February 28, 2022 by Dick RiceSee Peace of Mind® Terms for details. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice. H&R Block prices are ultimately determined ... Read more

February 25, 2022 by Dick RiceWhile any excess is allocated to patrons, any credit recapture applies as if the cooperative had claimed the entire credit. If the cooperative is subject to the passive activity rules, include on line 15 any credit for small employer health insurance... Read more

February 25, 2022 by Dick RiceYou also have the option to file electronically by working with an accountant or tax preparer participating in the IRS e-file program for excise taxes. If your business is paying excise taxes for communications or air transportation, you have the opt... Read more

February 25, 2022 by Dick RiceIf you aren’t good with numbers and don’t want to learn the ins and outs of learning Quickbooks or another bookkeeping software, consider hiring a virtual bookkeeper. It’s safe, simple, and relatively inexpensive if your finances ar... Read more

February 24, 2022 by Dick RiceThe tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Supporting Identification Documents must be original or copies certified by the issuing agency.Add lines A through G... Read more

February 24, 2022 by Dick RiceProvide each partner with a copy of their Schedule K-1 or substitute Schedule K-1 by the 15th day of the 3rd month after the end of the partnership's tax year. Form 7004 is used to request an automatic 6-month extension of. Read more

February 24, 2022 by Dick RiceIn addition, if you are age 60 or older, you may qualify for free tax preparation services through Tax Counseling for the Elderly and the AARP Foundation's Tax-Aide programs. You are still responsible for the representations on your taxes, but accoun... Read more

February 24, 2022 by Dick RiceFor example, Saez and Zucman estimate that in 2019, $9.4 trillion of U.S. household wealth, or 51 percent of GDP, would be subject to a wealth tax with a $50 million threshold. Barry L. Isaacs interprets current case law in the. Read more

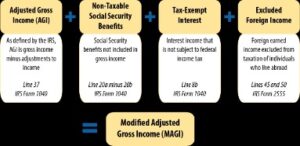

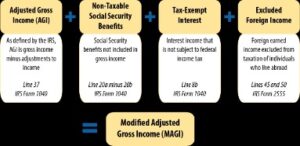

February 22, 2022 by Dick RiceYou must include that amount in your income when your former spouse receives it. Joe Taxpayer earns $50,000 annually from his job, and he has an additional $10,000 in unearned income from investments. Gross business income is not the same as. Read more

February 22, 2022 by Dick RiceFICA taxes are calledpayroll taxes because they are based on income paid to employees. Your employee must take FICA tax out of your paycheck and send that portion of money to the IRS. This money then goes toward Medicare and Social. Read more