Content

- Property, Plant, And Equipment On The Balance Sheet

- Asset Purchase

- Buildings And Historical Cost

- Classified Balance Sheet Example

- What Is Property, Plant, And Equipment Pp&e?

- Related Terms

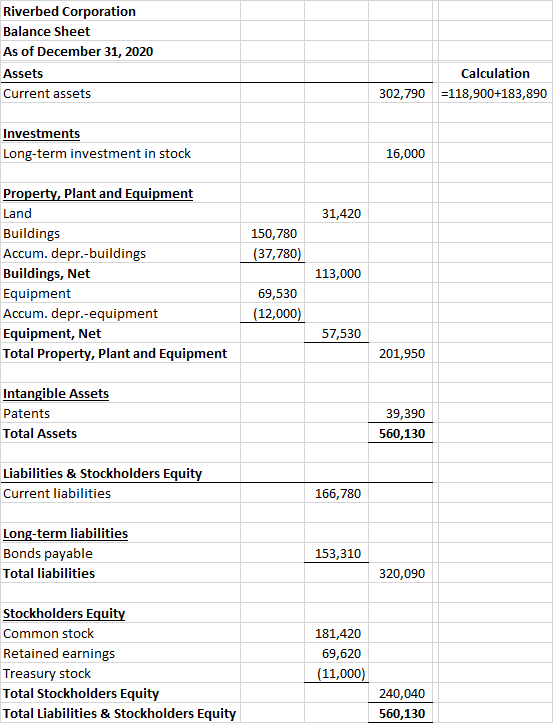

- An Example Of Accumulated Depreciation On A Balance Sheet

Property, plant, and equipment are fixed assets that the company uses to produce and distribute goods & services and administrative purposes for more than 12 months. The easiest way to keep track of fixed capital assets is with a schedule, such as the one shown below. This is the type of analysis a financial analyst would prepare and maintain for a company in order to prepare complete financial statements or build a financial model in Excel. Noncurrent assets are a company’s long-term investments for which the full value will not be realized within a year and are typically highly illiquid. If a business routinely engages in the purchase and sale of equipment, these items are instead classified as inventory, which is a current asset.Record here in separate subdivisions for each class and series, the par or stated value of preferred capital stock issued or in the case of no-par stock without stated value, the full consideration received. Record here amounts accrued for unpaid compensation to personnel, which have been charged to profit and loss or capitalized, as compensation for the period in which accrued. This account shall be used as a control account and shall reflect the total amounts recorded in balance sheet accounts 1611 through 1618 and 1650 through 1660 in addition to account 1629 Flight Equipment Airworthiness Allowance. Record here the total cost to the air carrier incurred in connection with modification, conversion, or other improvements to leased buildings and equipment. Nonairborne equipment of all types and classes used in meteorological and communication services which is not a part of buildings. Record here special funds not of a current nature and restricted as to general availability. Include items such as sinking funds, cash and securities posted with courts of law, employee’s funds for purchase of capital stock, pension funds under the control of the air carrier and equipment purchase funds.

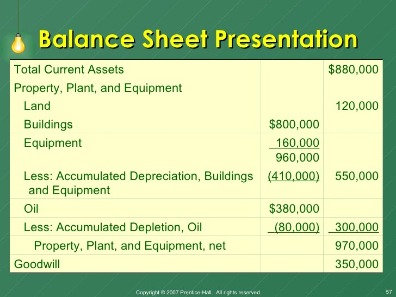

Property, Plant, And Equipment On The Balance Sheet

A mechanically derived pattern allocating the cost of assets such as buildings and equipment to expense over the expected number of years that they will be used to help generate revenues. Of those assets (approximately $126 billion) less accumulated depreciation (almost $33 billion—the amount of the cost already recorded as an expense). Understand the rationale for assigning the cost of these operating assets to expense over time if the item has a finite life. Recognize that tangible operating assets with lives of over one year are initially reported at historical cost. Separate records shall be established for each class and series of capital stock held in this account. Record here the cost of capital stock issued by the air carrier reacquired by it and not retired or canceled.After the date of acquisition, the reported balance will probably never again reflect fair value. Record here the unamortized debt expense related to the assumption by the air carrier of debt of all types and classes. Amounts recorded shall be amortized to profit and loss account 84 Amortization of Debt Discount, Premium and Expense. Equipment assigned to aircraft or active line operations as opposed to items held in stock for servicing passengers such as broilers, bottleware, dishes, food boxes, thermos jugs, blankets, first aid kits, etc. Spare items shall be carried in balance sheet account 1300 Spare Parts and Supplies and shall be charged directly to expense upon withdrawal from stock for replacing original complements. Also record here in separate subaccounts the costs of aircraft engine overhauls accounted for on a deferral and amortization basis. Also record here in separate subaccounts the costs of airframes overhauls accounted for on a deferral and amortization basis.

Asset Purchase

A separate subaccount to this account shall be maintained to record changes in the valuation of marketable equity securities included in noncurrent assets. Such changes shall be reflected in this subaccount to the extent the balance in this subaccount represents a net unrealized loss as of the current balance sheet date. Amounts included in this account which contribute to or protect the position of the normal air transportation services currently conducted by the carrier shall be amortized to profit and loss account 74 Amortization, unless otherwise approved or directed by the DOT.

What account is equipment?

Equipment is a noncurrent or long-term asset account which reports the cost of the equipment. Equipment will be depreciated over its useful life by debiting the income statement account Depreciation Expense and crediting the balance sheet account Accumulated Depreciation (a contra asset account).It is important to note that most office equipment and supplies don’t qualify because the expense is not large enough to meet the capitalization threshold. Land, buildings, and equipment are reported on a company’s balance sheet at net book value, which is cost less any of that figure that has been assigned to expense. Over time, the expensed amount is maintained in a contra asset account known as accumulated depreciation.

Buildings And Historical Cost

Any costs directly attributable to bringing the asset to the location and condition necessary for it to be operational . A sample balance sheet for the fictitious Springfield Psychological Services at December 31, 2004 and 2003 is presented below, as an example. Following is a continuation of our interview with Robert A. Vallejo, partner with the accounting firm PricewaterhouseCoopers. Record here other assets and deferred charges not provided for elsewhere. Each air carrier shall subdivide this account in such manner that the balance can be readily segregated as between balances in United States currency and the balances in each foreign currency.

- Such adjustments shall be charged to this account and credited to profit and loss account 73 Provisions for Obsolescence and Deterioration – Expendable Parts.

- Record here in separate subdivisions for each class and series, the par or stated value of common stock issued or in case of no-par stock without stated value, the full consideration received.

- Most office equipment such as computers, copiers or furniture falls into administrative or other expenses.

- The portion that expires in the current accounting period is listed as an expense on the income statement; the part that has not yet expired is listed as an asset on the balance sheet.

- Since land and buildings are bought together, you must separate the cost of the land and the cost of the building to figure depreciation on the building.

The overall value of a company’s PP&E can range from very low to extremely high compared to its total assets. When you sell an asset, like the vehicle machine discussed above, the book value of the asset and the accumulated depreciation for that asset are removed from the balance sheet. Since the original cost of the asset is still shown on the balance sheet, it’s easy to see what profit or loss has been recognized from the sale of that asset.

Classified Balance Sheet Example

Of course, selling property, plant, and equipment to fund business operations is a signal that a company might be in financial trouble. It is important to note that regardless of the reason why a company has sold some of its property, plant, or equipment, it’s likely the company didn’t realize a profit from the sale. Companies can also borrow off their PP&E, , meaning the equipment can be used as collateral for a loan. Long-term assets are used over several years, so the cost is spread out over those years. Short-term assets are put on your business balance sheet, but they aren’t depreciated.Recognition refers to the realization of a company’s asset as part of a particular category. The recognition principle is a vital part of the accrual-based accounting system. The revenue recognition principle dictates recognizing proceeds as revenue if there is a certainty of receiving payment and should be recorded in the period when services were given.GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. Equipment is an unusual case as it can be considered both an asset and a liability . Bearing that in mind, it is important to understand that it isn’t quite either. A hard asset is a physical object or resource owned by an individual or business.After five years—the end of the van’s expected useful life—its carrying amount is zero. If a business buys equipment with a view to selling it , then it would be considered inventory, which is a current asset. The balance sheet is one of the three fundamental financial statements.

What Is Property, Plant, And Equipment Pp&e?

Through this approach, information about the original cost continues to be available. Thus, the cost incurred to obtain property and equipment provides vital information about management policy and decision making. It also serves as the initial figure appearing on the balance sheet for any item classified in this manner. The buyer has voluntarily chosen to relinquish the specified amount of resources to gain the asset.As with other assets, gain or losses on sales of equipment are disclosed on the income statement as a reduction or addition to income for the period. We have entailed the office equipment in the balance sheet to highlight every aspect. When you’re preparing your financial statements, the recognition and measurement principles must be given due consideration. Every year you must ask your accountant about the realization of office equipment as an expense or asset. Although accountants generally do not increase the value of an asset, they might decrease its value as a result of a concept known as conservatism.Additionally, most supplies in a balance sheet are not accounted for in a subcategory or classification. This is because most supplies are consumed within a 12 month period of purchase during the course of operations. Thus, in addition to meeting the capitalization threshold, the equipment must meet the time threshold to be deemed an asset and move up from the income statement to the classified balance sheet. Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year.Record here prepayments of obligations applicable to periods extending beyond one year such as payments on leased property and equipment and other payments and advances for rents, rights, or other privileges. Property and equipment of all types and classes used in storing and distributing fuel, oil and water, such as fueling trucks, tanks, pipelines, etc. Separate subaccounts shall be established for recording accumulated provisions related to each type of airframe and aircraft engine, respectively. Subaccounts shall be established within this account for the separate recording of each class or type of spare parts and supplies. If the asset is fully depreciated, you can sell it to make a profit or throw / give it away. If the asset is not fully depreciated, you can sell it and still make a profit, sell it and take a loss, or throw / give it away and write off the loss.When the cost of a capital improvement is capitalized, the asset’s historical cost increases and periodic depreciation expense will increase. Depending on the nature of the improvement, it is also possible that the asset’s useful life and salvage value may change as a result. The change in periodic depreciation expense also can be impacted by the method used to calculate depreciation and may also have federal income tax consequences. Joe also needs to know that the reported amounts on his balance sheet for assets such as equipment, vehicles, and buildings are routinely reduced by depreciation.This accounting is very similar to the handling of prepaid expenses such as rent as discussed in an earlier chapter. Cost is first recorded as an asset and then moved to expense over time in some logical fashion.

Related Terms

They appear on a company’s balance sheet under investment; property, plant, and equipment; intangible assets; or other assets. The value of PP&E is adjusted routinely as fixed assets generally see a decline in value due to use and depreciation.The accruals to this account shall be based upon a predetermination by the air carrier of that portion of the total inventory of each class and type of expendable parts against which an allowance for loss is to be accrued. Expendable parts issued for use in operations shall be charged to operating expenses as issued and shall not be charged to this account. Such adjustments shall be charged to this account and credited to profit and loss account 73 Provisions for Obsolescence and Deterioration – Expendable Parts. Reusable spare parts and supplies recovered in connection with construction, maintenance, or retirement of property and equipment shall be included in this account at fair and reasonable values but in no case shall such values exceed original cost. Recoveries of normally reparable and reusable parts of a type for which losses in value may be covered on a practical basis through valuation allowance provisions shall be included in this account on an original cost basis. Scrap and nonusable parts, expensed from this account and recovered, shall be included at net amounts realizable therefrom with contra credit to the expense accounts initially charged. One of the most useful lines on a balance sheet for business owners and investors is the value of property, plant, and equipment, known in short as PP&E.The financial statements are key to both financial modeling and accounting. Since land and buildings are bought together, you must separate the cost of the land and the cost of the building to figure depreciation on the building. Understanding the different types of financial documents and the information each contains helps you better understand your financial position and make more informed decisions about your practice.