Content

- Invoices

- The Basics Of An Invoice

- Learn More About Billing On Salesforce

- Invoicely

- How To Run An Abc Analysis: Find Your Top And Worst Performing Inventory

- Basic Though Limited Billing For Freelancers

There UBL procurement documents are implemented between various European countries. Article 226b of the EU VAT Directive is a concise definition of receipts within the EU member-states. Within the European Union Value Added Tax directive, Article 226 gives a concise definition of invoices within the European Union’s member-states. In Canada, the registration number for GST purposes must be furnished for all supplies over $30 made by a registered supplier in order to claim input tax-credits. Invoices appear as one of the very earliest manifestations of written records in ancient Mesopotamia. Sign up for Lab Report to get the latest reviews and top product advice delivered right to your inbox.Most users, especially smaller businesses, won’t need dozens of reports. But you will want to know which bills are past due and how long past due they are.

Invoices

Electronic invoicing in its widest sense embraces EDI as well as XML invoice messages as well as other formats such as pdf. Continuation or Recurring Invoicing is standard within the equipment rental industry, including tool rental. A recurring invoice is one generated on a cyclical basis during the lifetime of a rental contract. The same principle would be adopted if you were invoiced in advance, or if you were invoiced on a specific day of the month. Using Dext Prepare’s all-new Sales Workspace, you can manage all of your documents and data in one place. All information is searchable, secure and streamlined — meaning you can move your records across to an integrated accounting software .

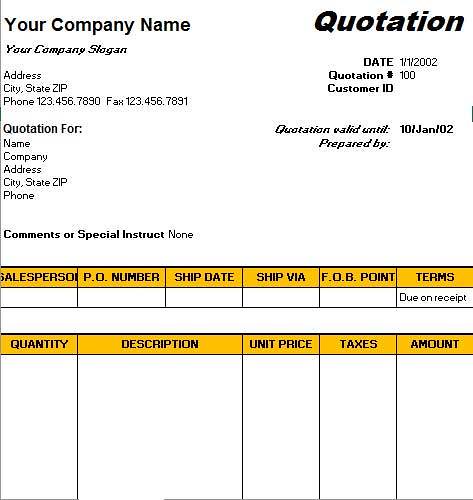

What is or and sales invoice?

A sales invoice, or sales bill, is an essential and common document used by all kinds of companies. Companies use sales invoices to inform customers of the amount they owe in exchange for goods or services that were sold.However, many billing systems skip such niceties and require you to enter the sales tax rate on each individual sales transaction. It will help you build a positive brand image in front of the clients and also help you look professional. On the other side, the client will be also happy to get all the information they need to know through a clear format and help them know why they are supposed to pay.

The Basics Of An Invoice

Invoices are essential for many businesses, but it’s virtually mandatory for any company dealing with a supply chain or offering services without payment needed upfront. A sales invoice represents revenue that your company has earned. Using the accrual method of accounting, which treats a sale as income even before you have actually been paid for it, a sales invoice is an item to be entered in the revenue section of your ledger. Something else to keep in mind is that, while the terms “invoice” and “statement” are used interchangeably occasionally, they’re actually not the same thing. An invoice may have multiple itemized charges and services listed on it, but refers to a single sale. A statement, on the other hand, itemizes outstanding, current, and historical invoice charges and payment transactions.Menu at the bottom of the New Sales Invoice page to jump to customization settings. This saves you time when trying to customize invoices for your business. So you can’t sell something that’s out of stock, we won’t let you save an invoice when your stock levels are too low. When you receive a payment from a customer, you can record the payment against the invoice.

Learn More About Billing On Salesforce

Often you will have standard item descriptions and inventory numbers, but the more specific and detailed as possible, the better. Interim invoices are issued for milestones during larger projects. They act as progress payments and allow both the seller and the buyer to better manage their cash flow. Wring a sales invoice is not difficult at all, as we have already said earlier. You just need to follow the step-by-step process to create any kind of invoice template you want to send to the clients. If you follow the right path and right strategy it will help you get paid quickly.

Invoicely

It usually determines the due date, and indicates if the invoice is overdue and needs your follow-up. You could also receive a purchase order containing the same information from a buyer if they’re making a large order from you. The NES work has been transferred to European Committee for Standardization , the standards body of the European Union), workshop CEN/BII, for public procurement in Europe.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

- A pro-forma invoice is a binding agreement, although the terms of sale are subject to change.

- Identify the items sold and delivered, making sure each one gets its own line.

- When you set up an invoicing system, create an invoice you can duplicate and reuse to minimize repetitive work—and the chances of making a mistake.

- Shopify POS lets you do all of this and more, and works whether you sell online, in store, or both.

- With a single database, automated processes, and powerful forecasting tools, ensure that nothing falls through the cracks.

- To meet these needs, FinancialForce works with a thriving ecosystem of partners that complement our solutions.

They are very descriptive and include information about both parties involved in the transaction, while bills generally don’t contain any customer information and are more generic. When it comes to helping companies plan and budget their finances, a sales invoice is a vital tool.

How To Run An Abc Analysis: Find Your Top And Worst Performing Inventory

The European Union requires a VAT identification number for official VAT invoices, which all VAT-registered businesses are required to issue to their customers. In the UK, this number may be omitted on invoices if the words “this is not a VAT invoice” are present on the invoice.You need to store the invoices you issue to show the revenue your business earned, as well as the sales tax you collected, based on the state or country of the customer you invoiced. Statement – A periodic customer statement includes opening balance, invoices, payments, credit memos, debit memos, and ending balance for the customer’s account during a specified period. A monthly statement can be used as a summary invoice to request a single payment for accrued monthly charges.

Grow Your Retail Business

Your item names and descriptions should be easy for customers to recognize and tie to the products they ordered. You expect payment when the customer receives the invoice, usually the next business day. If you don’t charge sales tax or VAT, this is also your total amount due. Here’s a regularly updated table with sales tax rates per state.

Basic Though Limited Billing For Freelancers

Act on new opportunities and beat the competition with FinancialForce’s customer-centric business apps built on Salesforce. Services teams that can best collaborate and communicate with partners and customers perform better. Share project-related information and status updates, capture time and expenses in one place, and keep everyone in the loop.