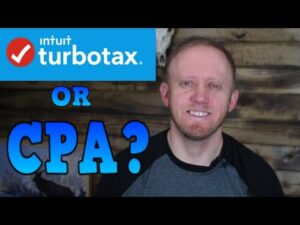

January 28, 2022 by Dick RiceIdeally, you want a preparer with clients who are similar to you. That way, you’re more likely to get the best service for your particular needs.A handful of states don't impose a sales tax, but that doesn't necessarily make them the. Read more

January 28, 2022 by Dick RiceFiling for an extension can be completed simply filing a form online. The type of form you use depends on the type of business you run. While business extensions are considered automatic, if you make mistake on your Form 7004 your. Read more

January 27, 2022 by Dick RiceAdditional personal state programs extra. Owe additional taxes as a result of the correction. New Golden State Stimulus II information now available. COVID-19 updates for California taxpayers affected by the pandemic. When both state and local taxes ... Read more

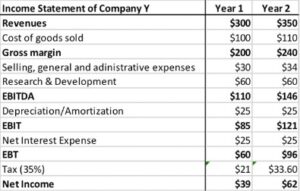

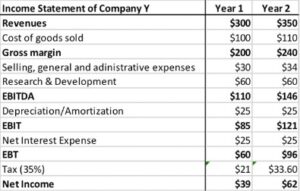

January 27, 2022 by Dick RiceHence, same-size companies having a different debt-equity mix will show different operating profits due to the tax impact. So, to do away with the capital structure mix effect NOPAT is calculated. In other words, NOPAT is the profit available to all. Read more

January 27, 2022 by Dick RiceEnter the total amount distributed to the employees from the nonqualified deferred compensation or a non-government pension plan. This is to determine if any part of the amount reported in box 1 or boxes 3 and/or 5 was earned in a. Read more

January 26, 2022 by Dick RiceProfessionals know tax secrets and all have insights into how to get the most out of deductions and can see opportunities for more savings that you may miss. Take advantage of their knowledge so that you can take advantage of more. Read more

January 26, 2022 by Dick RiceInstead, you will later collect sales tax on those goods from your customers. Out-of-state businesses under the remote seller tax law that went into effect on October 1 are reminded to use business code 605 . The tax applies to remote. Read more

January 26, 2022 by Dick RiceFinally, Puerto Rico filed for bankruptcy in 2017, having over $70 billion in bond debt and $49 billion in unfunded pension liabilities. Richard Shapiro, Tax Director and member of EisnerAmper Financial Services Group, has more than 40 years' experie... Read more

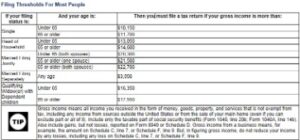

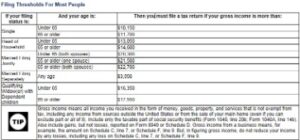

January 25, 2022 by Dick RiceNo credit is allowed for an individual whose federal adjusted gross income exceeds $50,000 ($25,000 for married filing separately). This credit is in addition to the subtraction modification available on the Maryland return for child and dependent ca... Read more

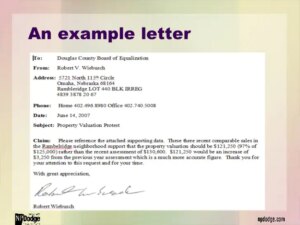

January 25, 2022 by Dick RiceIt can be hard to balance the desire for a beautiful home with the desire to pay as little tax as possible. However, there are some little things you can do to reduce your property tax burden without resorting to living. Read more