottom line. The operating profit margin shows how effective a company is at managing its costs, which providing an evaluation of the strength of a company’s management.

Questions About Your Credit? Experian Is Here To Help

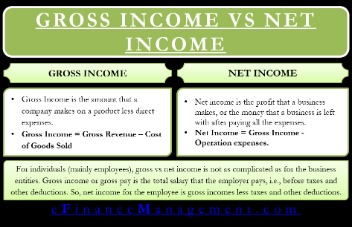

This person might well take your customer base figures more to heart than your bottom line. As long as you’re on track to profitability and meet your targets, you can still attract the capital you need to get off the ground. Investors, vendors, and other stakeholders need this information to get a clear picture of your operational health. For example, if you sell very few cat toothpaste tubes at boutique prices, you can survive on a lower volume of sales. Only large, big-box retailers can remain profitable on slim margins. Put another way, revenue equals gross income, but not net income. Business owners should know that an increase in net profit doesn’t necessarily mean that your cash balance will go up.

- As you see in the income statement, operating profit is calculated before the gain on sale and interest expense.

- The difference between net revenue and operating income shows how much expenses take out of your revenue stream.

- A company adopts strategies to reduce costs or raise income to improve its bottom line.

- We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep.

- Be sure to factor depreciation and amortization into your operating expenses.

- Every firm uses assets to generate revenue, and assets must be properly maintained and eventually replaced.

The margin is best evaluated over time and compared to those of competing firms. A higher operating profit margin means that the company is managing its costs well and earning more in revenue per dollar of sales. It is different from gross income, which only deducts the cost of goods sold from revenue.

Net Sales Or Revenue Vs Net Income

Operating income measures the profit that a company is able to generate through its main operations. Operating income is also sometimes called “earnings before interest and taxes” because those expenses are not considered “operating” expenses. Operating profit takes the profitability metric a step farther to include all operating expenses, including those included in the gross profit calculation. As a result, operating profit is all of the profit generated except for interest on debt, taxes, and any one-off items, such as a sale of an asset. This is why operating income is also referred to as earnings before interest and taxes . Operating profit represents the earnings power of a company with regard to revenues generated from ongoing operations. It can also be computed using gross income less depreciation, amortization, and operating expenses not directly attributable to the production of goods.

Operating Margin

The net profit, on the other hand, is the profit after all expenses have been considered. This is the essential difference between gross profit vs net profit. As a business owner, familiarizing yourself with some accounting rules and concepts can be vital for the wellbeing of your business. One of these concepts is the question about gross profit vs net profit vs operating profit. It’s crucial that you know the difference between these relevant figures. A company’s operating profit margin is operating profit as a percentage of revenue.

How To Calculate Gross Profit: An Example

Net income is the profit remaining after all costs incurred in the period have been subtracted from revenue generated from sales. NOPAT does not account for working capital or capital spending, and the formula calculates profitability before considering depreciation expense and tax expenses. Seaside posted $20,000 in depreciation, and the balance is included in total expenses. If Seaside pays $20,000 for a machine that is depreciated at a rate of $2,000 a year, the company does not write a check for the expense. Non-operating activities are not generated from normal business operations. Seaside manufactures furniture, and selling a piece of equipment is not Seaside’s main business. Conversely, the diluted EPS calculation uses diluted shares outstanding, which takes into account securities that could be converted into common stock at some future point.A higher gross profit provides your company with more money to meet its other expenses. To calculate EBIT, expenses (e.g. the cost of goods sold, selling and administrative expenses) are subtracted from revenues. Net income is later obtained by subtracting interest and taxes from the result.You can compare the profitability of Seaside and Premier by using operating profit. This article uses an income statement to explain NOPAT, and to point out how the calculation differs from net income, EBIT, and other balances.Depreciation is the accounting process that spreads out the cost of an asset, such as equipment, over the useful life of the asset. Two important terms found on any company’s income statement are operating profit and net income. Both profit metrics show the level of profitability for a company, but they differ in important ways.If Wyatt wants to calculate his operating net income for the first quarter of 2021, he could simply add back the interest expense to his net income. You could lower the interest cost that you pay on borrowed funds. Camino Financial offers small business loans at reasonable rates of interest. You may discover that taking a loan from us could lower the amount you pay towards interest. However, after deducting all the costs that it has incurred, this falls to a net profit of $11,000. Learn more about how you can improve payment processing at your business today.You can choose to upgrade at the end of the trial or continue using Track for free. To communicate clearly with other businesspeople, always specify the kind of profit to which you’re referring. This phrase has entered common speech because net profit is the best way to examine profitability . Executives and entrepreneurs use net income as the basis for a vast array of calculations, estimates, and projections. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

Do You Understand All Your Profits?

Here operating income has been calculated by deducting the cost and expenses from the total sales. However, to calculate net income, total expenses are deducted from total income, and then tax is levied. Also, as illustrated, net income is the bottom line, and the final number on the income statement as one follows the top-down approach.A higher earnings per share means a company is growing profits based on the number of stock shares that they’ve issued. EPS also shows how well a company’s management team is at investing in the long-term financial viability of the company.For example, investors, managers, creditors, etc. use net income figures to determine how efficiently companies make money. By understanding the ins-and-outs of this foundational concept, you can avoid costly miscalculations and misunderstandings – and create effective long-term strategies. Now that we’ve talked about some of the major line items found on the income statement, let’s discuss some of the important figures that are already calculated for us on it. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts.For example, a company might be losing money on its core operations. But if the company sells a valuable piece of machinery, the gain from that sale will be included in the company’s net income. That gain might make it appear that the company is doing well, when in fact, they’re struggling to stay afloat. Operating net income takes the gain out of consideration, so users of the financial statements get a clearer picture of the company’s profitability and valuation. Net operating income is a term often used within the real estate industry, but it can also apply to any business or company that earns income from its property. To calculate net operating income, you must calculate all revenue received from the property, subtracting related operational expenses like utilities, repairs, and maintenance. Outside of the real estate sector, net operating income is often called earnings before interest and taxes, or EBIT.