Content

- What Are Taxable Wages?

- Popular Offers

- Will You Pay Taxes During Retirement?

- Tax Services

- Alimony Received

- How To File Your Taxes

Assignment of income.Income received by an agent for you is income you constructively received in the year the agent received it. If you agree by contract that a third party is to receive income for you, you must include the amount in your income when the party receives it. You are generally taxed on income that is available to you, regardless of whether it is actually in your possession. You can claim a Recovery Rebate Credit when you file your 2020 taxes if you did not receive your full authorized $1,200 Economic Impact Payment in 2020. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

What Are Taxable Wages?

You must include that amount in your income when your former spouse receives it. Joe Taxpayer earns $50,000 annually from his job, and he has an additional $10,000 in unearned income from investments. Gross business income is not the same as gross revenue for self-employed individuals, business owners, and businesses. Rather, it’s the total revenues obtained from the business minus allowable business expenses—in other words, gross profit.OBTP# B13696 ©2018 HRB Tax Group, Inc. What if I receive another tax form after I’ve filed my return? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

Popular Offers

An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.State e-file available for $19.95. When you come into surprise money, you have to pay taxes on prize money.

What income is tax free?

Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u/s 87A i.e tax liability will be nil of such individual in both – New and old/existing tax regimes. Basic exemption limit for NRIs is of Rs 2.5 Lakh irrespective of age.Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries. Early, non-required withdrawals of retirement plan funds are taxable as income and may be subject to a penalty of 10% additional tax. Find out about the penalties for early withdrawal from a retirement plan. Bank products and services are offered by MetaBank®, N.A. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

Will You Pay Taxes During Retirement?

If you file separately instead, you will need to be careful about which income belongs on yours and your spouse’s return. You will need to verify whose name is on which assets and report the income accordingly. If you live in a community property state, different rules apply, and you may each have to report 50% of the community income. You will also need good records dividing up deductions since you both won’t be able to use the same expenses when you calculate your deductions. This question isn’t as easy to answer as you might think. Most people realize that taxable income includes wages, salaries, bonuses, commissions and tips. But as you can see from this list, “income” means a lot more than that to the IRS.

Tax Services

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. Unemployment benefits must generally be included on your federal and state income tax returns as taxable income.

Is Social Security income taxable?

Some of you have to pay federal income taxes on your Social Security benefits. between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. … more than $34,000, up to 85 percent of your benefits may be taxable.In that case, you will not be charged tax on the cost of the plan or investment but only on the non-taxed interest accrued in the pension or annuity. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

Alimony Received

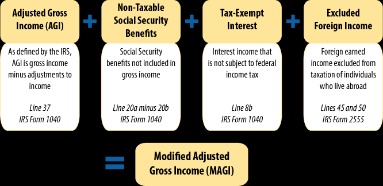

However, for the 2020 tax year, up to $10,200 of unemployment benefits can be excluded from income. If you are married, each spouse can exclude this amount. Amounts over this remain taxable and if your modified adjusted gross income is greater than $150,000 then you can’t exclude any unemployment compensation. Bartering is the exchange of goods or services. Usually there’s no exchange of cash. An example of bartering is a plumber exchanging plumbing services for the dental services of a dentist. Bartering doesn’t include arrangements that provide solely for the informal exchange of similar services on a noncommercial basis .

- How long do you keep my filed tax information on file?

- Assignment of income.Income received by an agent for you is income you constructively received in the year the agent received it.

- It offers more tax breaks in the form of itemized deductions, which require you to record all expenses incurred that you wish to use on your tax returns.

- CAA service not available at all locations.

- For single taxpayers and married individuals filing separately, the standard deduction rises to $12,400, up $200 from the prior year.

- “Publication 525, Taxable and Nontaxable Income.” Accessed March 14, 2021.

If your list of itemized deductions adds up to more in tax savings than your standard deduction, then itemizing is the way to go. Just be sure to save receipts and record your expenses on a regular basis, and store them safely in the event the IRS asks about an itemized deduction. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation.Some of you have to pay federal income taxes on your Social Security benefits. For the 2020 tax year, Joe claimed an above-the-line adjustment to income for $3,000 in contributions he made to a qualifying retirement account. He then claimed the $12,400 standard deduction for his single filing status. While he had $60,000 in overall gross income, he will only pay taxes on the lower amount. Gross income, however, can incorporate much more—basically anything that’s not explicitly designated by the IRS as being tax-exempt. Tax-exempt income includes child support payments, most alimony payments, compensatory damages for physical injury, veterans’ benefits, welfare, workers’ compensation, and Supplemental Security Income. These sources of income are not included in your gross income because they’re not taxable.Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details.. How long do you keep my filed tax information on file? How do I update or delete my online account?

Compare By Credit Needed

If you are married, you will most likely want to file as married filing jointly . However, there are some limited instances where it may make sense to file as married filing separately . Since money and prizes won by gambling are considered income and subject to federal income tax, you have to report all of your gambling winnings on your tax return. You must include all cash winnings and the fair market value of non-cash winnings as taxable income. The IRS usually taxes those winnings at a flat 25% rate rather than at your income tax withholding rate. Since casinos, race tracks, fantasy sport websites, and other places of gambling are heavily regulated by the IRS, they are required to report your winnings on Form W-2G. Offer valid for tax preparation fees for new clients only.