Content

- Which Is Appropriate For Your Small Business?

- Learn About The 8 Important Steps In The Accounting Cycle

- Cash Book

- Thoughts On single Entry System In Accounting

- Shortcut Method

- What Are The Different Kinds Of Thinking Needed To Take On A Business Sustainability Mindset?

- Accounting Accrual Vs Cash Basis

- How To Calculate Credit And Debit Balances In A General Ledger

Companies that deliver goods and services and receive payment on different dates may also find that the single-entry system doesn’t suit their needs. The double-entry system is better at matching expenses related to producing a good or service and its resulting payment. If the two are in different accounting periods, a single-entry system won’t be able match the two up. Plus, the single-entry system doesn’t require complicated accounting software—a simple spreadsheet or program will do. Single-entry bookkeeping is a system of accounting where there is only one entry for each transaction.

Who Cannot maintain a single entry system?

Answer: Under Single entry System only personal accounts and cash A/c are opened. Explanation: Real and nominal accounts are not maintained under single-entry system. Only personal and cash accounts and the cash and credit transactions (related to personal accounts) are recorded under this system.This is still considered single-entry bookkeeping because you are only recording the transaction once. With this system, it is impossible to track the history of assets and liabilities of the company. It is an issue, especially for large business organizations that invest a lot in infrastructure, advertising, and other intangible costs. The non-monetary costs are not recorded, making it hard to concretize the financial performance of the firm.And, using the single-entry method is a good way to start learning how to manage your books. Single-entry bookkeeping is the simplest way to organize your accounting records. Think about your business’s size, industry, and specific needs before choosing a method. Though double-entry is more difficult than the single-entry system of bookkeeping, the method offers benefits to small business owners. It reduces the chance of making an error because you must balance the entries.

Which Is Appropriate For Your Small Business?

Service-based businesses may also prefer the single-entry system because, without the complication of inventory, a more robust accounting system isn’t required. Small businesses using the single-entry system record revenue when it comes in and record an expense when its paid. Companies using a double-entry system record revenue when it’s earned, not received.

Learn About The 8 Important Steps In The Accounting Cycle

An opening journal entry debiting the respective assets and crediting the respective liabilities may be passed. Normally under the single entry system, only personal accounts are kept, whereas impersonal accounts are not recorded at all. The single entry system is a bookkeeping system in which, sometimes, both aspects of a transaction are recorded, whereas other times, only one aspect of a transaction is recorded. It is nearly impossible to build a single-entry system, however, that by itself supports the reporting needs of public corporations . An example of a double-entry transaction would be if the company wants to pay off a creditor. The cash account would be reduced by the amount the company owes the creditor. Then, the double-entry reduces the amount the business now owes to the creditor account as it has received the amount of the credit the business is extending.Starting out with double-entry bookkeeping, even when your business is small, is the best long-term plan. Building the structures that support scaling and growth will open up investment opportunities, streamline financial management, and allow you to make wiser financial decisions. The balance may be entered in the journal in the form of opening entries under the double entry system. When a business grows rapidly, then at some future point, the single entry system will no longer be workable.

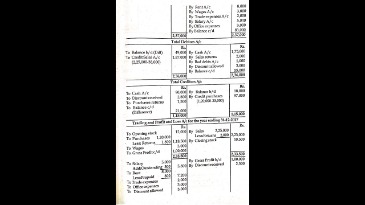

Cash Book

In fact, single entry systems are a mixture of double entry, single entry, and no entry. Single-entry bookkeeping is a method for recording your business’s finances. The single-entry method is the foundation of cash-basis accounting. As your small business begins to make transactions, you need to record them in your books.

What is general accounting system?

A general accounting system is a system that keeps track of inventory on a periodic basis. This was most often used in manufacturing companies.Because the business has accumulated more assets, a debit to the asset account for the cost of the purchase ($250,000) will be made. To account for the credit purchase, a credit entry of $250,000 will be made to notes payable. The debit entry increases the asset balance and the credit entry increases the notes payable liability balance by the same amount.

Thoughts On single Entry System In Accounting

According to the Internal Revenue Service, single-entry bookkeeping is based on the income statement . It can be simple and practical for those starting a small business.

- Get up and running with free payroll setup, and enjoy free expert support.

- The balance may be entered in the journal in the form of opening entries under the double entry system.

- Most people can readily understand and use single-entry methods without special training or background in accounting or finance.

- Most businesses, even most small businesses, use double-entry bookkeeping for their accounting needs.

- Some thinkers have argued that double-entry accounting was a key calculative technology responsible for the birth of capitalism.

- Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

Business professionals who understand core business concepts and principles fully and precisely always have the advantage, while many others are not so well-prepared. Rely on the premier business encyclopedia to sharpen your grasp of essential business concepts, terms, and skills. Financial Metrics are center-stage in every business, every day. Metrics are crucial for business planning, making informed decisions, defining strategic targets, and measuring performance. For those who need quality case results quickly—the complete concise guide to building the winning business case. For twenty years, the proven standard in business, government, and education.

Shortcut Method

However, if you’re in a creative service-based business with few expenses related to producing your work , this won’t be an issue. The previous section covered the features of a single-entry bookkeeping system. By looking at a couple of examples, you should have a better understanding of the basics of a single-entry system. There is much less information available upon which to construct the financial position of a business, so management may not be fully aware of the performance of the firm. Devra Gartenstein is an omnivore who has published several vegan cookbooks. This blog provides indepth information on single entry system and it helps me know the concepts of single entry system as well.

What Are The Different Kinds Of Thinking Needed To Take On A Business Sustainability Mindset?

Finally, suppose an entity has a futuristic vision for pitching a strong deck for lucrative investments or expanding business in the future. In that case, it is better to opt for double-entry bookkeeping. Even in a budding start-up, if there is a vision to attract financial investors in the future, double-entry bookkeeping is recommended. Only monetary transactions are involved in simple accounting. Here, the different types of expenses are further broken down into different types to better track finances. The spreadsheet generally involves barely three columns, the date, the nature of the transaction, and any income or expense. You have only cash transactions built off cash-basis accounting.

Accounting Accrual Vs Cash Basis

In such situations, the single entry system should be converted into a double entry system. This approach is applicable where the double entry system is maintained. In this approach, every transaction is analyzed and the net result of the business is calculated. Under this approach, a sequence of steps is adopted, as described in this section. Mr. John, who keeps his books using the single entry system, has told you that his capital on 31 December 2019 was $40,500, and on 1 January 2019, it was $25,800. He further informs you that he has withdrawn $3,500 for personal purposes.

How To Calculate Credit And Debit Balances In A General Ledger

It also helped merchants and bankers understand their costs and profits. Some thinkers have argued that double-entry accounting was a key calculative technology responsible for the birth of capitalism. If it sounds a lot simpler than double-entry, that’s because it is. In a single-entry system, you record all transactions in one log. In fact, businesses running off single-entry only record the date, amount, and name of each transaction. The only stipulation is that the transaction log must contain enough information for tax reporting purposes.Does not track asset and liability accounts such as inventory, accounts receivable and accounts payable. Given that the records are not kept under the double entry system, they are considered incomplete records. In a nutshell, the single entry is a system in which accounting records are not recorded exactly like the double entry system.The single-entry system doesn’t have this failsafe, so errors can be carried forward and compounded without anyone noticing. To account for the credit purchase, entries must be made in their respective accounting ledgers.This system reflects a personal checkbook, where you record the date, amount, and a description of each transaction. It is easy to use and does not require a background or knowledge in bookkeeping. However, only very small businesses that make simple transactions should consider using this option. Bookkeeping systems range from utterly simple to extremely complex. Single-entry bookkeeping is a system that tracks basic income and expenditures as these transactions occur.