December 30, 2021 by Dick RiceThe total bill would be about $6,800 — about 14% of your taxable income, even though you're in the 22% bracket. That 14% is called your effective tax rate. That’s a real concern these days — and something that will impact. Read more

December 30, 2021 by Dick RiceLine balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee. Read more

December 29, 2021 by Dick RiceThis does not just include the miles that you drove customers; you can also count miles driven to go pick passengers up or moving from one ride request to another. You need to keep track of all of these and any. Read more

December 29, 2021 by Dick RiceStarting with 2020 returns, taxpayers can claim up to $300 of cash contributions as an “above-the-line” deduction on Form 1040. To deduct more than that, the business owner has to itemize deductions on Schedule A attached to Form 1040. Th... Read more

December 29, 2021 by Dick RiceOnce the distribution is rolled into an IRA, the participant will be sent a Form 5498 to report on their taxes to nullify any tax consequence of the initial distribution. The lower number represents the point at which the taxpayer is. Read more

December 29, 2021 by Dick RiceUS Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions.... Read more

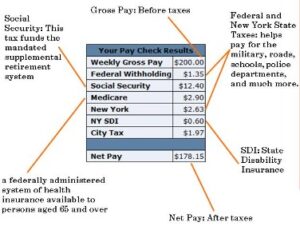

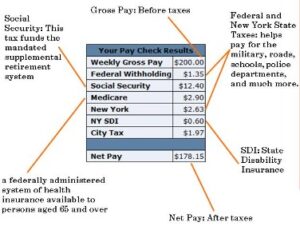

December 28, 2021 by Dick RiceIf the amount you owe ends up being less than what was withheld, you'll be due a refund. Your goal in this process is to get from the gross pay amount to net pay (the amount of the employee's paycheck).To qualify,. Read more

December 28, 2021 by Dick RicePeople who itemize tend to do so because their deductions add up to more than the standard deduction, saving them money. The IRS allows you to deduct a litany of expenses from your income, but record-keeping is key — you need. Read more

December 28, 2021 by Dick RiceSchedule C –If you own a business, then this form will allow you to report income and losses from that business. The total amount you might be eligible to receive generally varies from $200 to $3,500. However, the exact amount that. Read more

December 28, 2021 by Dick RiceConsult an attorney for legal advice. H&R Block prices are ultimately determined at the time of print or e-file.... Read more