February 22, 2022 by Dick RiceUse the same IRS Form 1040 as you would for living taxpayers, but note the date of death on the top. If there's no surviving spouse, then the trustee, executor or administrator must file Form 56 letting the IRS know that. Read more

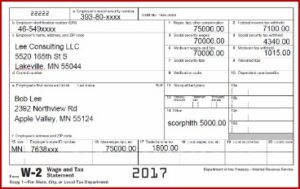

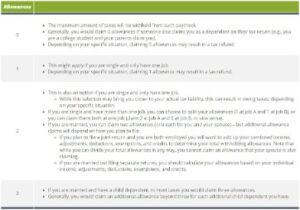

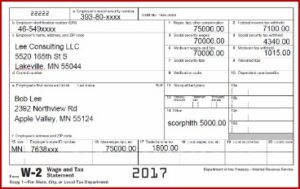

February 21, 2022 by Dick RiceFor example, Jeff earns $20,000 per year. He elects to contribute $4,000 to his 401 plan, and his employer matches 25%, or $1,000. His Social Security wages are $20,000, but his elective deferral contribution is still subject to FICA, and the. Read more

February 21, 2022 by Dick RiceIf you can't file your income tax return on time, you can get an extension until October 15. However, to get the extension, you have to request it before midnight tonight. To make the request, either file Form 4868 or make. Read more

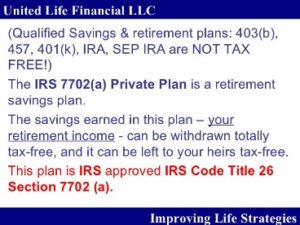

February 21, 2022 by Dick RiceThe most common way to earn interest that is tax-exempt at the state and local levels in addition to the federal level is for an investor to purchase a municipal bond issued in his or her state or locality of residence.. Read more

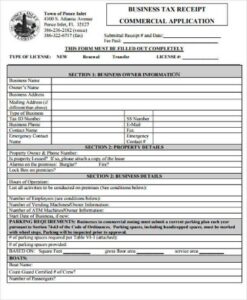

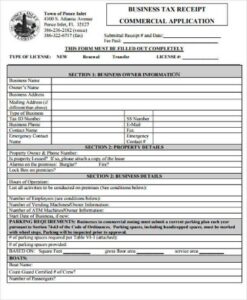

February 21, 2022 by Dick RiceOtherwise, you could find yourself without evidence if an audit occurs in the future. Since some employees may make small office supply purchases with petty cash, keeping the tax receipt is all the more important. Without it, you won’t have any... Read more

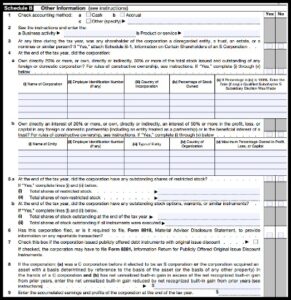

February 18, 2022 by Dick RiceThese include wages, distributions, loans, and reimbursement for business expenses. If you are using public inspection listings for legal research, you should verify the contents of the documents against a final, official edition of the Federal Regis... Read more

February 18, 2022 by Dick RiceGiven volume, storage costs, the rarity of requests for these paper returns, and no adverse effect on agency or taxpayer needs for the records, IRS proposed reducing the retention period to 40 years. This recommendation considers litigation and poten... Read more

February 18, 2022 by Dick RiceThe internet has made scamming people much easier and more widespread. The IRS uses new and social media tools to share the latest information on tax changes, initiatives, products and services. If you are a victim of monetary or identity theft,. Read more

February 18, 2022 by Dick RiceFees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and. Read more

February 17, 2022 by Dick RiceUsually, purchases of this stock are funded by employer contributions made to the plan based on total employee compensation. On leaving the firm through separation or retirement, the participant will receive all vested interests in the form of the ac... Read more