January 20, 2022 by Dick RiceMLPs can be great investments, but they sure are complicated. Many MLPs operate in multiple states – especially pipeline companies like Kinder Morgan. In those cases, you could have a tax liability in multiple states. That means you need to file. Read more

January 20, 2022 by Dick RiceMost life insurance payouts are made in one lump sum right after the death of the insured person. But some beneficiaries choose to delay the payout, or choose to take the payout in installments over time. When these delayed payouts include. Read more

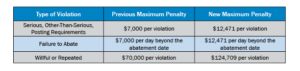

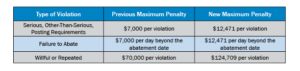

January 20, 2022 by Dick RiceThe first-time penalty abatement waiver is an administrative waiver that the IRS may grant to relieve taxpayers from failure-to-file, failure-to-pay and failure-to-deposit penalties if certain criteria are met. The policy behind this procedure is to ... Read more

January 19, 2022 by Dick RiceCase Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day. Best Of We've tested, evaluated and curated the best software solutions for your specific business needs. Alternat... Read more

January 19, 2022 by Dick RiceThe IRS began accepting and processing federal tax returns on February 12, 2021. To get your tax return started, you'll first need to find out how much money you made in 2020. Then you'll need to decide whether to take the. Read more

January 19, 2022 by Dick RiceBSO lets you print copies of these forms to file with state or local governments, distribute to your employees, and keep for your records. BSO generates Form W-3 automatically based on your Forms W-2. You can also use BSO to upload. Read more

January 19, 2022 by Dick RiceOf all the taxes that we pay, income taxes are the most familiar, because we see them taken out of our paychecks. Form The federal excise taxes reported on Form 720, consist of several broad categories of taxes, including the following.. Read more

January 18, 2022 by Dick RiceIf you live in one of the other states, then filing may not be required or you’ll have to look for different software. This option covers your returns directly with the IRS. Should you have moved to a new state or. Read more

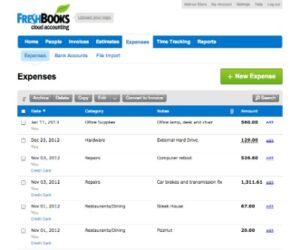

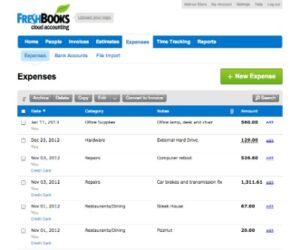

January 18, 2022 by Dick RiceIf those have been recorded within FreshBooks, they will have been listed as an Expense. Check your Expense Report to see how much you’ve already paid. That way, if you end up owing taxes, you will only have to pay the. Read more

January 18, 2022 by Dick RiceValid for 2017 personal income tax return only. Return must be filed January 5 - February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules.... Read more