January 25, 2022 by Dick RiceWhen hiring counsel, consider how that counsel presents themselves. It is imperative that you hire an attorney who is well respected, experienced, and present your IRS audit information in a way that is orderly, neat, explanatory, and aesthetically p... Read more

January 25, 2022 by Dick RiceThe funds in this trust are still part of the company's general assets and would be subject to creditors' claims in a corporate bankruptcy. Qualified plans fall under a set of laws that come from the Employee Retirement Income Security Act. Read more

January 24, 2022 by Dick RiceFile your taxes online, the software will ask about your mileage during the interview process and calculate the deduction. There are two options for calculating the deduction for the business use of your vehicle. GSA has adjusted all POV mileage reim... Read more

January 24, 2022 by Dick RiceOnce you inform them you are represented by counsel they are required to direct any additional correspondence with your hired counsel. Your Counsel will need to supply an IRS Power of Attorney first however.If the taxpayer the taxpayer obtained a fil... Read more

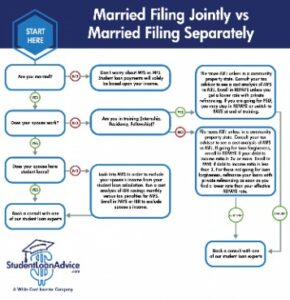

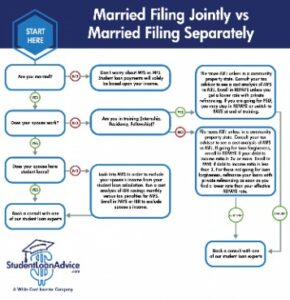

January 24, 2022 by Dick RiceFiling separate returns in such a situation may be beneficial if it allows you to claim more of your available medical deductions by applying the threshold to only one of your incomes. The capital loss deduction limit is $1,500 each when. Read more

January 24, 2022 by Dick RiceA group universal life policy is universal life insurance offered to a group that is less expensive than what is typically offered to an individual. The change is noteworthy because more people today rely on life insurance for more than solely. Read more

January 21, 2022 by Dick RiceThe receipt is generally either a receipt from the charity, a bank account statement showing an ACH transaction, or verification of a credit card payment. If you signed up for periodic donations through a payroll deduction, paystubs or W-2 forms are. Read more

January 21, 2022 by Dick RiceIf you're an authorized person for an electing partnership or S corporation, you may opt in to PTET through October 15, 2021. Various confidentiality laws and privileges apply to ADOR records. COVID-19 updates for California taxpayers affected by the... Read more

January 21, 2022 by Dick RiceThose with the lowest income qualify for the biggest credits. Those with incomes above the phase-out threshold qualify for lower credits until they reach the point where the credit is eliminated completely.... Read more

January 20, 2022 by Dick RiceWhat's more, you don't have to rely on a hiring a lawyer to explain all that legal jargon anymore. Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.... Read more