Content

- Notable Competition: Myfreetaxes Via Taxslayer

- Best Tax Software For Itemizing Deductions

- Tools To Stay On Top Of Your Taxes All Year Long

- Best For Complex Returns Needing Professional Input

- Taxact

Forbes Advisor has reviewed six online tax platforms to identify the best platforms for people who are self-employed. We analyzed how much it would cost to file, expert assistance options and customer service. When choosing online tax software, go with the platform that hits the sweet spot between ease-of-use, budget friendliness and excellent customer service. Plus, you’ll want an option that helps you claim all the deductions you’re entitled to.

Can you go to jail for messing up your taxes?

You cannot go to jail for making a mistake or filing your tax return incorrectly. However, if your taxes are wrong by design and you intentionally leave off items that should be included, the IRS can look at that action as fraudulent, and a criminal suit can be instituted against you.You may qualify for the IRS Free File Program if you have an adjusted gross income of less than $72,000. Your AGI is your total income minus certain deductions, which means that you would qualify if your net income is less than $72,000. Credit Karma expects to sell its tax software business to Square. In December 2019, the Department of Justice cited Liberty Tax for not taking measures to prevent fraudulent tax return filings by its stores. The platform offers a chatbot that can answer most tax filing questions, or direct you to articles on the TurboTax website that address specific topics. If you are overwhelmed by the idea of doing your own taxes or don’t feel confident using computers, you definitely don’t have to do your taxes yourself.

Notable Competition: Myfreetaxes Via Taxslayer

For in-person assistance, you might qualify for the IRS’s free tax-preparation services. Doing your taxes might never be fun, but the right tool can turn the worst annual chore into a manageable—and dare we say, rewarding—afternoon. The best tax software makes sure you get all the credits and deductions you deserve without dragging you through forms hell. After testing six online tax apps updated for the 2020 tax year, we can say with confidence that TurboTax is the most sophisticated, accurate, and straightforward tool for the job. File for free with the IRS Free File by TurboTax version if you meet the requirements, or start with TurboTax Free Edition if you don’t.There are many options when it comes to doing your taxes, but TurboTax offers the best experience overall if you’re willing to pay a slightly higher price. Its automatic imports and easy-to-follow prompts make it a winner. Plus, if you get stuck, you can upgrade to have a tax pro take over your preparation for you.

Best Tax Software For Itemizing Deductions

If you feel reasonably confident, it’s an unnecessary extra. TaxSlayer includes a 100% accuracy guarantee and a guaranteed maximum refund. Finally, it was important for us to find software that offered generous accuracy and maximum benefit guarantees.But if you’re a landlord, freelancer or small business owner, you may need to upgrade. Once you turn over your forms and documents, the pro enters your data for you, which not only saves you time but also prevents DIY errors. Plus, their pricing is often more up front than that of most online software, which usually tries to upsell you midway through the filing process. Building a relationship with a pro that you can count on for years to come is also invaluable. There’s a lot to consider when comparing and contrasting online tax software providers. Ease of use, costs and fees—including free options—and customer service are the three broad areas to look at when choosing the best platform for you.

- We also reference original research from other reputable publishers where appropriate.

- It’s not 100% free like Credit Karma, but the platform’s biggest draw is its excellent live personal support from experienced tax professionals, including text-chat and phone help, and even live video chat for an added fee.

- — Help is easy to access, and explanations are clear and authoritative.

- According to the IRS, there were 509,917 tax returns audited for the 2020 tax year, a very low fraction of all returns.

- We called TurboTax customer service before and during tax season, and both times we waited less than five minutes to speak with a representative.

The average cost of professional tax preparation ranges from $188 to $481 depending on the complexity of the returns. This means you need to be vigilant as you click through each screen in order to avoid falling for the unnecessary upsell. Student loan interest and higher-education tuition and fees are valuable deductions you can take even if you file with the standard deduction. Unfortunately, our top pick, TurboTax Free Edition, doesn’t support filing those forms. If you have those student forms and only a handful of other forms to file, such as a W-2 and bank interest income, this is the best way to file for free. One downside is that TurboTax constantly tries to upsell you throughout the tax filing process more often than its competitors with “add-on” features, like IRS audit representation and identity theft insurance.

Tools To Stay On Top Of Your Taxes All Year Long

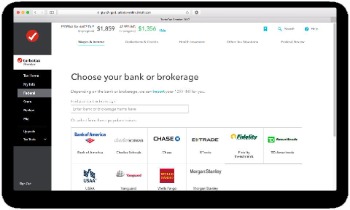

Whether you file online or with the download version, the tax software comes with a maximum refund guarantee and 100% accuracy guarantee. Whichever you choose, H&R Block covers most tax situations and is a top choice for many business owners, which is why it gets our best overall ranking. TaxSlayer offers a simple interface like most of the providers we reviewed. Users just start by entering their tax situation (or importing last year’s tax return), enter their income, or import a W-2, and the software gets to work finding the best deductions. On-screen explanations aren’t as comprehensive as that of TaxSlayer’s competitors, but users can access phone and email tech support. The personal tax preparation services we review here are capable of producing very complex tax returns. You’ll pay more if you need more forms and schedules to complete , but the tools are there for advanced topics like self-employment, depreciation, rental income, and capital gains.However, the costs can add up fast with the more complex deluxe, premium and self-employed plans — the most expensive is $170 for federal, plus $50 per state. If you want to add live tax support, the surcharge can be $35 to $100, plus state fees. The free version of H&R Block is one of the best, said Coombes. It supports W-2 income, interest income, dividend income, retirement distributions, the student loan interest deduction and the Earned Income Tax Credit, which is more than TurboTax covers for free.

Best For Complex Returns Needing Professional Input

Most tax software packages come with similar guarantees for accuracy and a maximum refund, but the user experience and features can vary widely. To select the best tax software for small business, we reviewed 10 different software options based on product features, ease of use, accuracy, and more. So, if you’re looking to do taxes for a small business this year, here are the best tax software offerings for you. We looked at close to a dozen tax software programs for this review. At the top of our list was software that was easy to use since most people using these programs have little to no tax experience. Support was also an important consideration, so providers that offered more than online guides (like live chat or one-on-one phone support) ranked high.Fortunately, protecting your traffic is as simple as using a VPN. A VPN can create a secure tunnel that encrypts your data, ensuring that anyone who manages to intercept it sees only gibberish. In another survey on the security of using tax software, we found that only 37% of e-filers use a VPN. Instead, some of these solutions, such as H&R Block and TurboTax, provide state-of-the-art user experiences. They’re designed to make what is an unpleasant task more palatable. They use color, graphics, design, and layout to present screens that are lively and attractive, rather than dull and lifeless like the actual forms. Long-term capital gains rates stayed the same for 2020, but their income thresholds increased.

Taxact

Many tax online software providers offer an advertised free tax filing version for simple returns on their website. While these tax online software products provide these advertised versions, you may also qualify for the IRS Free File Program’s tax options . TurboTax is the best online tax software because of its thorough and intelligent interview process. Even if you might have some deductible expenses, such as mortgage interest or charitable donations, it’s better to start here and upgrade to Deluxe only if you’re required to. Our analysis included a thorough review of each platform’s support options. We determined if the online tax software provider offered phone, live chat, email, or help articles for users, and evaluated each option. Also, we contacted customer service departments by phone to evaluate its hold time and customer service quality.