Content

- Reconcile Your Bank Account And Financial Documents Every Month

- The 5 Accounting Elements

- Federal Tax Partner, Real Estate

- How Does Real Estate Accounting Differ From Other Types Of Business Accounting?

- Mj Business Published An Article By Assurance Partner Kellan Mcconnell About Accounting Best Practices In The Cannabis Industry

- Quicken Standout Features

- Do I Need A Financial Advisor? The 3 Main Types & What They Do

- Link Your Accounts

- Zero Work At Tax Time

Monthly reconciliation is the only way you can be confident you’ve picked up all the activity in an account. RealtyZam is only for self-employed individuals―not corporations, partnerships, or LLCs―because it doesn’t track assets and liabilities. Wave is our next best bet if you want simple bookkeeping to keep track of your assets and liabilities.Nowadays, the term “bookkeeping” refers only to the accounting practice—you don’t actually have to keep transaction records in printed business ledgers. Nonetheless, that’s still how many modern businesses choose to do it. Books, books, books, and filing cabinets; it’s worked for centuries, and it still does today. Going from property to property to sell, speak with clients, or monitor a network of properties requires a lot of time and travel. Don’t make the mistake of forgetting to include these numbers in your real estate accounting procedures. Although fairly basic, your job duties might require the use of standard office supplies, equipment, and other administrative tools.Talk to a financial professional who specializes in real estate accounting. Along with following the rules, a real estate accounting firm can help you choose a business structure, avoid unnecessary spending, and create reports. Staying on top of your transactions is one thing, but you must also validate that theses transactions are being reflected in your bank account balance. To ensure accuracy, you should reconcile your books with your bank account on a monthly basis. Through this reconciliation, you can identify any gaps in your transactions, and also flag any outstanding payments. Accrual accounting is a little bit more difficult than cash basis. The entries are equal but opposite, which helps ensure that your books are accurate.

Reconcile Your Bank Account And Financial Documents Every Month

Accounting is a necessary aspect of property management to analyze profits, track spending, and evaluate your properties’ success. Real estate investors need to understand how to use real estate accounting to ensure their business’s long-term success. These statements provide an accurate snapshot of how your business is running. Want to know how much cash flow your business generated in the past month? Perhaps you’re interested in a graph of your expenses over the past three years? Again, unless you are a pro with spreadsheets, this will be much easier using accounting software.

- The key here is to zero in on any excess money that you don’t need to be spending and to find ways to save.

- For example, if you send the tenant an invoice for the January rent in December, income is credited in December and recorded as receivable from the tenant.

- The right accountants should have no problem assisting you with catch-up bookkeeping, especially if it’s a finance company that has multiple accountants it can place on your books.

- Find out how you can get started with Real Estate Winners by clicking here.

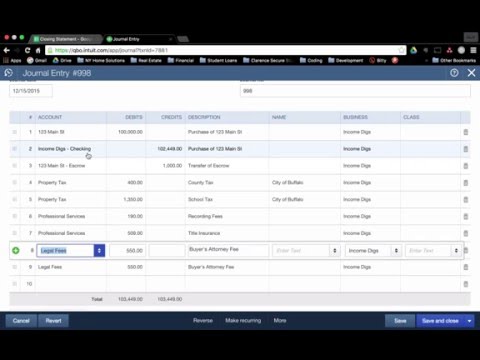

The right accountants should have no problem assisting you with catch-up bookkeeping, especially if it’s a finance company that has multiple accountants it can place on your books. Imagine that you have an open book in front of you—a business ledger. In traditional bookkeeping, you would enter the debited amount on the left page, and the credited amount on the right page.

The 5 Accounting Elements

Again—and for the last time, we promise—we recommend enlisting the services of an accounting company. Accounting is a massive and massively important business endeavour. It’s all too easy to get behind on the books or to record inaccurate information—and don’t forget that your business may face severe financial penalties if you do. If you’re running a small real estate business, you might have to wear many different hats due to lack of manpower. If you’re wearing many hats, it’s easy to fall behind on your bookkeeping—especially given how many small costs and fees that are part of a single real estate transaction.Update your chart of accounts often to ensure you maintain complete financial records. As the name suggests, real estate accounting is simply an accounting practice with a focus on real estate entities. Believe it or not, knowing how to handle real estate accounting is likely an important part of your job as a real estate professional. With that in mind, we’ve brought you a guide on this tricky subject. Read on below to learn what real estate accounting is, how it works, and some tips that you should follow to better manage your money. Lastly, after entering in all this data for the property, you now will be able to generate reports on the success of your property.

Federal Tax Partner, Real Estate

Real estate bookkeeping and accounting is often not the most exciting part of having a real estate business, but it is an essential one. Every real estate professional should at least have some grasp on accounting basics. With that in mind, use the tips above to help you get a handle on your accounting today. You can use it to create reports, measure your business growth, and keep a history of historical transactions. Procedures can be tailored to focus on the high risk and key areas of concern or importance. Our expertise includes financial statement preparation, tax return preparation, tax consulting, investor reporting, accounting systems, partnership cash flow modeling and transactional services. The act of recording each of these transactions is referred to as bookkeeping, which also includes organizing and maintaining documents to support each transaction.

How Does Real Estate Accounting Differ From Other Types Of Business Accounting?

But, real estate accounting is a necessary part of property management for keeping up with financial records, catching issues and seeing growth opportunities. A rental property accounting system like Stessa automatically tracks income and expenses and helps real estate investors to maximize revenue with personalized recommendations. Many modern real estate businesses generate income through rental properties. General features include bookkeeping features typically found in modern bookkeeping software, including online payments, mobile apps, and receipt capture. We also determined whether the software is a double-entry system, which means it tracks both assets and liabilities as well as income and expense.

Mj Business Published An Article By Assurance Partner Kellan Mcconnell About Accounting Best Practices In The Cannabis Industry

Typically, finances are tracked on a monthly basis—e.g., January 1 through January 31 and February 1 through February 28. If you are using a spreadsheet, you can simply list the above categories on the lefthand side of the screen and make one column for each month. Join BiggerPockets (for free!) and get access to real estate investing tips, market updates, and exclusive email content. Eric Gerard Ruiz is a staff writer at Fit Small Business’s accounting content. He was a freelance writer from various companies and clients in the Philippines, the United States, and Australia. Now that he is part of Fit Small Business’s writing team, he wants to share his knowledge in accounting and finance to give the best answer to everyone.Finally, real estate agents have very specific needs that can be addressed affordably with RealtyZam. Because Realtyzam is designed for a very specific purpose, it didn’t score well in our rubric.

Quicken Standout Features

For example, if you own a real estate brokerage, the income of your staff would be accounted as an expense . Digital bookkeeping, however, has taken the accounting world by storm.Transactions are recorded differently, depending on which accounting method you use. Create historical property performance data to help make refinancing a rental property easier. A CPA will tell you that come January 1st when tax season rolls around, they begin working seven days a week preparing tax returns. By providing your tax professional with tax-ready financial statements, you’ll make their job much easier and reduce the number of billable hours they charge to you. The latest edition of our annual update highlights selected accounting and reporting developments that may be of interest to real estate entities. Any time you charge for a good or service, the cash you recieve is income. In real estate, you might gain income by collecting rent from a tenant.Professional real estate agents have a lot to manage when it comes to keeping up with clients, listings, finances, and growing personal business networks. Get insightful reports, monitor cash flow, and save hours of bookkeeping time by using our dedicated team of accountants. This allows us to not only help you with accounting expertise and tax advice, but also provide unique operational insights. If you don’t feel like dealing with the ins and outs of accounting on a regular basis, consider hiring a real estate accountant to do the job. While you’ll still have to do your best to maintain good records, having someone else who can help manage your finances can take a lot of weight off your shoulders. The other side of the coin from minimizing your expenses is increasing your revenue. Before diving into the five steps to successful real estate accounting, let’s cover the basic terminology.Rent collection, banking, bill pay and access to competitive loans and insurance – all free for landlords. Brandon Turner is an active real estate investor, entrepreneur, writer, and podcaster. $119.40 if billed annually—monthly price equivalent is $9.95 per month. Recognize the types of entities that can be classified as common interest realty associations, as well as the accounting for special assessments. Specify the types of project costs, as well as when and how to capitalize interest on a real estate project. Looks like you’ve logged in with your email address, and with your social media. Link your accounts by signing in with your email or social account.Therefore, a must-have feature for real estate accounting software is the ability to assign income and expenses to a particular class, location, or other identifiers. As a property manager, you probably know that there are a lot of moving parts to real estate accounting.

Zero Work At Tax Time

Bookkeeping is the recording of all your company’s financial transactions . Accurate bookkeeping is the foundation of good real estate accounting (and it’s something you’ll want to uphold, unless you enjoy IRS audits). Interesting idea…maybe I could apply the same concept I used to help notaries track their expenses and save money on their taxes to help real estate agents. The more I thought about it the more fun it sounded (yeah…this is the kind of stuff that software guys think is fun). So I did some research and decided to create Realtyzam – officially founded in 2014.The real estate professional needs to be aware of the accounting rules for real estate, in order to avoid adverse reporting outcomes. Real Estate Accounting covers the accounting rules for every type of real estate transaction, which can be used to structure real estate deals appropriately. The course covers the accounting for real estate sales, property exchanges, and time-share intervals. It also reveals the related financial statement presentations and accompanying disclosures. In addition, it describes the accounting related to the rental of property, and investments in real estate ventures. In short, this course is the go-to reference for discerning the proper accounting treatment for a real estate transaction. Basic steps in setting up a real estate accounting system include creating a chart of accounts, separating business transactions from personal funds, and keeping documents and receipts organized.