Content

- Double Tax Break

- Income Limits

- Although You Need To Act Quickly, You Still Have A Few Hours To Make A 2020 Ira Contribution And Lower Your Tax Bill

- If You Are Married Filing Separately

- Do Ira Contributions Reduce Agi?

- Financial Services

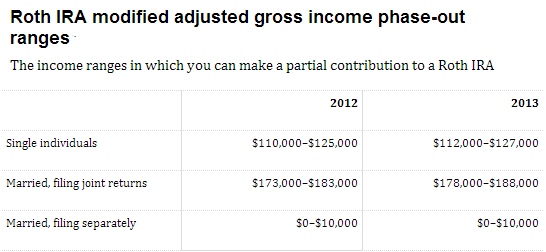

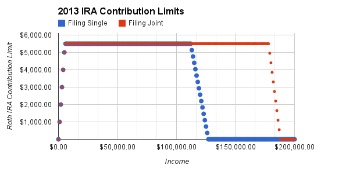

However, you may accomplish your goal of contributing larger sums if your spouse establishes their own IRA, whether they work or not. The IRS updates the Roth IRA income limits every year to account for inflation and other changes. Most people qualify for the maximum contribution of $6,000, or $7,000 for those age 50 and up.

Double Tax Break

A credentialed financial advisor can, at the very least, help you go over the financial pros and cons as you weigh your options. Timing is based on an e-filed return with direct deposit to your Card Account. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. Emerald Cash RewardsTMare credited on a monthly basis.A contribution to a Roth IRA is not tax-deductible. You pay the full income taxes on the money you pay into the account. However, you will owe no taxes on the contributions or the investment returns when you retire and start withdrawing the money. The contribution is tax-deductible as long as your household income doesn’t exceed the limits for married couples filing jointly. Your AGI is how much you have earned in a tax year after taking any applicable deductions.

Income Limits

Year-round access may require an Emerald Savings®account. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. See your Cardholder Agreement for details on all ATM fees. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. One personal state program and unlimited business state program downloads are included with the purchase of this software.

How much does an IRA contribution reduce taxes?

Contribute to an IRA. You can defer paying income tax on up to $6,000 that you deposit in an individual retirement account. A worker in the 24% tax bracket who maxes out this account will reduce his federal income tax bill by $1,440. Income tax won’t apply until the money is withdrawn from the account.Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Here is a list of our partners and here’s how we make money.

Although You Need To Act Quickly, You Still Have A Few Hours To Make A 2020 Ira Contribution And Lower Your Tax Bill

You’ll have to balance any current tax savings with the taxes you’ll have to pay in the future. For investors who want to take a do-it-yourself approach to their finances, using an online brokerage or robo-advisor can take the pressure out of the process.

- Let’s look more closely at how the Roth IRA works, and how much in tax savings you’re likely to get by using one.

- When both state and local taxes are considered, you’ll pay more sales tax when shopping in these states.

- It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation.

- Our IRA Center can help you sort out the differences, as well as give you some tips on how to get started investing.

- A Roth IRA can be an excellent way to stash away money for your retirement years.

- So, you can’t deduct contributions to a Roth IRA. However, the withdrawals you make during retirement can be tax-free.

These are funded with pre-tax dollars, so they can help lower your taxable income. Donating funds to a charitable organization provides an opportunity to reduce your taxable income. Are Roth IRA contributions tax deductible? If you are not working but your spouse does, you may be able to contribute to your IRA if your total modified adjusted gross income is within the IRS limits. If you use a Roth IRA, then the full $40,000 is free of federal income tax. That effectively saves you $10,000 in the example above — or whatever income tax that amount would have generated based on your particular tax bracket. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

If You Are Married Filing Separately

Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. Starting price for simple federal return.

Do Ira Contributions Reduce Agi?

David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes. The table below shows the income limits for 2022 for making Roth contributions. As with traditional IRA contribution limits, the Roth income limits are adjusted for inflation each year.