Content

- What Is The Salt Deduction, And How Has It Changed?

- Still Feeling Unsure? Talk To A Tax Pro

- Excise Taxes

- Top Rates In Each State Under Joe Bidens Tax Plan

- Who Uses The Salt Deduction?

- Not Right For All Businesses

Each of these caps could then be reduced annually by $2,000 and $1,000, respectively, eventually reaching zero. By 2032, while the SALT deduction would still technically be in the tax code, it would have effectively been removed altogether, which we have argued for previously.

What is the SALT deduction for 2020?

The Joint Committee on Taxation (JCT) estimated that the deduction for state and local taxes paid would cost the federal government $24.4 billion for 2020. If Congress does not make permanent the individual tax provisions, the SALT deduction cap of $10,000 per household will expire as scheduled after 2025.The average size of Rhode Island SALT deductions was $12,138.75. At the same time, the SALT deduction is one of the largest federal tax expenditures. In fact, the Congressional Budget Office expects that those and other tax expenditures added up to over 8% of GDP in 2017. That’s an amount equal to nearly half of all federal revenues in 2017. The federal income tax system and some states have higher standard deductions for people who are at least 65 years old and for people who are blind.

What Is The Salt Deduction, And How Has It Changed?

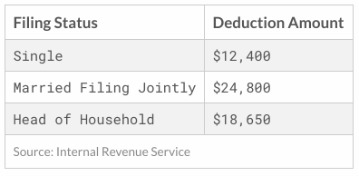

Under federal guidelines, if you are 65 or older and single, your standard deduction goes up by $1,650 for 2020. If you are married filing jointly and one of you is 65 or older, your standard deduction goes up by $1,300. If both of you are 65 or older, the deduction increases by $2,600. Even though all taxpayers are limited to the same $10,000 deduction, the savings won’t be the same for all taxpayers.

- That hit taxpayers, especially high-income taxpayers, in high-income-tax states hard.

- California, for example, has a top rate of 13.3%; Hawaii’s is 11%; New York’s is 10.9%; New Jersey’s is 10.75%.

- Bankrate.com does not include all companies or all available products.

- According to the Tax Foundation, people with incomes over $100,000 receive more than 88% of SALT deduction benefits.

- After legislators realized the impact of this, it was decided to simply reduce the SALT deduction to $10,000.

- People can reasonably disagree about the pros and cons of these various policies.

The reason the savings are so great is that the SALT cap is currently scheduled to expire at the end of 2025, so our proposal to keep phasing it out instead results in some big savings. People can reasonably disagree about the pros and cons of these various policies.

Still Feeling Unsure? Talk To A Tax Pro

This would give some short-term relief for the families with state and local tax bills slightly above the current limit. Again, we don’t think this is necessary, but there is clear political pressure for something here. But they are as much a part of American life as baseball and apple pie. Here’s what you need to know about income taxes before you sit down to file your taxes this spring. If you’re having trouble figuring out what kind of taxes you’ll be paying, try using SmartAsset’s free income tax calculator.

Excise Taxes

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. For example, last week, Gov. Gavin Newsom of California signed a law allowing some businesses to pay an extra 9.3% levy on each owner’s share of the company’s net income.

Top Rates In Each State Under Joe Bidens Tax Plan

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

How does the salt tax deduction work?

The SALT deduction provides state and local governments with an indirect federal subsidy by decreasing the net cost of nonfederal taxes for those who pay them.The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published onlinehere. The findings, interpretations, and conclusions in this report are solely those of its author and are not influenced by any donation. These 10 real estate plays are the best ways to invest in real estate right now.

Who Uses The Salt Deduction?

That doesn’t mean it can’t be done—you can still deduct donations to charity, medical expenses and mortgage interest—but it does mean you have to do some math. Amelia JosephsonAmelia Josephson is a writer passionate about covering financial literacy topics. Amelia’s work has appeared across the web, including on AOL, CBS News and The Simple Dollar. Since these tax matters can get complex, it’s useful to have guidance through tax season from an expert. Financial advisors can provide you with that guidance, and you can pair up with an advisor usingSmartAsset’s matching tool. Student loan debt discharge due to death or disability has not been taxed since 2018.The TCJA doubled the child tax credit from $1,000 to $2,000 for those who qualify, including parents with higher incomes than in the past. Income thresholds for 2020 are $200,000 for single parents and $400,000 for those married filing jointly. In addition to eliminating the cap altogether, other proposals include allowing joint filers to claim the $10,000 deduction for each spouse. Currently, this cap creates a marriage penalty where married couples can only deduct up to $10,000 jointly, while the new proposal would allow them to deduct $20,000 jointly. Another proposal is to increase the cap on the SALT deduction to $15,000 for individual filers and $30,000 for joint filers.Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first.A whopping 45.04% of Maryland tax returns included a deduction for state and local taxes in 2014. That’s the highest percentage of returns claiming SALT deductions of any state.SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. These expenses, up to the amount of income you earned each year, are no longer deductible even though you do have to report any income you earn from your hobby.Child support payments are also nondeductible by the paying spouse and tax-free to the recipient. Remember, this is a tax credit so, unlike a deduction, which reduces taxable income, this comes directly off the total taxes you owe. In addition, a new $500 tax credit is available for dependents aged 17 and older.Help us continue our work by making a tax-deductible gift today. Percentiles would not get much—a 0.4 percent increase in after-tax income. The top one percent, in contrast, would see a 1.9 percent increase in after-tax income. Rather than reversing the cap, there is a strong case for building on the progress made in the TCJA and eliminating the deduction altogether. Take back your hard-earned cash and pay the IRS only what you have to.