Content

- Base Data Update

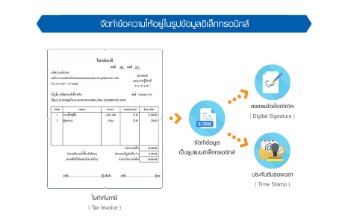

- Electronic

- 7 5 Printing Localization Invoices

- Processing Tax And Export Invoices

- 9 2 Forms Used To Review Legal Documents

- 1 Understanding Tax Invoices For India

The legal format mandates that the invoice be printed on an A4 page. The legal format is the same regardless of whether the invoice is generated by a dealer or a manufacturer. Whether you send invoices or tax invoices, you should keep a full, complete record of your sales documents. Both types of invoices are used for annual accounts and financial reports, while tax invoices are also needed to claim tax credits. Its therefore essential that you meet record-keeping guidelines and requirements, whichever type of invoice you send.The differences can be caused by a change in the price of the item or the tax rates. If the system finds a difference in one or more sales orders, the Invoice Print program automatically launches the Supplementary Tax Invoice program . This program generates the supplementary tax invoice which shows the old sales order amount, new sales order amount, and the net tax amount. The supplementary tax invoice is applicable for excise, sales, and service taxes, TCS as well as VAT and WCT.It is still common for electronic remittance or invoicing to be printed in order to maintain paper records. Standards for electronic invoicing vary widely from country to country. Electronic Data Interchange standards such as the United Nation’s EDIFACT standard include message encoding guidelines for electronic invoices. The EDIFACT is followed up in the UN/CEFACT ebXML syntax cross industry invoice. Timesheet – Invoices for hourly services issued by businesses such as lawyers and consultants often pull data from a timesheet. A timesheet invoice may also be generated by Operated equipment rental companies where the invoice will be a combination of timesheet based charges and equipment rental charges.

Base Data Update

Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. The template of a tax invoice is essentially the same as a regular invoice template – you can use the same design for both types of invoice, which are both covered byvoluntary standards. Organizations purchasing goods and services usually have a process in place for approving payment of invoices based on an employee’s confirmation that the goods or services have been received. On the other hand, a receipt is proof that certain products and services have been paid for. For the government, tax invoices are important as they prevent tax evasion. Along with the other details of a tax invoice, this form of tax invoice should prominently state the words “recipient created tax invoice”.

Electronic

When integrated to Premier Tax Free , the TFI is actually reprinted, maintaining the same invoice number, but this operation is allowed only once. In some countries it is not allowed to group receipts into only one TFI. In the journal you can select a single sale for the issuing of the TFI. Derives the net tax amount by calculating the difference between the old and the new taxes. Excise authorities have strict regulatory requirements on the number sequencing of invoices. Tax Invoice.The supplying party must provide a Tax Invoice to the receiving party for any Taxable Supply made by the supplying party under this deed.

- If you change a sales order for which you have already printed the tax invoice, you must generate the tax invoice again.

- Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances.

- Self-billing invoice – A self billing invoice is used when a buyer issues the invoice to themselves (e.g. according to the consumption levels he is taking out of a vendor-managed inventory stock).

- Some invoices are no longer paper-based, but rather transmitted electronically over the Internet.

- The supplementary tax invoice is applicable for excise, sales, and service taxes, TCS as well as VAT and WCT.

- A tax invoice consists of tax assessments for excise, sales, and service tax, as well as value-added tax , tax collected at source , and works contract tax .

A recurring invoice is one generated on a cyclical basis during the lifetime of a rental contract. The same principle would be adopted if you were invoiced in advance, or if you were invoiced on a specific day of the month. The European Union requires a VAT identification number for official VAT invoices, which all VAT-registered businesses are required to issue to their customers. In the UK, this number may be omitted on invoices if the words “this is not a VAT invoice” are present on the invoice. Such an invoice is called a pro-forma invoice, and is not an adequate substitute for a full VAT invoice for VAT-registered customers. These may specify that the buyer has a maximum number of days in which to pay and is sometimes offered a discount if paid before the due date. The buyer could have already paid for the products or services listed on the invoice.

7 5 Printing Localization Invoices

Including a header allows you and the client to tell them apart quickly. This will save you time when reviewing your records or completing taxes. From the journal you can select both “Retail Sale” and “Deferred Invoice” transactions. The “Deferred Invoice” transactions are created when a TFI is issued after the sale completion. In the journal you can see the reference to the invoice, for the “Retail Sale” transactions, and the reference to the sale, for the “Deferred Invoice” transactions. If the TFI was issued for more than one “Retail Sale”, the “Deferred Invoice” transaction has a message with the number of the receipts included in it.Contact Information Address NumberSpecify the address book number of the person who verifies the serial numbers of the invoices. The name and position of the person prints on the invoice as the Name & Designation of the Officer Authenticating the Document. This section provides an overview of sales order review and lists the forms used to review details for a sales order. If you’re a freelancer, entrepreneur, or sole trader in Australia, check out the Australian section of our blog, where we give useful tips and advice on invoicing, accounting, and running a small business. For example, a phrase along the lines of ‘total price including GST’. ISDOC is a standard that was developed in the Czech Republic as a universal format for electronic invoices. On 16 October 2008, 14 companies and the Czech government signed a declaration to use this format within one year in their products.

Processing Tax And Export Invoices

If you try to return an item from a receipt that was already included in a TFI, the system informs you that the old TFI will be voided and a new one issued. Select the invoices to print and then select Reprint from the Row menu. You can use the Reprint Invoices program to reprint selected documents. Tax Invoice.The supplier must deliver a tax invoice or an adjustment note to the recipient before the supplier is entitled to payment of an amount under clause 23.3. The recipient can withhold payment of the amount until the supplier provides a tax invoice or adjustment note as appropriate. There’s a few different ways to go about invoicing, and the process is the same whether or not your invoices include tax. In Australia, most goods and services are taxed at a rate of 10%, but some items are exempt from GST – including most basic foods, some medical-related goods and services, and some childcare services.

9 2 Forms Used To Review Legal Documents

Set up the second version to generate the export invoice in a foreign currency and select the sales order status of the previous version. In proof mode, the system does not assign a legal number or store information in localized tables. In final mode, the system assigns a legal number, based on the next numbers setup for legal documents, and an internal document number to each invoice.You send the supplementary tax invoice to the customer with the regenerated invoice to provide details of the difference in the invoice amount. Both invoices and receipts are ways of tracking purchases of goods and services. In general the content of the invoices can be similar to that of receipts including tracking the amount of the sale, calculating sales tax owed and calculating any discounts applied to the purchase. Invoices differ from receipts in that invoices serve to notify customers of payments owed, whereas receipts serve as proof of completed payment. Specify the last status code and the next status code for sales orders if an error occurs during invoice processing. You generate export invoices only for foreign customers who are not located in India.

1 Understanding Tax Invoices For India

The format of a tax invoice is based on whether the document is generated by a dealer or a manufacturer. Although it’s only common in a few specific industries, it is possible to have both taxable and non-taxable items within a single sale. If this happens, you should send an invoice that clearly shows which of the items listed are taxable, as well as the total amount of GST to be paid. Whenever you make a sale, you should bill your customer, but whether you do this with standard invoices or tax invoices depends on whether or not you’re registered for GST. Some invoices are no longer paper-based, but rather transmitted electronically over the Internet.The recipients must issue the tax invoice to the suppliers within 28 days of the sale. They should also retain the original or a copy of the invoice for tax purposes.See our guide to invoicing software for small businesses for more detail on all your options. These formats can include file numbers , unique billing codes, or date-based purchase order numbers.VAT or GST, then the buyer and seller may need to adjust their tax accounts in accordance with tax legislation. A Self-Billing Agreement will usually provide for the supplier not to issue their own sales invoices as well.The tax invoices are also issued to a customer who is GST registered. Every business has to charge for different taxes, whether VAT, HST, and GST , from every customer who makes purchases and remits them to the government.Implementations of invoices based on UBL are common, most importantly in the public sector in Denmark as it was the first country where the use of UBL was mandated by law for all invoices in the public sector. Further implementations are underway in the Scandinavian countries as result of the North European Subset project. Implementations are also underway in Italy, Spain, and the Netherlands (UBL 2.0) and with the European Commission itself. Electronic Invoicing is not necessarily the same as EDI invoicing. Electronic invoicing in its widest sense embraces EDI as well as XML invoice messages as well as other formats such as pdf. Continuation or Recurring Invoicing is standard within the equipment rental industry, including tool rental.For all GST purposes, a seller must issue a tax invoice to the buyer regardless of whether the sale involves cash or credit. Hence a tax invoice in Australia serves as an invoice as well as a receipt in the conventional sense. The tax invoice must contain seven facts as per the GST Tax Law. Instead of being issued by the supplier, a recipient created tax invoice is a tax invoice that is issued by the buyer of the products or services. These invoices can be issued only when there’s a written agreement between the recipient and the supplier that is current and effective. It’s important to include the date that each invoice is issued. This can clear up confusion when the same customer receives multiple invoices.