Content

- Tangerine Template

- Aster Template

- How Many Different Paycheck Stub Template Paper Types Are There?

- Insurance

- The Spreadsheet Paystub:

- Employee Information

- Charleston Template

- Best And Free Paystub Templates To Use In 2021

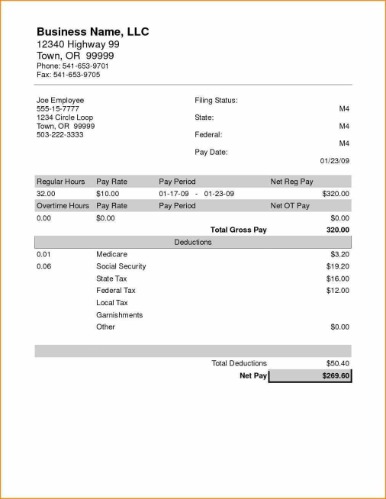

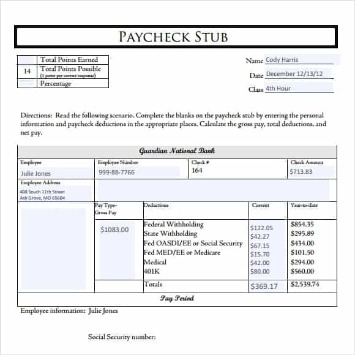

Let’s talk about the importance of having a pay stub template. A check stub template is one of the most prominent documents to have on hand. Imagine if you had to design a pay stub template every time you needed to show proof of income. Many employers include a similar listing for contributions to retirement savings plans and health plans. You’ll generally see these fields marked as the acronym “YTD” (year-to-date) on your pay stubs. The information you must include on a paycheck stub can also vary by state. Do your research and learn how to differentiate a fake pay stub example from a real check stub template.The reasoning behind this, is that you are converting time to dollars using decimal value. Fake pay stubs are known to simply round up much of the figures thus making it quite suspicious especially that those platforms cannot detect it. Having a ready laid out sample pay stub allows you the flexibility you seek. This could apply to possibly upgrading the document to meet higher tech standards or even edit it to meet new brand guidelines for your business. Pay stubs are important documents and as such, need time and attention to be produced well. Like anything in your life, dedicate some time to research what is needed and to create your pay stub template this one time. By inserting a simple table onto a word processing software, you can create your paystub outlining the hours worked and amounts paid.This makes you more vulnerable to payroll errors like typos for critical information. Pay stub templates are the cheapest option but the most error-prone.Having the opportunity to spice up your pay stub template with some color is never a bad idea as long as it looks like a professional paycheck stub template. Always make sure that you are abiding by the state laws and have a paystub template that is compatible with all standard check papers. You might also want to find out more information on thedifferent types of pay stub paper available. Lastly, who said that government documents need to be boring?Employers aren’t obligated to provide employee pay stubs. Our paycheck stub maker offers a diversity of samples, tailored to fulfill your demands. All samples are modern, practical and professional, adapted and trusted by thousands of users.

Tangerine Template

Ensure that you include local taxes if your city is one that enforces such deductions. The basic paystub is merely that, simple, minimal and excellent – suitable for your every need. The basic pay stub example contains all the necessary information about the pay period, hours worked and net earnings as well as deductions. Every worker contributes 1.45% of their gross income to Medicare and every employer pays an additional 1.45% on behalf of each employee. Depending on where you live, you may or may not be required to pay a state income tax. As with federal taxes, money for state taxes is withheld from every paycheck. Withholding refers to the money that your employer is required to take out of your paycheck on your behalf.Since you are the one producing your paycheck stub template, include all the necessary information but give it a twist. Perhaps add some subtle design elements such as a line on top or company brand colors. Afterall this is a proof of income document that you may end up filing for your taxes. Choosing to create a paystub template does not need to be costly or make a hole in your pocket. You can use a simple spreadsheet program and design your own proof of income paycheck stub template. In it you can include certain design elements to take up less space than a regular paystub sample.

Aster Template

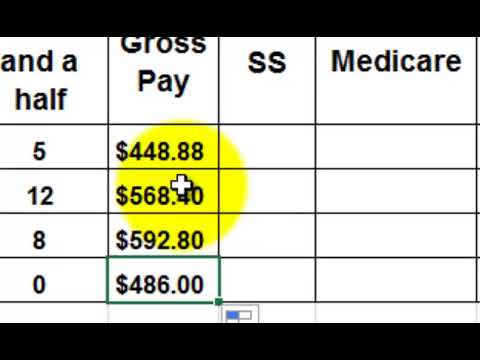

However, these templates are readily available and easy to use even if you have zero accounting experience. Different states have different requirements for employees’ pay stubs. Depending on the state, providing your employee pay stubs is a necessary part of being compliant. A pay stub shows identifying information about your employee and details on their wages. Here are some examples of things you’ll find on their pay stubs. Some individuals and companies prefer to use a spreadsheet when doing any form of calculations.

How Many Different Paycheck Stub Template Paper Types Are There?

Find out more about international payroll, and HR and payroll in the US. Personal and Check information includes your personal information, filing status , as well as the withholding number, according to your IRS form W-4. Workest is here to empower small business with news, information, trends, and community. Check your email you can get the passsword, if you have already password then enter password and sign in to stubcreator account. For example, if employees request a day off, it’ll automatically show up on their pay slip like magic. Forms 1099misc are to be used if you pay an independent contractor more than $600 in a year. Resources Access our resource articles that would help you get more insights about managing the payroll manually.

- Your go-to destination for quick and easy pay stub creation.

- Reviewing employee pay stubs can also bring mistakes to your attention.

- The payroll deductions on a pay stub vary depending on the small business employee benefits you provide.

- Using our paystub generator allows you to let go of your worries of creating the perfect pay stub template.

- Some individuals and companies prefer to use a spreadsheet when doing any form of calculations.

Each paycheck stub template has a professional layout which keenly classifies the way your stub details are reflected. You can choose from basic to advance template designs if you want a customized stub layout instead of the default one. The sample of free check stub templates can be downloaded for reference. Also, the sample templates consist of Stub Creator watermark which will be removed as soon as you pay for the same. Since you are providing value to your employees in the form of stubs, it is great that you can choose the favorable pay stub template for them. That would be tedious and time-consuming especially if you are a business owner who had to create 100 pay stub example documents for your 100 employees. Using an executive, well produced paystub template also shows your dedication to quality.All you need to do is fill in the necessary fields and verify the information. You also have the option of emailing or printing out your employee pay stub template. However, the Fair Labor Standards Act does require you to keep records of certain employee information, including payroll information.You don’t have to be an accountant to easily understand how to create pay stubs. However, understanding the foundations can help you choose the best pay stub solution for your business today. This is a fill-in vertically long blue pay stub template for your convenience. All information submitted is shown on the stub, besides the employee’s full… This is a fill-in vertically long green pay stub template for your convenience. For employers, pay stubs prove their business is paying their employees as promised.

Insurance

Making a careless mistake can lead to chaos and a lot of misunderstandings and even audits. Make sure you include the company name, information about contact details and address. Take a look at our templates designed to answer your detailed needs. Unlike some other generators providing paystubs that might look fake, our checkstubs look totally real and formal. A pay stub should accurately determine an employee’s pay within a payroll period. It can even be used as evidence to either settle a dispute, or check for any discrepencies in pay. In a payroll period, the taxes deducted from a paycheck typically include Social Security and Medicare taxes, otherwise known as FICA .

The Spreadsheet Paystub:

Customize your paystubs further by adding a company logo, YTD, FUTA, SUTA, and any additional earnings and deductions. Let’s talk about some of the standard information one must include from the income point of view on a pay stub example. Make sure you include gross and net pay, year to date as well as the date of the payment period. This way you are not being shady and hiding anything from the government.

Employee Information

Contributions to a health savings account are deducted from your pre-tax income. Deductions shows any additional deductions that might be taken out of your paycheck after tax, like group life or disability insurance. Finally, some employees must have paycheck deductions due to judgements rendered against them, such as child support payments or another legal settlement. Include both the pay period net pay and year-to-date net pay on the check stub. After subtracting taxes and deductions, you have the employee’s take-home pay.About Zenefits HR Streamline hiring, onboarding, and employee documentation into your workflow. HR Streamline hiring, onboarding, and employee documentation into your workflow. Generally, each stub is about $8, with the option to buy a bundle for a reduced cost. Once you have all the applicable fields filled in, preview your document to make any last edits before you purchase. The trusted source for small business owners & self-employed individuals. Blogs Find out the trending topics in the payroll industry and the product updates from 123PayStubs.

We Are Checking Your Browser Fairygodbosscom

This is the portion of your benefits paid by your employer, not deductions from your earnings. ESS platforms allow employees to have immediate access to HR information, update personal information, perform job-related tasks, and more. Streamline onboarding, benefits, payroll, PTO, and more with our simple, intuitive platform. Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial. Deductions could also include charitable contributions, payments toward loans, and any other voluntary or involuntary deductions (e.g., child support).You can even choose a template for your employees and a different one for your contractors without any additional cost! You can generate professional pay stubs by using our free pay stub templates to show proof of income.It is also a record confirming required taxes and fees have been deducted. For employees, pay stubs can be reviewed to ensure accurate payments and correct deductions. As an employer, you might need to pay various contractors for side jobs. Using this pay stub template you can include invoice and client details as well as insert a table displaying the services performed and hours worked. Common pay stub deductions include federal and state income tax, as well as Social Security. These federal and state withholdings account for much of the difference between your gross income and net income. There may be other deductions as well, depending on the programs that you sign up for with your employer.