January 13, 2022 by Dick RiceSupporting Identification Documents must be original or copies certified by the issuing agency. Original supporting documentation for dependents must be included in the application. Price for Federal 1040EZ may vary at certain locations. Wave self-se... Read more

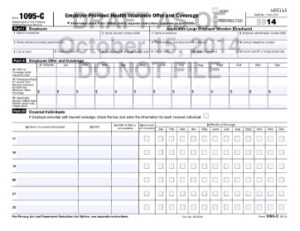

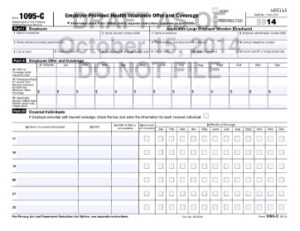

January 12, 2022 by Dick RiceIf you did not receive a 1095-C but believe you should have, or if you have additional questions, please contact the University of Pittsburgh’s Benefits Department. You may also visit learn more.... Read more

January 12, 2022 by Dick RiceClearly, if your credit card offers two percent cash back on purchases, you're not going to make much money. “You'd barely be coming out ahead,” says Ted Rossman, industry analyst at creditcards.com. On a $10,000 tax bill, you'd get $200 ... Read more

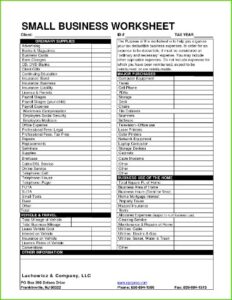

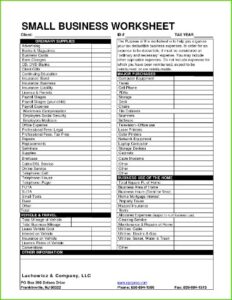

January 12, 2022 by Dick RiceEmployees have this deducted from their paychecks, but as a sole proprietor, it is up to you to make these contributions while paying your income taxes. You will report your self-employment taxes on a Schedule SE which is submitted along with. Read more

January 12, 2022 by Dick RiceThe IRS released final instructions for Form 941 (Employer’s Quarterly Federal Tax Return), Schedule B , and Schedule R . The second quarter Form 941 and its schedules, when applicable, are due July 31 .Next, you’ll start completing Part ... Read more

January 11, 2022 by Dick RiceEngine output was increased to 225 PS with re-map to improve torque above 4,250rpm, as well as a unique sports exhaust system. Cosmetically the “SE” was fitted with Porsche colour matched “Porsche Sport” steering wheel, Bi-pla... Read more

January 11, 2022 by Dick RiceThe IRS allows you to deduct daily travel costs of this long-distance commute. It’s important to note that many companies offer reimbursements to employees directly for mileage expenses; therefore, those employees cannot deduct business mileage... Read more

January 11, 2022 by Dick RiceFurthermore, if you have a dependent care flexible spending account through your employer, you can't use the money you set aside in that account and the Child and Dependent Care Credit toward the same expenses. But with the high cost of. Read more

January 10, 2022 by Dick RiceAdditionally, your employer also contributes the same amount -- a total of 7.65% of your wages. However, when you're self-employed, you are the employer and the employee. Therefore, you're responsible for paying all of the Social Security and Medicar... Read more

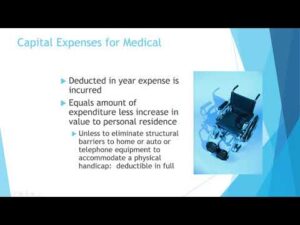

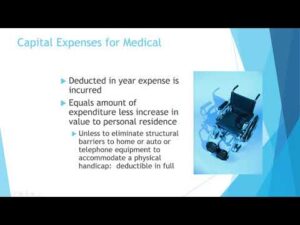

January 10, 2022 by Dick RiceMary would include the amounts she paid during the year on her separate return. If they filed a joint return, the medical expenses both paid during the year would be used to figure their medical expense deduction. You can include medical. Read more