December 20, 2021 by Dick RiceTurboTax will even suggest deductions like employee gifts or employee perks. Now, the secret to having an accountant is you can hire them to do all the work for you. Or you can do all the work yourself and just pay. Read more

December 17, 2021 by Dick RiceAnother way the IRS allows taxpayers to hang on to a bit more money is through tax credits. Tax credits are exactly what they sound like–credits that the IRS grants to qualifying individuals that directly lower how much they owe the. Read more

December 17, 2021 by Dick RiceIf you received some form of unemployment benefits this year due to the COVID-19, you will owe taxes on the money you received. Unemployment benefits are untaxed and are considered to be taxable income. Although you don’t have to pay Medicare. Read more

December 17, 2021 by Dick RiceIf you are not going to be able to file your tax return by the deadline, you should file an extension of time to file by submitting Form 4868 to the IRS by the due date . You're supposed to pay. Read more

December 17, 2021 by Dick RiceSmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can. Read more

December 16, 2021 by Dick RiceYou may have a check that was received in the following year although it was included on the 1099 for the year being audited. Show the agent how the difference was deposited the year after because it was received in that. Read more

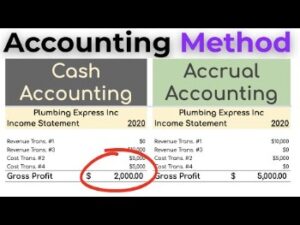

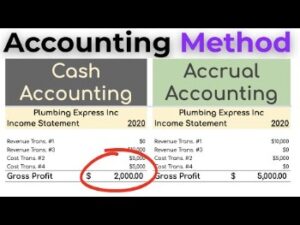

December 16, 2021 by Dick RiceYou could continue running your business in an unprofitable manner for at least another month — and possibly longer — on inaccurate assumptions made from your cash basis income statement. The reason some small business owners find the need to switch. Read more

December 16, 2021 by Dick RiceYou must reduce the total of all your casualty or theft losses on personal-use property for the year by 10 percent of your adjusted gross income. If your home or personal belongings are destroyed or damaged by a hurricane, you may. Read more

December 16, 2021 by Dick RiceIf you're hellbent on doing your own business taxes, Mezzasalma urges you to consider purchasing accounting software to keep your records straight. "The IRS was making it rain, so to speak, by quickly disbursing tax returns without verifying the info... Read more

December 15, 2021 by Dick RiceFree File Alliance is a coalition of tax software companies that partner with the IRS to help U.S. taxpayers e-file their returns. Your adjusted gross income cannot exceed $72,000 a year to qualify for the service. Remember, only eligible individuals... Read more