Content

- 1 10 Maintaining Combined Statements

- Daily Statement Of Account

- Why You Should Be Monitoring Your Checking Account Regularly

- Previous Account Balance

- 1 5 Maintaining Statement Generation Batch

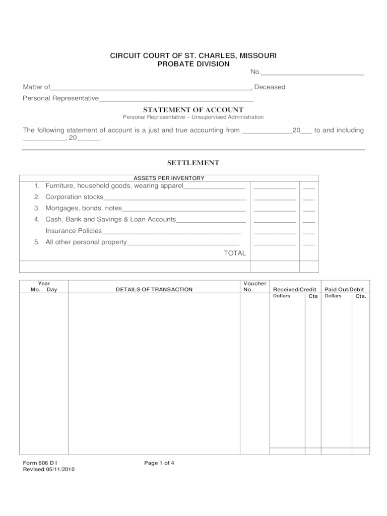

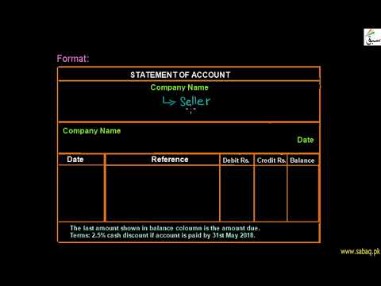

- Definition And Examples Of A Statement Of Account

- More Definitions Of Statement Of Account

The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance. She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction from Bennington College. If ‘All Accounts/Loans’ is unchecked then the ‘Populate’ button will be disabled. Specify the account branch from which charge is deducted for the E-Statement. You need to maintain two records – for one choose ‘Savings’ and for the other choose ‘Nostro’. You need to maintain two advice formats – one for Savings accounts and the other for Nostro accounts viz ‘ACST_DETAILED’ and ‘SWIFT’ respectively as shown below. Provide more details about this review of ‘Statement of Account’.Choose ‘ACST_DETAILED’ for Savings type of account class and Nostro type of account class. If desired, click “Print Statement” to create a printable version of the account statement. Consider labeling this balance clearly as the current account balance or updated balance to make this important information stand out. You can adjust your formatting to bold this number or create a box around it to make it easily visible. A personal financial statement is a document or set of documents that outline an individual’s financial position at a given point in time.A statement of account is a summary of a client’s account activity over a specific time period which can be monthly, quarterly, or another defined period. An account statement can be issued for any account type that has ongoing transactions, such as a bank account, credit card account, or insurance account. Periodically, the account statement makes it easier to view all invoices sent to the customer and payments received from the customer.

1 10 Maintaining Combined Statements

A statement of account captures the financial transactions between the two companies during a specific period of time, usually a one month period. The statement of account may show an amount still owing by the client. A statement of account, or account statement, is issued by a vendor to a client. It lists out all the financial transactions between the two businesses within a specific time period . The statement may reflect a zero balance, if not, it acts as a reminder to the client that money is due.

Daily Statement Of Account

The ending balance shows customers exactly how much they owe the company. If the balance is zero, it means the customer has made all of their payments. An account statement is not the same as an invoice; rather, it’s a report sent to a client that lists all the invoice amounts and payments during that period. Learn about how statements of account work, read a few examples, and discover the types of account statements business use. The companies above generally bill their customers at the end of every month, and they send an account statement detailing all transactions in the customer’s account. The statement shows debits paid to the account, credits received, account maintenance fees, state taxes, and any surcharges included in the account.

- They are most effective when issued within an email with a payment link, so that customers can pay at once with a credit card.

- You need to maintain two advice formats – one for Savings accounts and the other for Nostro accounts viz ‘ACST_DETAILED’ and ‘SWIFT’ respectively as shown below.

- An account statement is also important for clients because it allows them to accurately track their payments and spending.

- The account statement is also important when checking the consistency of records in a customer’s account.

- An account statement is a periodic statement summarizing account activity over a set period of time.

The system displays the date on which the statement request was last executed, if any. Specify ‘ACSTHAND’ or select this value from the adjoining option list. Here you need to maintain three records with the following details. The Date column for “Tuition, Fees, and Other Charges” represents the last time the charge was adjusted. For example, tuition charges, depending on enrollment status and other factors, may change. However, an electronic statement can be easier to obtain than a physical one through computer fraud, data interception, and/or theft of storage media. Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014.A credit or loan account statement, for example, may show not only the outstanding balance due but the interest rate charged on that debt and any fees that have been added during the payment cycle. This can include late charges for payments not received by their due date as well as overdraft fees when bank account holders overspend.

Why You Should Be Monitoring Your Checking Account Regularly

Savings account transactions are recorded on a periodic statement. Malcolm Tatum After many years in the teleconferencing industry, Michael decided to embrace his passion for trivia, research, and writing by becoming a full-time freelance writer. Since then, he has contributed articles to a variety of print and online publications, including , and his work has also appeared in poetry collections, devotional anthologies, and several newspapers. Malcolm’s other interests include collecting vinyl records, minor league baseball, and cycling. Statement of Accountmeans the Bank’s monthly or other periodic statement sent to the Cardholder showing details of the Statement Balance.An account statement lists the debits and credits that have taken place over a time period. Financial institutions are required to produce paper statements to customers unless the customer requests either electronic statements or no statements at all. Historically, the production of statements was regarded as part of the banking function, the cost of which was part of providing the service.

Previous Account Balance

An account statement is a periodic statement summarizing account activity over a set period of time. In rare cases, the presence of large credits on a statement of account may reveal that the seller owes money to the customer, in which case a payment or ongoing credit is arranged. The adjoining option list displays all the valid account numbers maintained in the system. You can invoke the ‘Customer Address Maintenance’ screen by typing ‘MSDCUSAD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. You can invoke the ‘Advice Format Maintenance’ screen by typing ‘MSDADVFT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.Any cash payments in and out of the account are shown in the statement, and the ending balance shows the current account balance at the end of the period. An account statement can be generated for any type of account with ongoing transactions such as a brokerage account, insurance account, credit card, or bank account.

1 5 Maintaining Statement Generation Batch

A statement of accounts is one tool you can use to record customer transactions and balances. This tool can help you organize your company’s finances and ensure timely payments for services.

What is bank statement account?

Key Takeaways. A bank statement is a list of all transactions for a bank account over a set period, usually monthly. The statement includes deposits, charges, withdrawals, as well as the beginning and ending balance for the period.Service providers also send a periodic account statement to their customers, showing the level of consumption, unpaid credits, prepayments, and the amount due for the period. Examples of utility companies include cable TV service, telephone and internet subscription providers, water providers, and power companies. With the advent of digital technology, banks don’t issue as many personal account statements anymore. This is because customers can now go online to pay their bills or move their money, and can see transactions right up to the second they log in.You can invoke this screen by typing ‘STDACRST’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Bank statements are commonly used by the customer to monitor cash flow, check for possible fraudulent transactions, and perform bank reconciliations.These include cash withdrawals, bill payments, and wire transfers. The post date is the day, month, and year when a card issuer posts a transaction and adds it to the cardholder’s account balance. Select ‘User Input Date’ to specify the date with which the combined statement should be generated. The statement displays the balance for CASA and TD accounts based on book dated or value dated balance. Account No – The system displays all the open and closed loan accounts based on the customer selected. Account No – The system displays all the open and closed deposit accounts based on the customer selected.You can invoke this screen by typing ‘STDCRSMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. An account statement is the record of transactions and their effect on account balances over a specified period of time for a given account.The Date column for “Payments, Financial Aid, and Other Credits” represents the original date in which the credit was posted to the student’s account. Clicking the “Print Statement” button will open a new window, displaying a PDF version of the requested Statement of Account. Indeed is not a career or legal advisor and does not guarantee job interviews or offers. Explore answers to frequently asked questions about earning a master’s degree in computer science, including whether you need one and potential career paths. Impose refers to the act of placing a fee, levy, tax, or charge on an asset or transaction to the detriment of the investor. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities.

Is A Statement Of Account An Invoice?

At the end of your statement, you can include information about when a payment is due, your company’s late fees and how a customer can pay you. If you prefer customers to pay by check or mail, you can include a removable paper slip for the customer to send back with their payment. You could also include electronic payment options and links to your website to help customers pay their charges. Consider making this section clear and easy to read to improve your customers’ payment process. At the end of the period, the card company sends out a credit card statement to the cardholder that shows all the transactions, the fees charged, and the balance. It can also show billings to the customer and payments made by the customer, resulting in an ending balance that can be positive or negative. Companies may send the account statement to a customer to remind them of credits that are still unpaid for the services rendered.