Content

- How To Calculate Shareholders’ Equity

- How Do You Calculate Shareholders Equity?

- How To Calculate Stockholders Equity

- What Insight Does Shareholders’ Equity Provide?

- Example Of Stockholders’ Equity

- What Does Negative Shareholders’ Equity Mean?

This financial metric is frequently used by analysts to determine a company’s general financial health. Simply put, the stockholders’ equity is what the company owns minus what it owes.Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem.

How do you calculate stockholders equity?

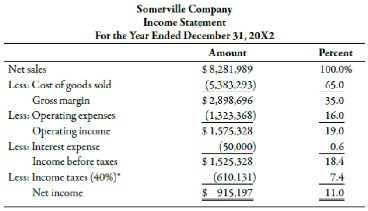

Stockholders’ equity refers to the assets remaining in a business once all liabilities have been settled. This figure is calculated by subtracting total liabilities from total assets; alternatively, it can be calculated by taking the sum of share capital and retained earnings, less treasury stock.The stockholders’ equity is only applicable to corporations who sell shares on the stock market. For sole traders and partnerships, the corresponding concepts are the owner’s equity and partners’ equity. Treasury shares are issued by the company and later reacquired.

How To Calculate Shareholders’ Equity

He is the sole author of all the materials on AccountingCoach.com. As you can see, Equity includes several components regardless of the type of business. Now, we are going to calculate Stockholder’s Equity by using another formula. Capital employed, also known as funds employed, is the total amount of capital used for the acquisition of profits.

- As functions of Owners, Shareholders or Stockholder are liable for sharing all the profit and losses of the company.

- Equity, also referred to as stockholders’ or shareholders’ equity, is the corporation’s owners’ residual claim on assets after debts have been paid.

- The stockholders’ equity, also known as shareholders’ equity, represents the residual amount that the business owners would receive after all the assets are liquidated and all the debts are paid.

- Conceptually, stockholders’ equity is useful as a means of judging the funds retained within a business.

- Liabilities and equity are the two sources of financing a business uses to fund its assets.

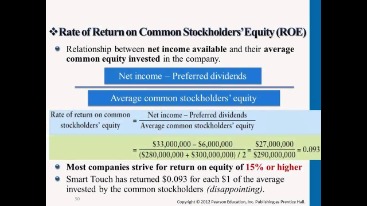

Shareholder equity can also indicate how well a company is generating profit, using ratios like the return on equity . This shows you the business’s net income divided by its shareholder equity, to measure the balance between investor equity and profit.

How Do You Calculate Shareholders Equity?

These figures can all be found on a company’s balance sheet. Treasury shares continue to count as issued shares, but they are not considered to be outstanding and are thus not included in dividends or the calculation of earnings per share .If it’s in positive territory, the company has sufficient assets to cover its liabilities. If it’s negative, its liabilities exceed assets, which may deter investors, who view such companies as risky investments. But shareholders’ equity isn’t the sole indicator of a company’s financial health.

How To Calculate Stockholders Equity

The second source consists of the retained earnings the company accumulates over time through its operations. In most cases, especially when dealing with companies that have been in business for many years, retained earnings is the largest component. Using the following accounts and balances, prepare the Stockholders’ Equity section of the balance sheet Fifty thousand shares of common stock are authorized, and 5,000 shares have been reacquired. Stockholder’s equity includes things like what the investors gave the company to start it in exchange for stock, any donated money, or other assets or earnings. Learn more about the definition and formula for stockholder’s equity.Current assets are those that can be converted to cash within a year, such as accounts receivable and inventory. Long-term assets are those that cannot be converted to cash or consumed within a year, such as real estate properties, manufacturing plants, equipment, and intangible items like patents. Equity typically refers to shareholders’ equity, which represents the residual value to shareholders after debts and liabilities have been settled. If positive, the company has enough assets to cover its liabilities. The changes which occurred in stockholders’ equity during the accounting period are reported in the corporation’s statement of stockholders’ equity. Excluding these transactions, the major source of change in a company’s equity is retained earnings, which are a component of comprehensive income. However, there are other sources and thus, other comprehensive income.

What Insight Does Shareholders’ Equity Provide?

Retained earnings are the total profits you have kept since you started your business that you have not distributed as dividends. Treasury stock represents the cost of any shares you repurchased from investors. Preferred stock, common stock, additional paid‐in‐capital, retained earnings, and treasury stock are all reported on the balance sheet in the stockholders’ equity section. Information regarding the par value, authorized shares, issued shares, and outstanding shares must be disclosed for each type of stock. If a company has preferred stock, it is listed first in the stockholders’ equity section due to its preference in dividends and during liquidation.

Example Of Stockholders’ Equity

The company provides shares of the company in exchange for the money given by the people to the company. Hence, People who are holding shares of the company is called as Shareholder or Stockholder. As functions of Owners, Shareholders or Stockholder are liable for sharing all the profit and losses of the company. In short, there are several ways to calculate stockholders’ equity , but the outcome may not be of particular value to the shareholder. There may be a number of valuable intangible assets, such as brands, that are not recognized in a company’s balance sheet at all. Instead, the cost to establish and maintain these assets may have been charged to expense as incurred.If equity is positive, the company has enough assets to cover its liabilities. This metric is frequently used by analysts and investors to determine a company’s general financial health. Conceptually, stockholders’ equity is useful as a means of judging the funds retained within a business. If this figure is negative, it may indicate an oncoming bankruptcy for that business, particularly if there exists a large debt liability as well. Stockholders’ equity is also the corporation’s total book value (which is different from the corporation’s worth or market value).

What is Stockholders equity in balance sheet?

Shareholders’ equity (or business net worth) shows how much the owners of a company have invested in the business—either by investing money in it or by retaining earnings over time. On the balance sheet, shareholders’ equity is broken down into three categories: common shares, preferred shares and retained earnings.The SE is an important figure to be aware of, primarily for investment purposes. When shareholders’ equity is positive, this indicates that the company has sufficient assets to cover all of its liabilities. However, when SE is negative, this indicates that debts outweigh assets. If the shareholders’ equity remains negative over time, the company could be facing insolvency. The stockholders’ equity, also known as shareholders’ equity, represents the residual amount that the business owners would receive after all the assets are liquidated and all the debts are paid. Share capital includes all contributions from the company’s stockholders to purchase shares in the company.To calculate shareholders’ equity, use the following steps. The value of $65.339 billion in shareholders’ equity represents the amount left for stockholders if Apple liquidated all of its assets and paid off all of its liabilities. Stockholders’ equity is often referred to as the book value of the company and it comes from two main sources. The first source is the money originally and subsequently invested in the company through share offerings.The expanded accounting equation is derived from the accounting equation and illustrates the different components of stockholder equity in a company. Every company has an equity position based on the difference between the value of its assets and its liabilities. Positive equity indicates the company has a positive worth. A company’s share price is often considered to be a representation of a firm’s equity position.

What Is Included In Stockholders’ Equity?

Looking at the same period one year earlier, we can see that the year-on-year change in equity was a decrease of $25.15 billion. The balance sheet shows this decrease is due to both a reduction in assets and an increase in total liabilities. Consolidated Stockholders’ Equitymeans, as of any date of determination for the Company and its Subsidiaries on a consolidated basis, stockholders’ equity as of that date, determined in accordance with GAAP. Stockholders’ equity and liabilities are also seen as the claims to the corporation’s assets. However, the stockholders’ claim comes after the liabilities have been paid. Stockholder’s Equity is used for the calculation of book value of shares of the Company.Keep in mind that assets are things the company owns and liabilities are what is owed, like loans. Stockholders’ equity (also known as shareholders’ equity) is reported on a corporation’s balance sheet and its amount is the difference between the amount of the corporation’s assets and its liabilities. Anastasia is a common stockholder in the Company ABC. She wants to calculate the ROCE equation to compare the firm with the industry. Anastasia knows that the company has distributed $200,000 in preferred dividends and that the firm’s reported net income is $850,000.

What Does Negative Shareholders’ Equity Mean?

Instead, the equivalent classification in the balance sheet of a nonprofit is called “net assets.” At some point, accumulated retained earnings may exceed the amount of contributed equity capital and can eventually grow to be the main source of stockholders’ equity. For instance, when a company issues a dividend, the stockholders’ equity may decrease. On the flip side, if the company adds to retained earnings because it made money, stockholders’ equity may increase. She will check this again next quarter to track the company’s performance. Let’s put some of the terms in action by going over the formula for stockholders’ equity. Maggie goes to her favorite search engine, Yagoog, and types in MNO Corporation.Book value measures the value of one share of common stock based on amounts used in financial reporting. To calculate book value, divide total common stockholders’ equity by the average number of common shares outstanding. Stockholders’ Equity is an account on a company’s balance sheet that consists of capital plus retained earnings.

Treasury Shares

Treasury shares can always be reissued back to stockholders for purchase when companies need to raise more capital. If a company doesn’t wish to hang on to the shares for future financing, it can choose to retire the shares. Equity, also referred to as stockholders’ or shareholders’ equity, is the corporation’s owners’ residual claim on assets after debts have been paid.

What Is Stockholders’ Equity?

Compared to the industry average of 22.4%, the company ABC is a safe bet for investing. For example, assume your small business has $30,000 in accounts payable, $25,000 in unearned revenue and $95,000 in notes payable. The First Formula of Stockholder’s Equity can be interpreted as the Number of Assets left after paying off all the Debts or Liabilities of Business. Positive Stockholder’s Equity represents the company has sufficient assets to pay off its debt. It gives a positive impact on a Company’s Financial Growth.