Content

- The Balance Sheet

- Boundless Business

- What Is Included In The Balance Sheet?

- What Is Equity?

- Defining The Balance Sheet

- Intangible

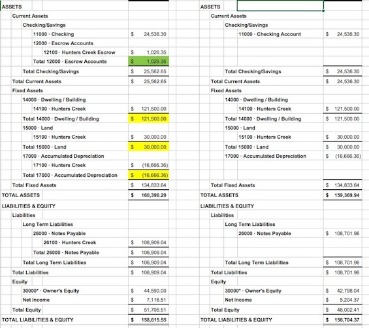

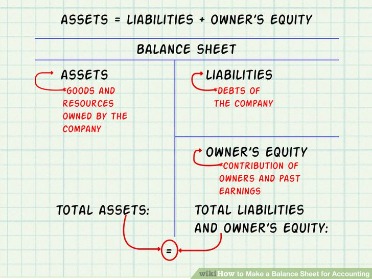

Irrespective of the business’ size, keeping track of assets is very important. Items like land, buildings, properties, accrued expenses etc., are primarily used as examples to define assets. Without understanding assets, liabilities, and equity, you won’t be able to master your business finances. But armed with this essential info, you’ll be able to make big purchases confidently, and know exactly where your business stands. All this information is summarized on the balance sheet, one of the three main financial statements .Over time, you’ll be able to see how every transaction impacts the whole business and start to increase equity claims on assets relative to liabilities. Accrued liabilities are other balance sheet liabilities that must be paid but don’t have a direct invoice. For example, on my company’s balance sheet I have accrued liabilities for items such as employee tax withholding that is withheld from paychecks weekly but only paid to the government quarterly. I’ll also calculate accrued sick and vacation time based on all of our employees’ current balances and their pay rates.Guidelines for balance sheets of public business entities are given by the International Accounting Standards Board and numerous country-specific organizations/companies. The image below is an example of a balance sheet from Exxon Mobil from September 2018. If you add up the company’s total liabilities ($157,797) and its shareholder equity ($196,831), you get a final total of $354,628—the same as the total assets.The AT&T example has a relatively high debt level under current liabilities. With smaller companies, other line items like accounts payable and various future liabilities likepayroll, taxes will be higher current debt obligations. The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Expenses and liabilities should not be confused with each other. One is listed on a company’s balance sheet, and the other is listed on the company’s income statement.When you sell something on account, you create an accounts receivable that is an asset on your balance sheet. Additionally, if you prepay for a year’s worth of rent, you would show that as an asset on your balance sheet. Your balance sheet is divided into two parts, assets and liabilities.Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business’ calendar year. Like most assets, liabilities are carried at cost, not market value, and undergenerally accepted accounting principle rules can be listed in order of preference as long as they are categorized.They can also make transactions between businesses more efficient. For example, in most cases, if a wine supplier sells a case of wine to a restaurant, it does not demand payment when it delivers the goods.

The Balance Sheet

They can include a future service owed to others (short- or long-term borrowing from banks, individuals, or other entities) or a previous transaction that has created an unsettled obligation. The most common liabilities are usually the largest like accounts payable and bonds payable. Most companies will have these two line items on their balance sheet, as they are part of ongoing current and long-term operations. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a “snapshot of a company’s financial condition”.

- Deferred tax liability is the amount of taxes that accrued but will not be paid for another year.

- Expenses and liabilities should not be confused with each other.

- Even if there are far more assets than liabilities, a business cannot pay its liabilities in a timely manner if the assets cannot be converted into cash.

- Unidentifiable intangible assets include brand and goodwill.

- It can be looked at on its own and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health.

- There are other assets, such as patents, where the cost of filing the patent is capitalized on to the balance sheet.

Here, the owner’s value in assets is $100, which is the company’s equity. In the accounting world, you will come across these three terms pretty often. Let’s dive in and give you a clear understanding of why and how these terms affect the balance sheets.A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Liabilities are categorized as current or non-current depending on their temporality.Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. Some practitioners are more familiar with financial terminology than others. You may find it helpful to consult a glossary of financial terms as you read this article. And though the subject of finances is tedious for many health professionals, it is crucial to be informed and to monitor the financial pulse of your practice. Say goodbye to bookkeeping stress and hello to saved time and money. Based on the example mentioned above, this is what your business’ balance sheet will look like. Since assets are the most important element, this is the equation your business is most likely to use.

Boundless Business

Since it is just a snapshot in time, it can only use the difference between this point and another single point in time in the past. In the final transaction, you make a credit sale to a customer.

What Is Included In The Balance Sheet?

They help you understand where that money is at any given point in time, and help ensure you haven’t made any mistakes recording your transactions. A few days later, you buy the standing desks, causing your cash account to go down by $10,000 and your equipment account to go up by $10,000.Alternatives Looking for a different set of features or lower price point? Check out these alternative options for popular software solutions. AccountingYour Essential Guide to S Corporations Are you thinking about becoming an S corporation? Read more to know what it is, how it’s different from an LLC, and its pros and cons for your business. Now, let’s say you want to buy a few high-end software for your designing needs worth $4000. Stockholders Equity – funds contributed by the owner plus retained earnings.

What Is Equity?

The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. Shareholders’ equity is the difference between total assets and total liabilities. Unlike the other basic financial statements, the balance sheet only applies to a single point in time of the calendar year. You buy inventory on account, so your inventory balance goes up, but you need to pay the invoice, so your liabilities go up as well. For most small businesses, the only long-term liabilities will be term loans from banks.

Is rent an asset?

Under the accrual basis of accounting, if rent is paid in advance (which is frequently the case), it is initially recorded as an asset in the prepaid expenses account, and is then recognized as an expense in the period in which the business occupies the space.Some companies issue preferred stock, which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued. Intangible assets include non-physical assets such as intellectual property and goodwill. These assets are generally only listed on the balance sheet if they are acquired, rather than developed in-house.

Defining The Balance Sheet

A company’s ROIC is often compared to its WACC to determine whether the company is creating or destroying value. This account includes the amortized amount of any bonds the company has issued. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet.

The Accounting Equation & Bookkeeping

Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals.The amount of retained earnings is the difference between the amounts earned by the company in the past and the dividends that have been distributed to the owners. In accounting and finance, equity is the residual claim or interest of the most junior class of investors in assets, after all liabilities are paid. The first step to reading a balance sheet is understanding the difference between assets and liabilities. With balance sheet data, you can evaluate factors such as your ability to meet financial obligations and how effectively you use credit to finance your operations . Understanding the different types of financial documents and the information each contains helps you better understand your financial position and make more informed decisions about your practice. This article is the first in a series designed to assist you with making sense of your practice’s financial statements.Simply stated, assets represent ownership of value that can be converted into cash . The balance sheet of a firm records the monetary value of the assets owned by the firm. It is money and other valuables belonging to an individual or business. Two major classes are tangible assets and intangible assets. You can’t manage a business without measuring your success, and the first step to being able to measure success is knowing how to read financial statements.Assets are resources as a result of past events and from which future economic benefits are expected to flow to the enterprise. The balance sheet is a summary of the financial balances of a company. In the initial transaction, you increase both inventory and payables, but from then on the two are split, and it is up to you to decide how and when to sell the inventory and pay off the payables. Once there is no balance, it means you have also lost track of data regarding assets, liabilities, or equity. Ownership Equity – When a business needs to liquidate assets to repay debts. Take this example to get a better understanding of assets, liabilities, and equity.