February 9, 2022 by Dick RiceThe appropriate income tax rate is applied to the tax base to calculate taxes owed. Under this formula, taxes to be paid are included in the base on which the tax rate is imposed. If an individual's gross income is $100. Read more

February 9, 2022 by Dick RiceThis link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their. Read more

February 9, 2022 by Dick RiceThere are many different kinds of 1099 forms. Dozens of special situations call for a Form 1099 but they all cover payments you receive that may potentially be taxable. Bankrate.com is an independent, advertising-supported publisher and comparison se... Read more

February 9, 2022 by Dick RiceA passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. The audit risk assessment is not a guarantee you will not be audited.... Read more

February 8, 2022 by Dick RiceThe above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, y... Read more

February 8, 2022 by Dick RiceA credentialed financial advisor can, at the very least, help you go over the financial pros and cons as you weigh your options. Timing is based on an e-filed return with direct deposit to your Card Account. US Mastercard Zero Liability. Read more

February 7, 2022 by Dick RiceAvailable at participating offices and if your employer participate in the W-2 Early AccessSM program. One state program can be downloaded at no additional cost from within the program. Most state programs available in January; release dates vary by ... Read more

February 7, 2022 by Dick RiceIn 19 of these states and the District of Columbia, renters were eligible for the circuit breaker program. The government levying the property tax typically assesses the real property value by estimating what the property would sell for in an arms-le... Read more

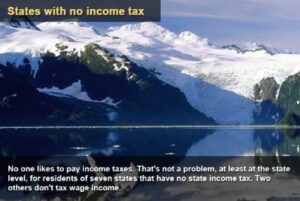

February 7, 2022 by Dick RiceOne way to accomplish that might be to live in a state with no income tax. As of 2021, our research has found that seven states—Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming—levy no state income tax. Since 1975,. Read more

February 7, 2022 by Dick RiceThe tax take was reduced during the Thatcher years and some of the postwar revenue has been squandered. Income poverty for pensioners has to a significant extent been reduced by the triple lock, something my parents were unable to benefit from.. Read more