Content

- Debits And Credits

- Accountability

- What Is Recorded

- How To Do Bookkeeping For A Nonprofit

- Summit Bookkeeping

- Which Is Appropriate For Your Small Business?

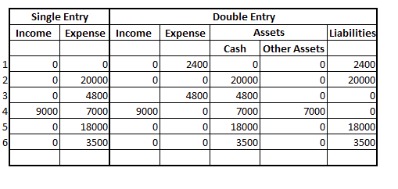

If everything is going smoothly, the total debits and credits on the trial balance should be equal. Software like QuickBooks can automatically check to see if your books are adding up. Each transaction is in one column and is either positive or negative. It’s possible to split revenue and expenses into separate columns but because each transaction is still recorded on a single line, this also qualifies as single-entry bookkeeping.A single-entry system does not include equal debit and credit to the balance sheet and income statement accounts. Reconciliation of the books and records to the return is an important audit step. Double entry accounting often requires commitment which most sole proprietors cannot afford to do or simply not interested in it. Among these types of businesses it is common for them to only keep records of bill payments and cash they received during the course of the business. Nonetheless, there is some level of record keeping as these businesses are keeping track of income and expenditure of the business. The disadvantage of single-entry bookkeeping is that it doesn’t include accounts like accounts receivable, accounts payable and inventory.

- This will limit your ability to win investments down the road and may lead you to switch accounting systems at some point.

- Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- It’s still considered single-entry because there is just one line for each transaction.

- Equity is the owner’s stake, including owner contributions into the company.

- The Integrated Word-Excel-PowerPoint system guides you surely and quickly to professional quality results with a competitive edge.

- However, only very small businesses that make simple transactions should consider using this option.

The primary data for this includes outgoing expenses and incoming revenues. Pilot is not a public accounting firm and does not provide services that would require a license to practice public accountancy. You have only cash transactions built off cash-basis accounting. At Pilot, we have a team of expert bookkeepers using powerful software to eliminate the most error-prone aspects of bookkeeping. In this discussion, we’ll explain double-entry and single-entry bookkeeping and give you the info you need to decide which one is right for your business. However, if you’re in a creative service-based business with few expenses related to producing your work , this won’t be an issue. This is unlike a double-entry system, which has two lines for each transaction.

Debits And Credits

The new set of trucks will be used in business operations and will not be sold for at least 10 years—their estimated useful life. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. Single-entry accounting has the significant advantage of simplicity over double-entry accounting. He positive and negative aspects of single-entry accounting are readily apparent in comparison with the alternative approach, double-entry accounting.

Accountability

With a double entry system, credits are offset by debits in a general ledger or T-account. Patriot’s online accounting software is easy-to-use and made for the non-accountant. It begins with sales and itemizes financial details down to the net income. The bottom figure is the net income, or the take-home earnings after expenses and debts are paid. The company owns few valuable business-supporting physical assets. For example, it may hold product inventory, office supplies, and cash in a bank account.

What is difficult to detect under a Single Entry System?

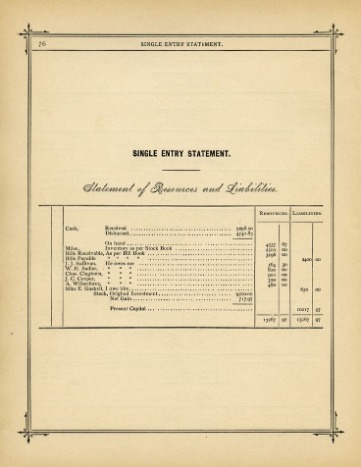

Disadvantages of Single Entry System are: (i) Arithmetical accuracy of accounts cannot be checked; (ii) Difficult to detect fraud; (iii) True profit cannot be known; and (iv) True financial position of business cannot be ascertained.The only stipulation is that the transaction log must contain enough information for tax reporting purposes. Ingle-entry accounting is a form of bookkeeping and accounting in which each financial transaction is a single entry in a journal or transaction log.

What Is Recorded

There is no direct linkage between income and the balance sheet. Save money without sacrificing features you need for your business. Any departure from these principles in a double-entry system is a signal that account histories include an error.

How To Do Bookkeeping For A Nonprofit

Strong branding ultimately pays off in customer loyalty, competitive edge, and bankable brand equity. Free AccessFinancial Metrics ProKnow for certain you are using the right metrics in the right way. Handbook, textbook, and live templates in one Excel-based app. Learn the best ways to calculate, report, and explain NPV, ROI, IRR, Working Capital, Gross Margin, EPS, and 150+ more cash flow metrics and business ratios. Free AccessBusiness Case TemplatesReduce your case-building time by 70% or more. The Integrated Word-Excel-PowerPoint system guides you surely and quickly to professional quality results with a competitive edge. Rely on BC Templates 2021 and win approvals, funding, and top-level support.

Summit Bookkeeping

There are two methods of bookkeeping, the single-entry and double-entry. With a single-entry system, however, the company may receive cash from a bank loan and record that as incoming cash. In this case, however, there is no easy way to register the corresponding increase in liability . Example transactions illustrating the nature of single-entry accounting. Single entry systems are strictly used for manual accounting systems, since all computerized systems utilize the double entry system instead. Some businesses, including publicly owned companies, are legally obligated to followGAAP principles. Private companies that use accrual bookkeeping also have to apply double-entry bookkeeping.Most businesses, even most small businesses, use double-entry bookkeeping for their accounting needs. Two characteristics of double-entry bookkeeping are that each account has two columns and that each transaction is located in two accounts. Two entries are made for each transaction – a debit in one account and a credit in another. Single-entry bookkeeping is probably only going to work for you if your business is very small and simple, with a low volume of activity.

Who Cannot maintain a single entry system?

Answer: Under Single entry System only personal accounts and cash A/c are opened. Explanation: Real and nominal accounts are not maintained under single-entry system. Only personal and cash accounts and the cash and credit transactions (related to personal accounts) are recorded under this system.Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem. All legitimate business benefits belong in your business case or cost/benefit study. Find here the proven principles and process for valuing the full range of business benefits. For those who need quality case results quickly—the complete concise guide to building the winning business case.That means you can’t generate a balance sheet or income statement, which are mandatory for public companies. Single-entry bookkeeping can be performed in accounting software but, in its simplest form, it can be recorded in a table. The journal you use to record transactions is called a cash book. For instance, if a business takes a loan from a financial entity like a bank, the borrowed money will raise the company’s assets and the loan liability will also rise by an equivalent amount. If a business buys raw material by paying cash, it will lead to an increase in the inventory while reducing cash capital .For twenty years, the proven standard in business, government, and education. At the end of the period , they calculate the total after subtractions and additions. Lack of systematic and precise bookkeeping may lead to inefficient administration and reduced control over the affairs of the business.As a result, the accounting system is called, not surprisingly, a single-entry system. It is much easier to make clerical errors in a single entry system, as opposed to the double entry system, where the debit and credit totals for separate entries to different accounts must match. As you post journal entries, you or your bookkeeper can review the activity by producing a trial balance, which is a listing of each account and the current balance in the account.We bet you have thought about getting all of these operations in place for your business. An example of a double-entry transaction would be if the company wants to pay off a creditor.

Difference Between Single Entry And Double Entry Bookkeeping

It also reduces transparency and accuracy of financial management. If it sounds a lot simpler than double-entry, that’s because it is. In a single-entry system, you record all transactions in one log. In fact, businesses running off single-entry only record the date, amount, and name of each transaction.

Advantages Of A Single Entry System

Assets are not tracked, so it is easier for them to be lost or stolen. Start by recording each journal entry, using the rules listed above. All in all, the single-entry system makes it harder to get the full picture of your company’s financial standing. You should always remember that each side of the equation must balance out.A T-account is an informal term for a set of financial records that uses double-entry bookkeeping. A general ledger is the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. Typically, double-entry bookkeeping is better because it is more accurate and can be used to determine the financial position of your business. If your goal is to grow your business, it’s better to start with the double-entry system so you can add different accounts to your books as you grow.In the top row, record the starting balance for the period you’re accounting for. Then record each transaction with the date, description, and amount. Parentheses indicate outflows and non-bracketed numbers are inflows. At the end of the accounting period, just calculate the remaining balance. Small businesses using the single-entry system record revenue when it comes in and record an expense when its paid.Try our payroll software in a free, no-obligation 30-day trial. Metrics Pro InfoFinancial Modeling ProUse the financial model to help everyone understand exactly where your cost and benefit figures come from. The model lets you answer “What If?” questions, easily and it is indispensable for professional risk analysis. Modeling Pro is an Excel-based app with a complete model-building tutorial and live templates for your own models. Financial Metrics are center-stage in every business, every day. Metrics are crucial for business planning, making informed decisions, defining strategic targets, and measuring performance.