Content

- Interest Coverage Ratio

- British Dictionary Definitions For Solvency

- Statistics For Solvency

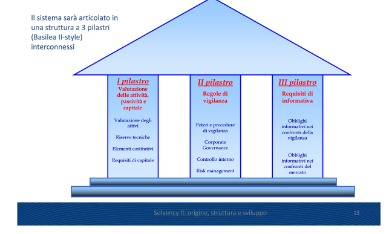

- How Do You Determine Solvency Ratio Requirements Under The Basel Iii Accord?

- The Ideal Quick Ratio

- What Factors Can Risk Solvency?

- How To Find A Companys Financial Solvency

- What Happens If A Company Is Not Financially Solvent?

To summarize, Liquids Inc. has a comfortable liquidity position, but it has a dangerously high degree of leverage. As the quick ratio falls between the current ratio and the cash ratio, the “ideal” result also falls between those two ratios. Lenders will frequently look for a quick ratio of 1.2 or above before they’ll extend further debt to a company. Solvency and liquidity ratios make it much easier for businesses to strike the right balance between debt, assets, and revenues.

How does leverage work?

Leverage is the strategy of using borrowed money to increase return on an investment. If the return on the total value invested in the security (your own cash plus borrowed funds) is higher than the interest you pay on the borrowed funds, you can make significant profit.There are also other ratios that can help to more deeply analyze a company’s solvency. The interest coverage ratio divides operating income by interest expense to show a company’s ability to pay the interest on its debt. Thedebt-to-assets ratiodivides a company’s debt by the value of its assets to provide indications of capital structure and solvency health. If solvency and liquidity ratios are poor, focus on improving your solvency first. Reducing your company’s leverage will generally correspond to an increase in liquidity as well, but the reverse is not always true.

Interest Coverage Ratio

SST ratios filed with our regulator are subject to the regulator’s review and approval of the internal model. See “Note on risk factors” and “Cautionary note on forward-looking statements” in our most recent annual or half-year report for factors that could affect the SST ratio.

- Solvency and liquidity are two different things, but it is often wise to analyze them together, particularly when a company is insolvent.

- Accountants have come up with a number of different ways to assess a company’s solvency.

- Management of a company faced with an insolvency will have to make tough decisions to reduce debt, such as closing plants, selling off assets, and laying off employees.

- When calculating the solvency ratio, be sure that you are looking at reports generated in the same period.

- A rising debt-to-equity ratio implies higher interest expenses, and beyond a certain point, it may affect a company’s credit rating, making it more expensive to raise more debt.

It’s similar to the current ratio except that the quick ratio excludes inventory from current assets. The cash ratio is a much stricter way to measure liquidity than the current ratio. Instead of comparing all current assets to current liability, it uses only cash and cash-equivalent assets.

British Dictionary Definitions For Solvency

This is why it can be especially important to check a company’s liquidity levels if it has a negative book value. The quick ratio, sometimes called the acid-test ratio, falls between the current ratio and the cash ratio, in terms of strictness.

Statistics For Solvency

Any business looking to expand in the long term should aim to remain solvent. The balance sheet of the company provides a summary of all the assets and liabilities held. A company is considered solvent if the realizable value of its assets is greater than its liabilities.Overall, Solvents Co. is in a dangerous liquidity situation, but it has a comfortable debt position. But as a general rule of thumb, keeping your ratio around 2 is usually best. A ratio of 2 means that you have twice as much liability as equity, which is generally a good balance. Bakery B’s solvency ratio is less than 20% which could be looked at unfavorably by lenders.A company can be insolvent and still produce regular cash flow as well as steady levels of working capital. Carrying negative shareholders’ equity on the balance sheet is usually only common for newly developing private companies, startups, or recently offered public companies. The cash flow-to-debt ratio is generally calculated using a company’s operating cash flow, which is the cash it generates from its most important revenue-generating activities. By comparing cash flow to debt, you can see how much liability a company could afford to pay down using its revenues. The higher this number, the better, though it’s rare to have a cash flow-to-debt ratio of 1 or higher. The debt to equity ratio compares the amount of debt outstanding to the amount of equity built up in a business.

How Do You Determine Solvency Ratio Requirements Under The Basel Iii Accord?

If the ratio is too high, it indicates that the owners are relying to an excessive extent on debt to fund the business, which can be a problem if cash flow cannot support interest payments. Solvency ratios compare different elements of an organization’s financial statements. The intent of this comparison is to discern the ability of the target entity to remain solvent. Solvency ratios are commonly used by lenders and in-house credit departments to determine the ability of customers to pay back their debts. Also, solvency can help the company’s management meet their obligations and can demonstrate its financial health when raising additional equity.

What are the four liquidity ratios?

Most common examples of liquidity ratios include current ratio, acid test ratio (also known as quick ratio), cash ratio and working capital ratio.Once you’ve made the obvious cuts, look at any short-term ways to save money. For example, you might need to lay off some employees until you’ve dug your business out of its current difficulties. A cash flow Statement contains information on how much cash a company generated and used during a given period. Days sales outstanding, or DSO, refers to the average number of days it takes a company to collect payment after it makes a sale. A higher DSO means that a company is taking unduly long to collect payment and is tying up capital in receivables. Pilot is not a public accounting firm and does not provide services that would require a license to practice public accountancy. Check them at least quarterly if not monthly, and take immediate action if they start to slide.Viability isn’t just about financials, but how well poised for success the business is as a whole, taking into account things like marketing, customer base, and competitive advantage. Also provides a good indication of solvency, as it focuses on the business’ ability to meet its short-term obligations and demands. It analyzes the company’s ability to pay its debts when they fall due, having cash readily available to cover the obligations. The quick ratio is a calculation that measures a company’s ability to meet its short-term obligations with its most liquid assets.

The Ideal Quick Ratio

The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. Insolvency, however, indicates a more serious underlying problem that generally takes longer to work out, and it may necessitate major changes and radical restructuring of a company’s operations. Management of a company faced with an insolvency will have to make tough decisions to reduce debt, such as closing plants, selling off assets, and laying off employees.For example, Sears’ balance sheet for the fiscal year ending in 2017 revealed a debt-to-asset ratio of just over 1.4. That put the company in a very tight financial spot because any slowdown in revenue can make it extremely difficult for a highly leveraged company to meet its obligations. In the case of Sears, its high debt ratio was an important factor in the company’s 2018 bankruptcy.Solvency is the ability of a company to meet its long-term debts and financial obligations. Solvency can be an important measure of financial health, since its one way of demonstrating a company’s ability to manage its operations into the foreseeable future. The quickest way to assess a company’s solvency is by checking its shareholders’ equity on the balance sheet, which is the sum of a company’s assets minus liabilities.But be cautious about acquiring new debt; too much of that will put you right back where you started. Building up your sales and marketing efforts can greatly increase your revenues in the medium to long term. That means more cash coming in that you can use to pay down an excessive debt load. Net income can be calculated by subtracting your total expenses from total revenue. Analyzing the trend of these ratios over time will enable you to see if the company’s position is improving or deteriorating. Pay particular attention to negative outliers to check if they are the result of a one-time event or indicate a worsening of the company’s fundamentals. Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance.

What Factors Can Risk Solvency?

Cash-equivalents are investments that have a maturity date of three months or less, such as short-term certificates of deposit. Debt exceeds equity by more than three times, while two-thirds of assets have been financed by debt. Note, as well, that close to half of non-current assets consist of intangible assets .The lower your debt-to-asset ratio, the less risky you’ll look to bankers, investors, and the like. After all, if your assets are substantial compared with your liabilities, in a worst-case scenario you can sell some assets to cover those liabilities. ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces. Total liabilities are calculated by adding your current plus long-term liabilities. Every business needs to have solvency, or it’s game over very quickly, but just what does that mean in practical terms? Explore everything you need to know, starting with our solvency definition. A liquidity event is a process by which an investor liquidates their investment position in a private company and exchanges it for cash.

How To Find A Companys Financial Solvency

The current ratio is current assets divided by current liabilities, and indicates the ability to pay for current liabilities with the proceeds from the liquidation of current assets. The ratio can be skewed by an inordinately large amount of inventory, which can be hard to liquidate in the short term. The cash flow also offers insight into the company’s history of paying debt.The income statement shows performance over a set period of time , while the balance sheet shows running totals over the life of your business. Unlike the income statement, the balance sheet is a snapshot that captures the state of your business on a single day. A solvent company is able to achieve its goals of long-term growth and expansion while meeting its financial obligations. In its simplest form, solvency measures if a company is able to pay off its debts over the long term. The debt to equity (D/E) ratio indicates the degree of financial leverage being used by the business and includes both short-term and long-term debt. A rising debt-to-equity ratio implies higher interest expenses, and beyond a certain point, it may affect a company’s credit rating, making it more expensive to raise more debt.

Why Should Businesses Care About Solvency?

A low debt-to-equity ratio means you have lots of equity to balance out your liabilities. This is generally a good thing — it means your business has little risk of becoming insolvent. On the other hand, an extremely low ratio may mean that you’re missing some important opportunities.Solvency portrays the ability of a business to pay off its financial obligations. For this reason, the quickest assessment of a company’s solvency is its assets minus liabilities, which equal its shareholders’ equity. There are also solvency ratios, which can spotlight certain areas of solvency for deeper analysis. Based on its current ratio, it has $3 of current assets for every dollar of current liabilities. Its quick ratio points to adequate liquidity even after excluding inventories, with $2 in assets that can be converted rapidly to cash for every dollar of current liabilities.But it’s not simply about a company being able to pay off the debts it has now. When assessing the financial health of a company, one of the key considerations is the risk of insolvency, as it measures the ability of a business to sustain itself over the long term. The solvency of a company can help determine if it is capable of growth. The shareholders’ equity on a company’s balance sheet can be a quick way to check a company’s solvency and financial health. Most metrics come from either the balance sheet or the income statement. It’s rare to run a calculation that requires information from both, but that’s the case with the solvency ratio.