January 10, 2022 by Dick RiceWhen you file your 2021 tax return on eFile.com, we will calculate this for you and determine the credit that is most beneficial to you based on your tax information. Although the advance monthly payments can't be offset, the same rules. Read more

January 10, 2022 by Dick RiceThe IRS provides certain exceptions for filing a late Form 2553. It’s possible to file form 2553 after the deadline, however you won’t be granted S corp status until the following tax year. So if your deadline for S corp election. Read more

January 6, 2022 by Dick RiceOBTP# B13696 ©2018 HRB Tax Group, Inc. How long do you keep my filed tax information on file? How do I update or delete my online account? A payroll deduction plan is when an employer withholds money from an employee's paycheck,. Read more

January 6, 2022 by Dick RiceAnd if you made less than $57,000 last year and didn’t have any income from a rental property or from a farm, it presents an option to have your taxes prepared for you for free through GetYourRefund.org. Most of the software. Read more

January 6, 2022 by Dick RiceWe maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests ... Read more

December 31, 2021 by Dick RiceIf you've had gains and losses on different types of cryptocurrency, you can sell both and use the losers to offset your gains. Regularly for the past two years and now you've decided to sell some. By selling Bitcoin you've had. Read more

December 31, 2021 by Dick RiceIf the LLC elects to be taxed as an S corporation, the owners can divide the LLC’s income into wages (which are subject to self-employment tax) and dividends . See How to Save Employment Taxes with S Corporations for more information. Read more

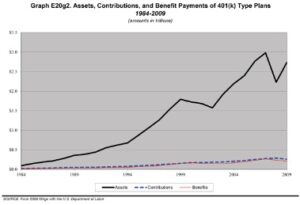

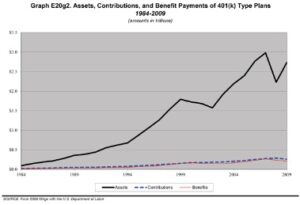

December 31, 2021 by Dick RiceQualified deferred compensation plans are also governed by the Employee Retirement Income Security Act . Both qualified and nonqualified deferred compensation plans are governed by Section 409A. Section 409A is a tax code that differentiates between ... Read more

December 31, 2021 by Dick RiceIs the form you fill out to amend or correct a tax return. On that form, you show the IRS your changes to your tax return and the correct tax amount. Severe penalties may be imposed for contributions and distributions not. Read more

December 30, 2021 by Dick RiceThis is true regardless of whether you get your insurance through the exchange in your state, or in the individual market outside the exchange. Premium subsidies are available in the exchange, but not outside the exchange. Verywell Health's content i... Read more