Content

- The Qbi Deduction If You Invest In Reits And Ptps

- Section 199a Deduction Phaseout Levels

- If You Have A Specified Service Trade Or Business

- How Is The Qualified Business Income Deduction Calculated?

- Tax Deductions And Benefits For The Self

- Get Your Clients Ready For Tax Season

- What Is The Qbi Deduction?

Select to receive all alerts or just ones for the topic that interest you most. However, the AICPA shares concerns regarding some other provisions of the bill, such as one that would specifically deny the deduction to an estate or trust. While the bill’s general intent is to limit the QBI deduction to individuals, the AICPA argues that excluding trusts and estates would be inequitable and an administrative burden for executors and trustees.

What income is excluded from QBI?

Items such as capital gains and losses, certain dividends, and interest income are excluded. W-2 income, amounts received as reasonable compensation from an S corporation, amounts received as guaranteed payments from a partnership, and payments received by a partner for services under section 707(a) are also not QBI.Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. Accounting AccountEdge Pro AccountEdge Pro has all the accounting features a growing business needs, combining the reliability of a desktop application with the flexibility of a mobile app for those needing on-the-go access.

The Qbi Deduction If You Invest In Reits And Ptps

The total taxable income of the owner from all sources is counted in determining eligibility for this deduction. The AICPA supports the Small Business Tax Fairness Act’s proposed removal of the current difference in treatment of specified service trades or businesses , which would allow all types of trades or businesses to qualify for the deduction. Many small business owners and self-employed people are eligible for the deduction. However, the rules for claiming the QBI deduction are complicated as the deduction is relatively new, and many restrictions apply.

Section 199a Deduction Phaseout Levels

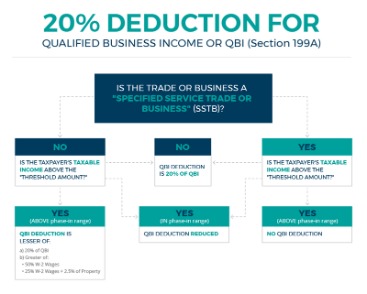

What happens if you’re the owner of a non-SSTB pass-through entity? Let’s say you’re single and your taxable income is about $207,500. You are allowed to take the deduction if you have qualified business income. However, your QBI deduction may be limited by the amount of W-2 wages your business has paid its employees, and by the unadjusted basis immediately after acquisition of the qualified property your business holds. The deduction is limited to the higher of 50% of total W-2 wages paid or 25% of total wages paid plus 2.5% of the UBIA of all qualified property. Their QBI deduction is limited or eliminated by taxable income over a threshold amount, which the bill also would increase to $400,000. The deduction allows them to deduct up to 20 percent of their qualified business income , plus 20 percent of qualified real estate investment trust dividends and qualified publicly traded partnership income.

Who Cannot take the Qbi deduction?

In addition to SSTB income, income from these three sources does not qualify for the QBI deduction: C corporations. Any trade or business whose principal asset is the reputation or skill of one or more of its employees or owners. Services you performed as an employee of another person or business.If Congress is concerned that individuals would create multiple trusts to increase their benefit with respect to the proposed $400,000 threshold amount, trust rules already in place prevent that strategy, the letter points out. The QBI deduction provides substantial tax savings to eligible pass-through entities. Qualified property includes all tangible, depreciable property that hasn’t reached the end of its depreciable life. For real estate, the depreciable life may be up to 39 years.

If You Have A Specified Service Trade Or Business

A unitholder is an investor who owns one or more units in an investment trust or MLP. Become a member of Real Estate Winners and learn how you can start earning institutional-quality returns with less than $1,000.Converting from a pass-through entity to a C corporation for the lower 21% tax bracket usually is not a good idea due to the double taxation of dividends when taking distributions. If you have a C corporation and have $1 million in C corporation income, you will owe $210,000 at the 21% tax bracket on the corporate tax return, form 1120. Then, when the corporation pays a dividend, you will pay tax again on that distribution on your personal return . You can’t take the deduction as a C corporation or while performing services as an employee.If your 2021 income is more than $329,800 or $164,900 and it’s earned from a qualified trade or business, your deduction is also subject to the W-2 wages limitation or the W-2 wages and qualified property limitation. Qualified businesses are those that intend to make a profit, even if they don’t make a profit.

How Is The Qualified Business Income Deduction Calculated?

This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction. Amounts received as reasonable compensation from an S corporation.

Tax Deductions And Benefits For The Self

Unlike a C corporation, which pays corporate federal income taxes, a pass-through entity’s business income “passes through” to the owner’s individual income tax return. In other words, “the business” doesn’t file taxes, the owners do. This article provides some general guidance to tax professionals when determining the impact of entity choice on the QBI deduction.

- Some non-qualified types of income, including capital gains, dividends, and non-business interest income, must be subtracted from net income.

- Comparisons Trying to decide between two popular software options?

- It was introduced as part of the 2017 Tax Cuts and Jobs Act.

- The qualified business income deduction deduction is for business owners.

- If you invest in REITs and PTPs, you can maximize your QBI deduction.

- In general, total taxable income in 2020 must be under $163,300 for single filers or $326,600 for joint filers to qualify.

If you want to take the QBI deduction for your real estate business, check with a licensed tax professional. Form 8995-A is for more complicated situations, including SSTBs and owners of multiple businesses. Another of the bill’s changes would also eliminate the ability of an electing small business trust to claim the deduction. The AICPA asks that Congress retain the QBI deduction for all trusts, including for an ESBT. If you invest in REITs and PTPs, you can maximize your QBI deduction. That’s because income from qualified REITs and PTPs aren’t subject to the SSTB limitation. Range and the reduction in the S corporation’s QBI for shareholder/employee compensation.

Get Your Clients Ready For Tax Season

W-2 wages may be used to calculate the Sec 199A limitations. Enter the W-2 wages paid to non-owners of the business activity. Range, the wages/qualified property limitation is fully phased in and there is no “excess” calculation. Of the wages/qualified property limitation, and 40% is allowed (“the applicable percentage”). The deduction is limited to the lesser of the QBI component plus the REIT/PTP component or 20 percent of the taxable income minus net capital gain. The deduction is available regardless of whether an individual itemizes their deductions on Schedule A or takes the standard deduction. The IRS developed 17 new business rules last year to identify potentially erroneous QBI deductions, in addition to two rules previously used in 2019.

What Is The Qbi Deduction?

Use the worksheet in the Form 1040 instructions if your taxable income before the QBI deduction isn’t more than $157,500 ($315,000 if married filing jointly). Use the Publication 535 worksheet if your taxable income before the QBI deduction is higher than that threshold. If your business is an SSTB and your taxable income is between $329,800 and $429,800 or $164,900 and $214,900 , your deduction faces limitations. These limitations are W-2 wages and W-2 wages and qualified property. Calculate these limitations to find your final deduction amount.