Content

- What Is Accounts Receivable Ar Financing?

- Questions About How Accounts Receivable Financing Works

- Cons Of Accounts Receivable Financing

- The Pros And Cons Of Accounts Receivable Financing

- The Role Of Factoring In Modern Business Finance

- Company

This method can be similar to selling off portions of loans often done by banks. The terms Receivables Based Financing and Factoring are often used interchangeably.The system offers the lure of getting immediate financing to enhance business growth. Because you need fast access to working capital, you reach out to accounts receivable factoring lenders to discuss your borrowing options. There are a lot of reasons to use accounts receivable financing to fund your small business. Accounts receivables financing is essentially short-term financing, so it can be expensive or simply the wrong choice for certain businesses.

What Is Accounts Receivable Ar Financing?

Accounts receivable lending companies also benefit from the advantage of system linking. In asset sale structuring, factoring companies make money on the principal to value spread. Factoring companies also charge fees which make factoring more profitable to the financier. Accounts receivable financing provides financing capital in relation to a portion of a company’s accounts receivable.Your total cost for 30 days of factoring was $4,000 and your APR comes out to an astronomically high 60%. Although the terms are often used interchangeably, account receivable factoring is not the same as account receivable financing.Invoice financing may also be a good option for businesses that are risk-averse — you’re borrowing money your business has already made, versus money you hope to make in the future. Accounts receivable loans are a source of short-term funding, where the borrower can use their accounts receivables as collateral to raise funds from a bank. The bank would typically lend a fraction – e.g., 80% – of the face value of the receivables. The fraction varies depending on the quality of receivables – the better the quality, the higher the fraction. Accounts receivable finance, then, refers to a type of financing that’s based on borrowing money based on the value of the accounts receivable.Also, if a business wishes to maintain good relationships with its debtors, then it should use factoring sparingly. We’d love to hear from you and encourage a lively discussion among our users. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Michelle Black Michelle Lambright Black, Founder of CreditWriter.com and HerCreditMatters.com, is a leading credit expert with over a decade and a half of experience in the credit industry. She’s an expert on credit reporting, credit scoring, identity theft, budgeting, and debt eradication.

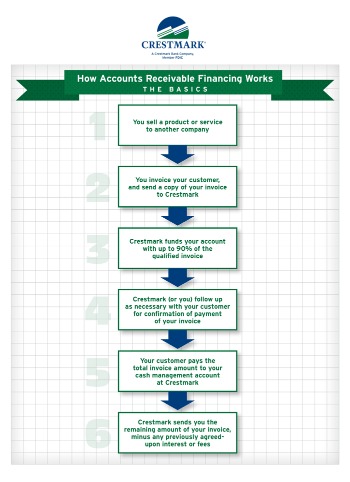

Questions About How Accounts Receivable Financing Works

While some factoring companies buy individual accounts receivable, others buy them in groups. The seller may be offered a choice of which accounts receivable to sell. Based on the criteria, we feel BlueVine provides the best overall terms, discount rates, and customer service of the providers mentioned.

Cons Of Accounts Receivable Financing

Some businesses won’t be able to qualify for traditional bank loans but will be able to qualify for accounts receivable financing. Abusiness line of creditor business credit card can sometimes tide you over when If you face a cash flow problem. But you might not be able to qualify for an affordable line of credit, or the credit limit might not be high enough on your business credit card. In those cases, accounts receivable financing can be a good option.So instead of paying you, your customers will send payment on the invoice to the financing company. It’s your responsibility to update your customers with the new payment address (note this means that your customers might become aware that you’re financing receivables). Accounts receivable financing is typically structured as an asset sale. In this type of agreement, a company sells accounts receivable to a financier.

The Pros And Cons Of Accounts Receivable Financing

Most importantly, it’s quicker, cheaper, and less limiting than a bank loan. Once all the information has been gathered, the broker will start referring customers to those lenders that are best suited to fulfill their requirements and generate quotes. As a good practice, though, make sure you ask the factoring company what their experience is working with your type of business. Additionally, here are a few accounts receivable lenders you might want to consider.At one point, the business may require quick money to fix its operations. Sadly, credit access has become so tight, especially to small businesses with many traditional lenders unwilling to offer viable help. Accounts receivable financing can help businesses overcome those financial challenges. The benefit of utilizing a traditional bank loan is that they are considered to be a cost effective form of lending.

- Once you accept all of the factoring company’s terms, $80,000 is deposited into your bank account.

- This clause allows the factoring company to withhold some of the finance funds until invoices are paid.

- Similarly, newer invoices are usually preferred over older invoices.

- Once customers pay up, the business pays back their loan, plus fees and interest.

You’ll notice the last point on our list was featured as both a positive and a negative. Depending on the reliability of your customers and their financial histories, this might be a negative or a positive . When the cost of accounts receivable financing gets converted to an APR, it comes to around 13% to 60%, but the harder the lender thinks collecting the invoice will be, the higher the APR will be. Since the financing company is financing your receivables, they will receive payment from your customers.

The Role Of Factoring In Modern Business Finance

Because the invoices serve as collateral, accounts receivable financing can be a great solution for borrowers with bad credit. In fact, lenders won’t be as interested in your credit history as in the quality of your invoices. Accounts receivable financing can also be structured as a loan agreement. One of the biggest advantages of a loan is that accounts receivable are not sold. A company just gets an advance based on accounts receivable balances. As such, both internally and externally, accounts receivable are considered highly liquid assets which translate to theoretical value for lenders and financiers. Many companies may see accounts receivable as a burden since the assets are expected to be paid but require collections and can’t be converted to cash immediately.

What are receivables in banking?

Receivables, also referred to as accounts receivable, are debts owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.A receivables secured loan can be made on a non-notification or notification basis, which determines to whom the borrower’s customer will make payments. Any manufacturing, distribution or service company requiring short-term financing to manage its business may find A/R based financing of value. Accounts receivable are one of the most liquid assets any firm holds. As such, they make excellent security for short-term loans needed to cover payroll, materials, costs tied to production, and even expansion. Quickly compare loan offers from multiple lenders without impacting your credit score.

When Does It Make Sense For A Business To Consider Accounts Receivable Financing?

The cost of accounts receivable financing would depend on a number of factors, including the quality of invoices and estimated difficulty collecting on those invoices. There’s often a flat, one-time upfront fee that would cover the lender’s underwriting and origination costs. This fee would be based on the size and complexity of your financing arrangement. If you choose to occasionally finance invoices rather than set up an ongoing accounts receivable financing agreement, you may have to pay this fee each time you obtain funds. Easy Approval – Factoring companies usually provide working capital to businesses who have been refused a bank loan or have little to no credit history.You can think of it as a line of credit that’s backed by outstanding debt that is due to be received from customers or clients. AR financing allows for the use of capital that would otherwise be unusable until the debtor settles their invoice, providing more working capital to utilise. Does your company need working capital, but your customers won’t pay until later?For small businesses, accounts receivable could be the key to unlock a number of financing options to keep things running smoothly. Another culprit that can sometimes cause cash flow and working capital issues can actually be success itself.Michelle is also an experienced personal finance and travel writer. You can connect with Michelle on Twitter (@MichelleLBlack) and Instagram (@CreditWriter). Your customers might be informed about your factoring relationship. Pros and Cons of Receivable-Based Financing ProsConsGood for cash flow emergencies. You use the funds to cover your business expenses such as payroll, purchases and rent.As such, the business of accounts receivable financing is rapidly evolving because of these liquidity and business issues. If you operate in the business-to-business space and issue invoices with clear repayment terms, you’re eligible for invoice financing. It’s an especially useful tool if you work in an industry with long payment cycles, as financing receivables allows you to tap into the cash that’s tied up in that process.