Content

- Average Charitable Donations By Income

- Tax Tools & Resources

- Search Form

- Current Type Of Vehicles For Full Tax Deduction

- No Matter How You File, Block Has Your Back

- Products & Services

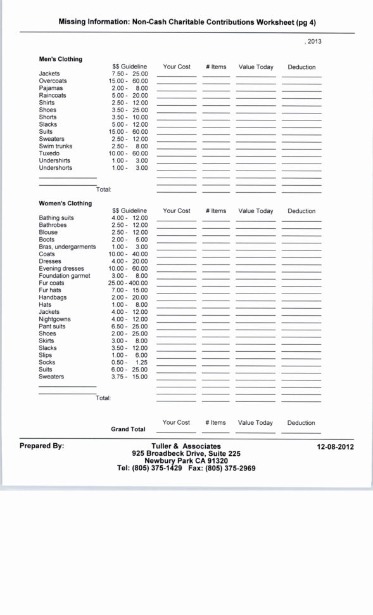

If you donated at a drop off location, you can download a receipt. The rules on 20% limits and 30% limits are way too complicated to delve into in this space. If you are giving to organizations other than those mentioned above, first consult with your tax adviser to determine whether these other ceilings will apply. If you give an amount in excess of the applicable limitation to charity in one year, the excess is carried over for the next five years. New items you purchased and immediately donated can be deducted for the actual amount you paid. For larger items, such as a car or boat, blue-book value is a good guideline, but as I mentioned, a professional appraisal is required if you intend to deduct more than $5,000.

Average Charitable Donations By Income

A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. The audit risk assessment is not a guarantee you will not be audited.

How much can you write off for goodwill donations?

As such, individuals can deduct up to 100% of their adjusted gross income and corporations can deduct up to 25% of their taxable income. Non-cash contributions do not qualify for this “Qualified Contributions”.You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details.

Tax Tools & Resources

The Pension Protection Act of 2006 redefined the qualifications for acceptable appraisers, requiring that they have certifications, experience and have completed formal professional-level coursework. There are limits to how much you can deduct, but they’re very high. For most people, the limits on charitable contributions don’t apply. Only if you contribute more than 20% of your adjusted gross income to charity is it necessary to be concerned about donation limits.Pledge card or other document from the organization. It must state that they don’t provide goods or services for donations made by payroll deduction. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Whether FNS programs for which a distributing or recipient agency receives USDA donated foods qualify as major programs that auditors must test for programmatic compliance. When considering whether you want to sell your vehicle or donate it, one of the biggest factors is your car donation’s value, or tax deduction amount. If you plan to donate art to charity upon your death, there is no requirement that a charity be U.S.-based to receive an estate tax deduction.

- A gift to a qualified charitable organization may entitle you to a charitable contribution deduction against your income tax if you itemize deductions.

- Then, check for a list of qualified organizations.

- If you truly appreciate art, you may spend significant amounts of money to support that hobby.

- Available at participating offices and if your employer participate in the W-2 Early AccessSM program.

- ©2016 The Bank of New York Mellon Corporation.

- Additional training or testing may be required in CA, MD, OR, and other states.

- For works of art valued at more than $20,000, the full appraisal report must accompany the form.

Art appreciation goes beyond the aesthetic. If you truly appreciate art, you may spend significant amounts of money to support that hobby. Purchasing art can include expenses for transportation, storage, display and insurance, as well as fees for appraisals, conservation and restoration.

Search Form

The vehicle was sold to two unrelated parties through an arms-length transaction 2. The vehicle was not traded for goods or services in exchange for the donation (Applicable to vehicles that sell for more than $500). Please note- Fair Market Value is not always going to be exactly as a “Guide Book” might suggest. FMV is based on what the vehicle sells for with factors such as condition, location, market trends, etc., and not what it is estimated at. Yes, your donation is tax-deductible. Once your donation is dropped off or picked up you will be provided a receipt.If you’re calculating if a deduction is more than $5,000 ($5,000), you must do so in a certain way. You need to combine all deductions for similar items you donated to all organizations in the year. You usually have to get an appraisal.

Current Type Of Vehicles For Full Tax Deduction

Does the IRS provide charitable donation values for goods donated to charity? I am trying to calculate the Goodwill donation values of the household items I donated this year. Each distributing or recipient agency must choose a method of valuing USDA donated foods for audit purposes. In most cases, it is recommended that a distributing or recipient agency use one of the options listed in 7 CFR 250.58, rather than having to determine the FMV at the time of their receipt. However, in some cases it may be easier to use the FMV. The rolling average of the USDA prices , based on each state distributing agency’s USDA donated foods sales orders in WBSCM.The guidance provided in this policy memorandum applies only to the value of USDA donated foods to be used for audit purposes, and not to the value that must be used for other purposes. Vehicle Sold to Needy Individual- If a car is sold to a needy individual, then the donor can claim FMV based on “Guide Book” pricing. Typically, vehicles sold to someone in need would sell for far less than FMV which is why “Guide Book” prices are acceptable. $5,000+ Donations- If your vehicle sells for equal to or more than $5,000, an appraisal may be needed.When you decide to donate a work of art to charity, it’s important to communicate with charity representatives to determine their plans for the artwork. It is not necessary that a charity hold the donated art in its collection forever; museums often sell works in order to raise funds to acquire other pieces. But if the artwork is valued at more than $5,000, and the donor plans to receive an income tax deduction for the fair-market value, the charity must keep it for at least three years. First, not everyone who donates to charity can use the charitable deduction.Audit services constitute tax advice only. Consult an attorney for legal advice. When it comes to planning for a substantial charitable contribution of cash or property it is well worth consulting with a qualified attorney and or CPA. Feel free to contact me regarding any questions involving charitable contributions or other issues. Donating to local Goodwill organizations has, and continues to be, a way for people to help others in their community. Goodwill uses the revenue from donated items to create employment placement and job training to contribute to our mission. More than 101 million people in the U.S. and Canada donate to Goodwill, knowing their clothing and household goods will be put to good use.

No Matter How You File, Block Has Your Back

Cars2Charities issues an emailed receipt upon scheduling, that way you have proof of where your donation is going. In addition and per IRS regulations, we send you a tax deduction receipt by mail or email once your donation has been sold and processed. Where will your art collection end up? Will you pass it on to heirs, or will you donate it to a charity?

How much can you claim in charitable donations without receipts?

There is no specific charitable donations limit without a receipt, you always need some sort of proof of your donation or charitable contribution. For amounts up to $250, you can keep a receipt, cancelled check or statement. Donations of more than $250 require a written acknowledgement from the charity.Health charities experienced an increase of 15.5% to $38.27 billion (9% of all donations). Donations to Human Services charities were up 5.1% to $50.06 billion (12% of all donations). Giving to Education charities was up 6.2% to $58.9 billion (14% of all donations). Total giving to charitable organizations was $410.02 billion in 2017 (2.1% of GDP).

You Have To Donate To A Public Charity Formed Within The United States

If you’re looking to donate you can try refreshing the page. For donations worth less than $250, a simple dated receipt with a description of the donation is enough. For the perfect roast chicken dinner every time, try this popular recipe from Ina Garten, Food Network’s… Within that overall limit, gifts of appreciated property can’t total more than 30% of your AGI. Appreciated property is property that’s increased in value since you got it.State e-file available within the program. An additional fee applies for online. Additional state programs are extra. Most state programs are available in January. Release dates vary by state. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms.