Content

- Rent And Utilities

- Are Depreciation And Amortization Included In Gross Profit?

- Activity

- Free Accounting Courses

- Calculate Overhead Allocation Rate

- Why Track Overhead And Operating Costs?

- Examples Of Overhead Rate Measures

- Stay Up To Date On The Latest Accounting Tips And Training

Unlike operating expenses, overheads cannot be traced to a specific cost unit or business activity. Instead, they support the overall revenue-generating activities of the business. Overhead costs are all of the costs on the company’s income statement except for those that are directly related to manufacturing or selling a product, or providing a service. A potter’s clay and potting wheel are not overhead costs because they are directly related to the products made. The rent for the facility where the potter creates is an overhead cost because the potter pays rent whether she’s creating products or not. Overhead and operating expenses are two types of costs that businesses must incur to run their business.An overhead cost for one company might be a direct production cost for another. For example, a marketing agency will likely list rent as an overhead cost, while a production facility will likely list rent as a direct cost. That means we spent 13.8 cents on overhead costs for every dollar we made. We discover that the total overhead cost for the bar last year was $32,445.

Rent And Utilities

Now we’ll use these two numbers in the overhead rate formula from above. Overhead costs can be prohibitive for many small businesses and startups.The following are common accounting tools which take account of business overheads. In the case of it being an overhead, the utility bill is pre-negotiated meaning that the monthly utility bill will be the same regardless of the amount in which the factory actually consumes. This will only be relevant in various countries where there is an option for standardized utility bills.

Are Depreciation And Amortization Included In Gross Profit?

The wages you pay your employees likely make up the bulk of your monthly expenditures. Let’s say your business has a total overhead cost of $20,000 per month and a total labor cost of $5,000 per month. For this example, our hypothetical business has monthly overhead costs of $2,000, 250 total units sold, and a current price per unit of $50.

Activity

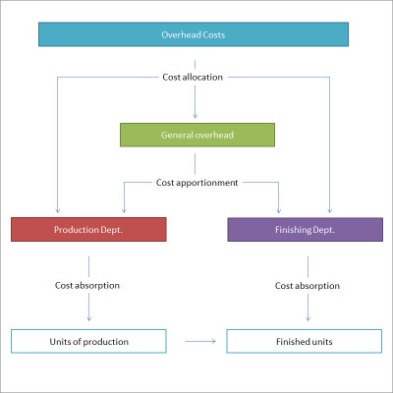

As per the Percentage of Prime Cost Method, the below formula is used to calculate the overhead rate. Therefore, one of the crucial tasks for your accountant is to allocate manufacturing overheads to each of the products manufactured. Such non-manufacturing expenses are instead reported separately as Selling, General, and Administrative Expenses and Interest Expense on your income statement. These expenses are reported for the period for which they are incurred. Furthermore, these costs decrease with an increase in output and increase with a decrease in output. This is because these costs are fixed in nature for a specific accounting period.

- So, in this case, 35 percent of your overhead is dedicated to direct material expenditures.

- For example, depreciation of plant and machinery, stationery, repairs, and maintenance.

- All of these expenses are considered overhead as they have no direct impact on the business’ good or service.

- More importantly, you should also calculate your overhead rate, which compares your overhead costs to revenue.

- Yet in most organizations activities like these account for a small portion of total overhead costs.

These business expenses can be further divided into overhead or operating costs, each of which depends on the nature of the business being run. Many larger companies offer a range of benefits to their employees such as keeping their offices stocked with coffee and snacks, providing gym discounts, hosting company retreats, and company cars. All of these expenses are considered overhead as they have no direct impact on the business’ good or service. Overhead expenses can also be semi-variable, meaning the company incurs some portion of the expense no matter what, and the other portion depends on the level of business activity. For example, many utility costs are semi-variable with a base charge and the remainder of the charges being based on usage. Before actually embarking on an overhead value analysis, it is difficult for a company to determine what the optimum low-risk/cost-reduction level is in each organizational unit or function. Inter- or intra-company comparisons or trend analyses seldom shed much light on this question, and in any case they are always open to challenge.These costs include equipment depreciation, staffing, overtime, and bills like cell phones that may incur extra costs. This includes office equipment such as printer, fax machine, computers, refrigerator, etc. They are equipment that do not directly result in sales and profits as they are only used for supporting functions that they can provide to business operations.While overhead costs are not directly linked to profit generation, they are still necessary as they provide critical support for the profit-making activities. For example, a retailer’s overhead costs will be widely different from a freelancer.

Free Accounting Courses

Exhibit I shows a framework that has proved useful for thinking through ways of reducing demand. It forces managers to consider every combination of service and cost-reduction options to meet the stretching target. In some overhead areas, it is worth making some effort to find options for streamlining , but in most areas this added effort produces only marginal improvement on the basic approach.Fixed overhead includes expenses that are the same amount consistently over time. Variable overhead expenses include costs that may fluctuate over time such as shipping costs. Overhead expenses may apply to a variety of operational categories.

Calculate Overhead Allocation Rate

The Overhead Costs form an important part of the production process. This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services.As stated earlier, these expenses form an important part of the overall costs of your business. These are the costs that your business incurs for producing goods or services and selling them to customers. You can also look at your business overhead expenses to find ways to reduce them. If you have a large expense or one that’s been creeping up over time, you might want to examine it. Once you download it, you can edit the cells and it’ll do the calculations for you. Input the overhead costs incurred for each quarter and let it calculate the total for you. Once you understand how it works, try entering your costs and doing some calculations.Sling will even notify you when you’re about to schedulesomeone into overtime so that you can make the necessary changes. As we mentioned at the beginning of this section, your business may operate on a per-unit basis rather than a billable-hour basis. When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in. If product X requires 50 hours, you must allocate $166.5 worth of overhead (50 hours x $3.33) to this product.This is because there may be times when the Overhead Expenses may… Again, we’ll use a hypothetical set of numbers to provide an example.

Examples Of Overhead Rate Measures

However, equipment can vary between administrative overheads and manufacturing overheads based on the purpose of which they are using the equipment. For example, for a printing company a printer would be considered a manufacturing overhead. To allocate the overhead costs, you first need to calculate the overhead allocation rate. This is done by dividing total overhead by the number of direct labor hours. To calculate the overhead rate, divide the total overhead costs of the business in a month by its monthly sales.

Stay Up To Date On The Latest Accounting Tips And Training

You have to manage food cost, liquor cost, and of course the dreaded fixed overhead costs. You can get control of those numbers — and reduce overhead costs in the process — by harnessing the power of apps like Sling. The sum of all your recurring monthly expenses makes up your overhead costs. Other expenses — like electricity and natural gas — are pretty much the same from month to month, so you can base your overhead costs calculations off the bill they send you. In economics, revenue curves are often illustrated to show whether or not a business should stay in business, or shut down. In theory, if a business is able cover variable operational costs but unable to cover business overheads in the short run, the business should remain in business. On the other hand, if the business is not even able to cover operational costs, it should shut down.Apply the overhead by multiplying the overhead allocation rate by the number of direct labor hours needed to make each product. They may also be semi-variable, so the amounts that need to be paid may change slightly over time.Every single property unless government owned is subject to some form of property tax. Therefore, the taxes on production factories are categorized as manufacturing overheads as they are costs which cannot be avoided nor cancelled.Other examples of fixed costs include depreciation on fixed assets, insurance premiums, and office personnel salaries. Generally, this diversity almost guarantees that some overhead activities will be inadequately reviewed by even the most cost-conscious managements. Overhead areas in which a number of employees perform similar repetitive tasks, such as typing pools and keypunching, are clearly suited to quantitative analysis. Yet in most organizations activities like these account for a small portion of total overhead costs.