Content

- What’s An Example Of A P&l Statement?

- Direct Costs

- Want More Helpful Articles About Running A Business?

- Depreciation

- Types Of Business, Capital And Personal Expenses

- Business Fees

- Overview: What Are Business Expenses?

The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. In accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

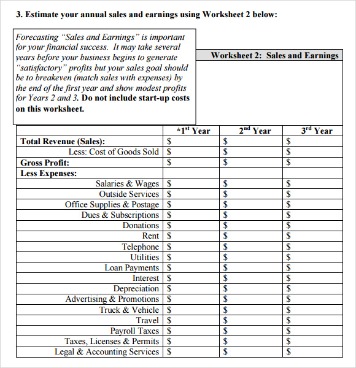

What’s An Example Of A P&l Statement?

We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Self-employed business owners can also deduct health insurance premiums for themselves, their spouse, and dependents on Schedule 1 attached to their Form 1040. However, if you are eligible to participate in a plan through your spouse’s employer, then you can’t deduct those premiums. Keep in mind, if you use a landline at home, you cannot deduct the cost of your first line, even if you use it solely for work.

What is included in other expenses?

Other expenses are expenses that do not relate to a company’s main business. As well as operating costs, the company needs to consider other expenses including interest expense and losses from disposing of fixed assets. Examples of other expenses include interest expense and losses from disposing of fixed assets.Joe is a self-employed writer and had $60,000 in self employment income in 2020. He has to pay 15.3% self employment tax plus income tax based on his individual tax rate. The SE tax on $60,000 is $9,180 and the income tax is $4,865, for a total of $14,045. If you regularly work from home, you may be able to consider your home office as a deductible cost. To qualify, a home office must be only for business needs, such as a separate room or a designated office space.

Direct Costs

If not daily, try to set aside the same time each week to scan and organize receipts. Write the business purpose on the receipt so you can remind yourself later, if needed. The value ofinventoryon-hand at the beginning and the end of each tax year is used in determining the cost of goods sold , which is a large direct expense for many companies.For a clear and complete explanation of amortizing these costs, visit the Amortization Section of IRS Publication 535, Business Expenses. For clear and complete rules for deducting depreciation, refer to How to Depreciate Property . Business-Related Education – You can deduct seminars, classes, educational tapes or CDs, and convention fees. Explore answers to frequently asked questions about earning a master’s degree in computer science, including whether you need one and potential career paths. Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends.You may want to keep photos of your home office workspace with your tax documentation as evidence in case the IRS selects your return for audit. Depreciation is more complicated than your average deduction, so we recommend reading our article What is Depreciation? Businesses can take advantage of bonus depreciation to deduct 100% of the cost of machinery, equipment, computers, appliances, and furniture. There are two methods for deducting vehicle expenses, and you can choose whichever one gives you a greater tax benefit. As a small business owner, it can be difficult to know what deductions are relevant to you. By locating the $6,000 in contractor expenses, Bench was able to reduce Joe’s tax liability by over $1,500 dollars.You can create a budget or use this number to help find net income. If you pay interest on these loans, you may be able to deduct that interest. These costs can sometimes be deductible and are important to budget for. Some fees, such as an accountant you go to each quarter, might be regular expenses you can budget for. Many businesses rely on the internet and phone to function.As long as the space is exclusively used for business, you can deduct $5 for every square foot, up to $1,500. Make sure this is separate from your personal checking account and only use it for business expenses. And you may be eligible for business credit or debit cards that come with perks like cash back or no-interest financing for three months.

Want More Helpful Articles About Running A Business?

In general, you can deduct rent as an expense only if the rent is for property you use in your trade or business. If you have or will receive equity in or title to the property, the rent is not deductible. If you use part of your home for business, you may be able to deduct expenses for the business use of your home.

- Therefore, they are deductions that can be included on your Schedule C.

- These costs might change regularly depending on your industry and business needs.

- Interest – Business interest expense is an amount charged for the use of money you borrowed for business activities.

- To qualify for this tax-saving deduction, though, you must use the accrual method of accounting, which entails booking income when a product or service is sold, for example.

- It can be helpful to keep receipts of all these costs for budgeting and tax purposes.

- You and the lender have a true debtor/creditor relationship.

Bank and credit card statements and copies of receipts are the best forms of proof. Miscellaneous business expenses do not include equipment costs, furniture, improvements to your property, or any personal living expenses.If you’re still tracking business expenses manually or using a spreadsheet, why not move up to accounting software or expense management software? The end result will be less work for you and a much better handle on your expenses. However, food is not considered a miscellaneous expense because miscellaneous expenses refer to deductions that are not easy to categorize. Food, which is considered a business expense, is entered on line 24 of your Schedule C. These might include taking a client out to lunch or providing employees with a special meal or office snacks.

Depreciation

These expenses are usually deductible if the business operates to make a profit. If you have any business loans to credit card companies, banks or vendors, you can count the loan payment as an expense.For rent paid in advance, you can only take a deduction for the portion that applies to your use of the property during the tax year. For assets placed in service in the 2021 tax year, you can take a maximum Section 179 deduction of $1,050,000. It’s also possible to claim a bad-debt deduction if someone doesn’t pay you for work you performed or products you sold.

Types Of Business, Capital And Personal Expenses

Consider this a checklist of small business tax write-offs. If your business trip includes personal side trips or extended stays for a personal vacation, you can only deduct travel expenses used for business-related activities. For example, suppose you live in Atlanta, and then went on a five day business trip to New York. You spent three days in business meetings, and two days sight-seeing and visiting friends.

Business Fees

If you don’t have a good DIY setup you’re happy with, check out Bench. Now, with $54,000 in taxable self employment income, he pays $8,262 in SE tax and $4,200 in income tax, for a total of $12,462.

Maintenance And Other Fees

In addition, you can’t deduct expenses related to client entertainment, with the exception of meals; fines or penalties for violating a law; country club dues; and illegal payments. By developing expense categories that fit your business and recording and organizing expenditures as you go, you’ll find it easier to get all the deductions you’re due. Those “ordinary and necessary” expenses must be incurred in an organization motivated by profit. Even if your small business faces financial problems and doesn’t actually generate a profit, the intent needs to be there. Otherwise, the IRS may determine your business is a hobby and disallow expenses. These expenses include bribes,lobbyingcosts, penalties, fines, and contributions made to political parties or candidates.That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team. Get clear, concise answers to common business and software questions. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. The balance sheet is one of the three fundamental financial statements.

Overview: What Are Business Expenses?

As long as an expense is “ordinary and necessary” to running a business in your industry, it’s deductible. Also referred to as deductions, business expenses are the costs of operating a business. These expenses will be subtracted from business revenue to show a company’s net profit or loss and taxable income. Not only will receipts and other documentation of your business expenses come in handy if you’re ever audited, the IRS requires some records be kept for up to 7 years. Things like receipts, tax returns and employment records need to be kept for 3-4 years. And documentation of writing off bad debt should be kept for 7 years. Consider using business accounting software to track your expenses and go paperless for record keeping.