Content

- Definitions & Examples Of A Sales Invoice

- Track Your Sales Invoice

- Excel Of Invoice Template

- The Difference Between Accrued Expenses And Accounts Payable

- Half Page Business Invoices

- When Is The Right Time To Send A Sales Invoice?

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem. After inserting the new row, you need to copy and paste from the row above so that the formatting, including the borders, ends up the same as the rest of the list.

Is every sales invoice also a purchase invoice?

No, sales invoices and purchase invoices are not the same. Both the invoices serve different purposes. However, a purchase invoice helps the supplier to issue the sales invoice and vice-versa.Within the European Union Value Added Tax directive, Article 226 gives a concise definition of invoices within the European Union’s member-states. In Canada, the registration number for GST purposes must be furnished for all supplies over $30 made by a registered supplier in order to claim input tax-credits. Invoices appear as one of the very earliest manifestations of written records in ancient Mesopotamia. Saves and closes this invoice and you can then create a new invoice. To save the invoice as a draft or pro forma, select the ‘Save as’ checkbox and choose a format option from the drop-down menu. So you can’t sell something that’s out of stock, we won’t let you save an invoice when your stock levels are too low.

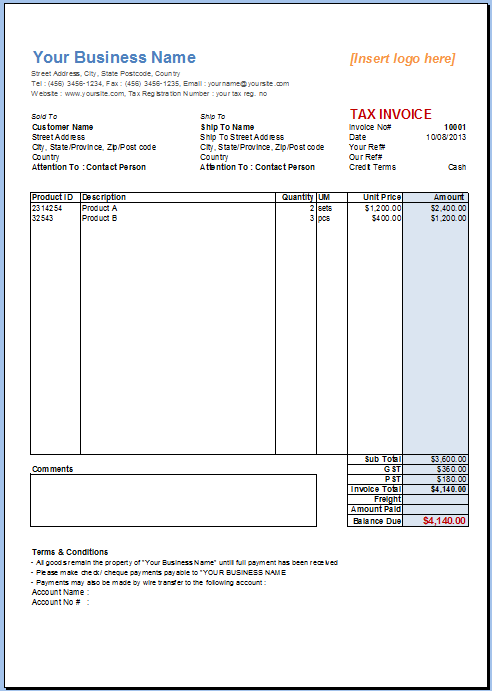

Definitions & Examples Of A Sales Invoice

A pro forma invoice is a preliminarybill of salesent to buyers in advance of a shipment or delivery of goods. All the information related to sales invoices such as the terms of payment, payment methods, the amount owed, and the due date should be clearly mentioned. Statement – A periodic customer statement includes opening balance, invoices, payments, credit memos, debit memos, and ending balance for the customer’s account during a specified period. A monthly statement can be used as a summary invoice to request a single payment for accrued monthly charges. Timesheet – Invoices for hourly services issued by businesses such as lawyers and consultants often pull data from a timesheet. A timesheet invoice may also be generated by Operated equipment rental companies where the invoice will be a combination of timesheet based charges and equipment rental charges. Evaluated receipt settlement – ERS is a process of paying for goods and services from a packing slip rather than from a separate invoice document.The calculations are done for you, and you can specify the tax rate, shipping and handling, or other fees. The sales invoices are used for any type of retail or private sale that involves products or services from a seller or vendor to a buyer in exchange for payment or trade. A sales invoice works perfectly for both sellers and buyers to know the detailed descriptions of the services or product purchased including their unit price and quantity. The best thing is that the invoice templates for sales can help you track how much inventory you have and how much stock you will need in the future based on past records and client demand. This template shows the company info, description, unit price, purchase order number, sales tax, shipping and total due to be paid. It has field for the company name and slogan including the addresses of the both the seller and the buyer. The template design is very simple and neutral and will work for well for most companies.

Track Your Sales Invoice

Electronic invoicing in its widest sense embraces EDI as well as XML invoice messages as well as other formats such as pdf. Continuation or Recurring Invoicing is standard within the equipment rental industry, including tool rental. A recurring invoice is one generated on a cyclical basis during the lifetime of a rental contract. The same principle would be adopted if you were invoiced in advance, or if you were invoiced on a specific day of the month.On 16 October 2008, 14 companies and the Czech government signed a declaration to use this format within one year in their products. You can easily edit your PDF invoice template and send it to your client as a compact file, in a matter of minutes. Perfect for keeping it from unwanted edits, especially with the ability to protect it with a password. A good choice if you want to reduce the file size of your invoice without sacrificing design or security. You need a smart account which lets you get paid quickly – and won’t cost the earth. The details of the sales invoice will now appear on the customer’s activity. We recommend that you save the invoice as a draft until you’ve recorded all of your purchase transactions.He is also the author of Finessin’ Finances, a full-length book on personal finances. A clearer view of your business finances with more automation, personalisation and control.

Excel Of Invoice Template

This saves you time when trying to customize invoices for your business. The allocation details of the transaction appears here, depending on the type of transaction you originally opened. To view further details, click the value in the Amount column. You may need to refresh this page to update this status.ViewedShows the email address and date when the customer viewed the email.

The Difference Between Accrued Expenses And Accounts Payable

Using templates for invoices allows you to fulfil this requirement quickly and easily, saving you money. As well as that, they allow you to keep track of payments coming in – and when they’re due – and goods going out. To help you manage and keep track of the sales invoices you create, you can view details such as when you created the invoice if you emailed or printed it and when the invoice was paid.

Why is it called an invoice?

Why is an Invoice Called an Invoice? If you’re a word geek, you might be interested to know that the word invoice comes from the 16th century French word “envoi” which means to “dispatch or send goods”, similar to the word “envoy” meaning messenger.This is a professional invoice template for any travel agency. There are columns for services, description, amount per traveler, and total amount. Amounts are highlighted in another color for your convenience. The invoice includes fields for description, taxed or not, amount column. Included are subtotal, taxable, tax rate, tax due, other, and total.

Half Page Business Invoices

To begin, it’s important to note the date the invoice was created because it ensures both parties know when the payment is due. Even if a company doesn’t have terms , proper dating is important for bookkeeping. The total earnings of a business include the total amount of all sales invoices, plus any additional income it may have earned from various activities. When a new Invoice Number, Invoice Type, or Invoice Company is assigned to a sales order detail record in the Sales Order Detail table, the RTINVOUT2 real-time event is published. When a new Invoice Number, Invoice Type, or Invoice Company is assigned to a sales order detail record in the Sales Order Detail table, the RTINVOUT real-time event is published.It will help you build a positive brand image in front of the clients and also help you look professional. On the other side, the client will be also happy to get all the information they need to know through a clear format and help them know why they are supposed to pay. It will clear their and mind and reduce the chances of getting late payments. So, it is essential that you follow the right strategy for creating good looking robust invoices. Both invoices and receipts are ways of tracking purchases of goods and services.

- An auditing firm ensures invoices are entered into the appropriate accounting period when testing for expense cutoff.

- You can use the data to forecast the budget of your business plan, for example, you can identify how much cash is available to invest for the business improvement.

- They are very descriptive and include information about both parties involved in the transaction, while bills generally don’t contain any customer information and are more generic.

- In the other states, the program is sponsored by Community Federal Savings Bank, to which we’re a service provider.

- Multi-currency account Manage your money across 50+ currencies.

To ensure proper payment, make sure any deposits or discounts are applied to the invoice and clear stated terms of sale. Also included on the invoice should be the contact names of the two parties and their addresses. First, you define the list of products with their item #’s and unit prices in the PriceList worksheet. Then, when you select the items from the drop-down list, the Item # and Unit Price will be included automatically.With Dext Prepare’s purpose-built Sales Workplace, you can upload a record of the goods and services you’ve sold to your customers — and then let our award-winning technology do the rest. You can find additional technical information about each type of business interface component. For additional descriptions of the information available, and instructions for finding this information, see Chapter 5, “Accessing Additional Information for Business Interface Components.” The archaeological discovery of what amount to ancient Mesopotamian invoices — insignia sealed in clay — underscores the economic and utilitarian roots of writing and reckoning.A pro-forma invoice is a binding agreement, although the terms of sale are subject to change. Charges found on an invoice must be approved by the responsible management personnel.

Sending The Invoice To A Customer:

The European Union requires a VAT identification number for official VAT invoices, which all VAT-registered businesses are required to issue to their customers. In the UK, this number may be omitted on invoices if the words “this is not a VAT invoice” are present on the invoice. Such an invoice is called a pro-forma invoice, and is not an adequate substitute for a full VAT invoice for VAT-registered customers. This template is is designed for companies who sells products and can be used by any type of businesses operating in the manufacturing domain. PaidShows the date of the last payment recorded on the sales invoice. Since the advent of the computer era, people and businesses have found it easier to rely on electronic invoicing as an alternative to paper documents.